Annual meetings are simple in concept but can be difficult to execute well. At Sapphire Partners, we are constantly asked what makes a good annual meeting, which makes sense given the typical GP attends one annual meeting (their own) while limited partners attend dozens.

As such, we’re providing one perspective on what we think differentiates the best annual meeting from all the others.

Before going into details, I think it’s important to mention two things:

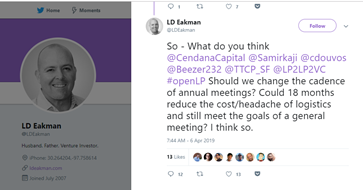

- We believe all venture firms should have annual meetings, even if a firm is young. We consider annual meetings a best practice. That’s our preference, though it’s important to note that some LPs feel differently, especially if the fund is small, and there are other routes that work well, as Lindel Eakman mentions, such as GPs visiting individual LPs, or meeting every 18 months if there is less activity.

- It’s important to keep your objective for the annual meeting in mind while planning the event. The point of an annual meeting is to share information with LPs about their investment in your firm. The true value for limited partners comes from spending time in person and sharing information that is not included in quarterly reports and financials (otherwise, should we all stay home and read them in sweatpants?) With that in mind, your goal should be to deliver that information about your firm and portfolio in a way that couldn’t be read in a spreadsheet and instead showcases your firm and engages your LPs.

There are three elements you need to focus on: Content, Format, Logistics

1. Content

As Chris Douvous has mentioned, your annual meeting should be an open and honest dialogue. And, you should only include relevant information. What is relevant depends on the team, strategy, and age of the portfolio. For example, if it’s a new or first fund, a discussion of liquidity is probably less applicable.

- Portfolio: This is one of the most important topics for LPs (obviously) because the investments in the portfolio are what drive returns. Limited Partners are one step removed from the companies, so it’s helpful to provide a way for LPs to look at the portfolio. If it is a more developed portfolio, you can bucket investments into categories such as potential fund-returners, emerging value-drivers, too soon to tell, lagging, written-off, etc. That way you can show their evolution from year to year (also a point Chris brings up).

It’s also incredibly helpful to an LP to provide metrics for each company such as revenue, projected revenue, growth rates, and major milestones because it gives an indication of company maturity. Hard metrics are always better than qualitative statements such as “it has a lot of traction” or “it is moving along.”

Portfolio return expectations, even a broad range, are also something LPs really appreciate.

Another topic that should be included is anticipated or potential liquidity – we all love distributions. As mentioned, if it’s a newer portfolio, some of these suggestions are less relevant, but it’s great to hear about recent investments or those in the pipeline.

- Team: An LP investment in a venture fund is an investment in the team, and that team’s ability to find, make and manage investments. Most LPs like to see a team summary and like to know if there will be any hires or departures that they don’t already know about.

If there aren’t changes, it can be as simple as flashing up a single team slide and saying there are no changes. If there are new hires, it’s nice to highlight them or have them give a quick hello so LPs can start to get to know them

- Strategy: Many LPs don’t need (or want) a complete rehash of the fund strategy, but it is nice to have a (very) quick reminder. It’s also important to note if you are adjusting the strategy for any reason and why, such as adding new themes or incorporating lessons learned that are shaping current investment criteria.

- Environment: LPs often appreciate a GP’s view into the environment, both generally and specifically how it impacts their platform. Often this overview ties into themes a GP is focusing on, or recent/upcoming deals in the pipeline. This section could also include a discussion of how a firm is competing and winning.

- Operational Value-Add: LPs love to hear how GPs work with their portfolios. If you have already covered this you don’t need to repeat, but it’s nice to hear about any big developments, or what is providing the biggest impact or differentiation.

- Next Fund: Fundraising is important for both GPs and LPs. Limited Partners like to know timing/fund size for the next fund for planning purposes and giving LPs a heads up about fundraising intentions can help you start conversations early.

2. Format

Various formats work for a successful annual meeting. Usually, it’s good to mix it up a bit and include some combo of the team/CEOs/special speakers/fireside chats/panels/videos. You should do what feels authentic for your firm. If you do have a panel, make sure the questions are interesting and challenging, not just layups used to repeat strategy basics.

- GP Team: It’s nice to involve multiple members of the GP team during the day to hear different voices. There isn’t one way to do this – it could be partners trading off, involving junior people who helped with investments or having a CFO go over financials. Some GPs might not realize this, but LPs do read into who is presenting. If it’s supposed to be an equal partnership between three partners but one person does 95% of the talking, is it really equal?

- Portfolio CEOs: I love hearing from portfolio CEOs. Nothing beats hearing the pitch directly from the CEO and learning why a GP is so excited about the investment. However, it’s best to pick CEOs who can tell the story in an accessible and concise way. LPs often cover numerous asset classes or geographies and may not know technology or industry as well as a GP (manipulating qubits using microwaves, what?).

Having a CEO speak for ~ 10-20 minutes with a couple of minutes reserved for questions works well. And if there are multiple funds, it’s nice to have a mix of CEOs from value-drivers and newer investments.

Plan to have a couple of CEOs, not one, but not ten. It’s also often great to invite CEOs to stay for cocktails instead of them hightailing out so LPs have the opportunity to get to know them and your portfolio better.

- Materials: Providing day-of materials generates a meaningfully better experience. This helps in multiple ways:

-

- LPs can focus on absorbing the content instead of madly scribbling notes.

- Typically, only part of an LP team attends any one meeting, so providing materials electronically (either before or after) makes it easier for LPs to share the update with the broader team.

- Prepared materials are also an easy place to include information you want to share but don’t necessarily want to take the time to cover. For example, I have seen firms only talk about value-drivers and new investments in funds, but provide nifty one-page summaries with ownership, cost, value, description, update, revenue and growth for every investment. Awesome!

3. Event Logistics

- Scheduling/Attendance: Attendance is important. LPs like to see a full room which brings better energy and more networking possibilities. Plus, if a GP is going to all the work of hosting a meeting, it’s nice to have good attendance.

To ensure a full room, it’s helpful to schedule the meeting in advance. Way in advance. Some of the GPs we work with even share the time and location for the next year’s annual meeting at the end of the current annual meeting. Knowing this in advance helps LPs plan and make arrangements.

Another consideration is coordinating with other GPs you know your LPs are working with. We know it’s not feasible to check in with all other GPs, but if you know that your LPs are partnered with another group that has their meeting around the same time, it could make sense to coordinate timing to ensure LPs can attend both. We even have had GPs in the same geographies plan their meetings close together so LPs invested in both firms can combine their trips. That is super considerate and helpful.

- Location: Location is another area where LPs have differing opinions. Some LPs prefer destination experiences and others optimize for easy access and logistics. I have had great experiences with both types though (sadly) often fall in the convenience-first camp. Above all, find a spot that is comfortable and has good lighting. Make sure there are plenty of bathrooms and power cords/outlets. Bonus points if there are tables to rest computers on vs. the circus act juggling of computers, coffee and waters on laps. Suggest hotels and negotiate rates if you have a big group coming. Some groups send shuttles if hotels are off-site or provide uber vouchers.

- Time: Plan the duration of the meeting to match the amount of material you want to cover and leave time for networking. Do not feel like you have to do a full-day meeting, in fact, very few people have the attention span for 8-10 straight hours of presentations. Instead, do dinner the night before and a morning presentation or a lunch, afternoon presentation and cocktails. If you have a small LP base or have a newer fund, it can usually be a much shorter, more casual meeting.

- Food: LPs like food. It’s nice to have a range of healthy/less healthy options so not all fried chicken and not all green juice. LPs will probably tell you they are excited about the juice but then eat the chicken. A quick lunch or coffee break is also a great time to build in a little networking time. I have heard mixed feedback on sit-down dinners. It can be a fun meal with the quality discussion but it’s also hard to talk to multiple people. If going the sit-down route, it often helps when GPs put thought into the seating chart so it’s a mix of the team, CEOs, and LPs.

- Swag: Swag is funny. LPs know they are paying for swag but like to forget this once a year and almost expect a fun gift bag.

LPs are truly proud of their partnerships, and they like to wear a hoodie or other sporty items to support their groups.

It’s often neat when a GP can include a sample of a portfolio company product though this works better for consumer products and less well for things like enterprise software.

If you are thinking of giving something heavy or bulky and you have LPs traveling far, it’s a nice gesture to offer to send it back for them. I think others probably have stronger opinions, but I like most gifts I have received…except, long baggy tee shirts go in the back of the closet when you are a 5’3 woman 😊.