For as powerful of a mechanism as fund recycling can be, we believe it is an under discussed strategy in venture investing. It can transform a good fund into a great fund, and a great fund into an even better one. Often with limited risk, it can boost GP proceeds, LP proceeds and net multiples. Investors ultimately depend on absolute dollars returned (you cannot eat IRR), so we are big fans of maximizing them.

The idea behind recycling is fairly simple. By taking proceeds and re-investing them into companies, GPs can take more shots on goal (in the case of new investments) or capture additional proceeds from existing top-performing portfolio companies (in the case of high potential follow-ons). This allows managers to generate returns on these new dollars and offset the dollars allocated to pay fees, which do not generate any returns. It can be surprising what a big difference there is between the gross multiple on the investments and the net multiple that goes to LPs after fees and carry are deducted, and this can help narrow that gap. Many funds can legally recycle up to 20% but some funds have the capability and aspirations to go even higher.

Fred Wilson recently wrote about how USV routinely uses recycling to boost returns. Brad Feld and Greenspring have discussed how generating a 3x net fund requires a lower gross multiple if you recycle. At Sapphire Partners, we love taking a quantitative approach. To better illustrate how recycling can significantly alter the equation, we put together a simplified analysis to understand the magnitude of impact recycling can have on a fund.

Spoiler: it’s pretty big!

The Premise

Let’s assume a $100M fund for simplicity. $20M of this fund is paid in fees, and the GP generates a very solid 3x gross multiple on the $80M remainder invested in companies. However this only equates to a 2.1x net return at the fund level due to the fees and carry with $240M in total distributions, of which $212M go to the LPs and $28M to the GP.

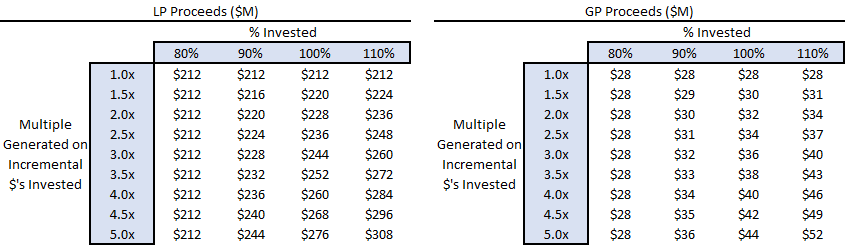

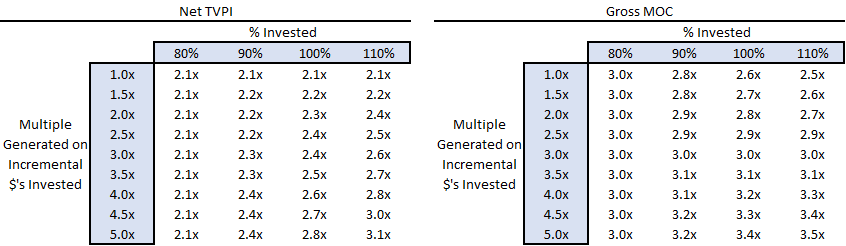

What happens to proceeds and net/gross returns (TVPI/Gross MOC) if this GP uses recycling? Here’s what things look like if the GP recycles between 0% to 30% of the fund, reaching 80-110% invested, and generates 1-5x gross returns on those recycled dollars:

LP & GP Proceeds and Returns Sensitivity Based on Recycled Dollars

Above are various combinations of outcomes, but here are three scenarios to better illustrate the possibilities:

Scenario 1: Knock it out of the Park with a High Multiple

The aspirational scenario is a fund reaching fully invested (100%) and generating a high return on those additional dollars. This augments total proceeds and improves both fund level metrics. Let’s say our GP recycles and reaches 100% invested and generates a 5x on those additional investments: LP proceeds grow from $212M to $276M, GP proceeds grow from $28M to $44M, net returns increase from 2.1x to 2.8x, and gross returns from 3.0x to 3.4x. Those are big differences!

Scenario 2: Recycling with Comparable Outcomes Generates Base Case Returns

A solid recycling scenario could mean a fund reaching fully invested (100%) while generating 3x returns (recycled dollars match returns from the rest of the portfolio). In this scenario, LP proceeds grow from $212M to $244M, GP proceeds grow from $28M to $36M, net returns increase from 2.1x to 2.4x, and gross returns remain at 3.0x.

Scenario 3: Recycling but with Lower Returns

It may be that a GP recycles funds but the incremental investment doesn’t yield high returns. If a GP reaches 100% invested in a fund but only generates 1.5x on the recycled dollars (not a great multiple by early stage venture standards), it still boosts LP proceeds from $212M to $220M, GP proceeds from $28M to $30M, and the net multiple from 2.1x to 2.2x. Note: the gross multiple goes down as the incremental dollars generated a lower return than the rest of the fund. In this scenario, the gross declines from 3.0x to 2.7x. We at Sapphire benchmark returns on net multiple (which is true of most LPs), so even with the gross multiple decreasing, the fund benefits from the increase in net multiple.

Sounds Great, So Why Not Recycle All the Time?

Unsurprisingly, the best case scenario is for a fund to recycle the most and achieve the highest possible multiple on the recycled capital (shocking!), but a key takeaway here is that modest recycling can still have substantial impact on proceeds and net returns, as long as recycled money at least returns capital.

In these scenarios, proceeds for both LPs and GPs go up and the net multiple significantly appreciates. In Scenario 2, the net jumps from 2.1x to 2.4x, which meaningfully narrows the gap between gross and net (formerly 3.0x and 2.1x) and could push a fund closer (or into!) the top quartile. A 2.5x multiple would have put this fund in the top quartile 15 out of the last 24 years according to Cambridge. So, the closer this fund can get to 2.5x, the better it will look when compared with vintage year peers. We underwrite Series A funds to generate a 3.0x net or above, so from our point of view, any increase in the net multiple helps underwrite the fund from an LP perspective.

If recycling feels so obvious, why doesn’t everyone do it?

- It’s simple, but you need early exits to have available dollars to recycle. No liquidity means no recycling. This has become increasingly challenging, as GPs are investing in tighter timeframes with fewer early liquidity events. And, as Fred says, you don’t want to sell your big winner early – venture is truly a power law business and if you sell your fund driver(s) early, the returns for the entire fund can suffer. However, if you have a portfolio of, say, 20 investments, odds are there will be a company that exits early because it’s on fire. Or the entrepreneur is done with the journey. Or it doesn’t work but still finds a happy home. Boom, now a GP has dollars for recycling.

- There is a time value of money (or IRR impact) which our deliberately simple analysis glosses over entirely. Extending the fund life can decrease the IRR. We, and many other institutions, care mostly about net multiples, but not all LPs are the same. And we at Sapphire *do* still look at IRRs.

- Most cynically, fees taper off as fund lives extend. If a GP is optimizing for carry there is a clear benefit to recycling, but if he or she is more driven by fees, there is a rationale for starting up a new fund earlier rather than elongating an older vintage.

Recycling: The Bottom Line

Fund recycling is a tool that can greatly benefit both LPs and GPs, and we love areas of GP<>LP alignment! It’s important to have plans in place to recycle, and GPs should incorporate recycling into the fund model and legal documents right at the outset. If you don’t have those aspirations, it won’t happen. The resulting increased net multiple can help strengthen a track record and bolster a GP track record for fundraising in the future.

Sapphire both talks to our managers about recycling and practices it in house. As direct investors, Sapphire Growth has focused on getting to 100%+ of invested since inception. With an explicit focus on being “long-term greedy,” Sapphire CEO and Partner, Nino Marakovic, explains, “recycling boosts LP returns, which gives us an opportunity to do what we love to do for longer.”

We love geeking out about fund management, and would love to hear other perspectives on fund recycling or different techniques GPs have used to reach fully invested or beyond! Below is a downloadable version of the simplified model for you to adjust the fund size or fees to match your own fund more closely.

Click here to access our downloadable recycling model. The inputs (fund size, fee, fund life, carry, and return on investable capital) can be adjusted to test how gross and net returns are impacted based on the various levers.

Happy recycling!