Being data-driven is not a new concept for global enterprises. However, we’re now experiencing a shift across the enterprise data stack as a growing number of disparate cloud applications collide with legacy on-premise systems to produce more data than most companies know what to do with. Yet even with this shift and the continued importance of data to make more and better-informed decisions, enterprises still have a difficult time ensuring their data is accurate, consistent, accessible, up to date and secure.

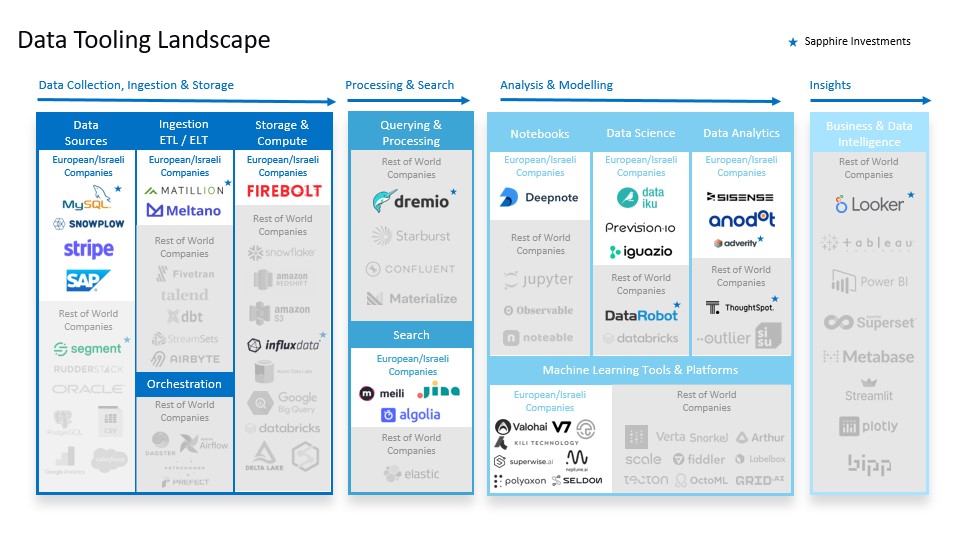

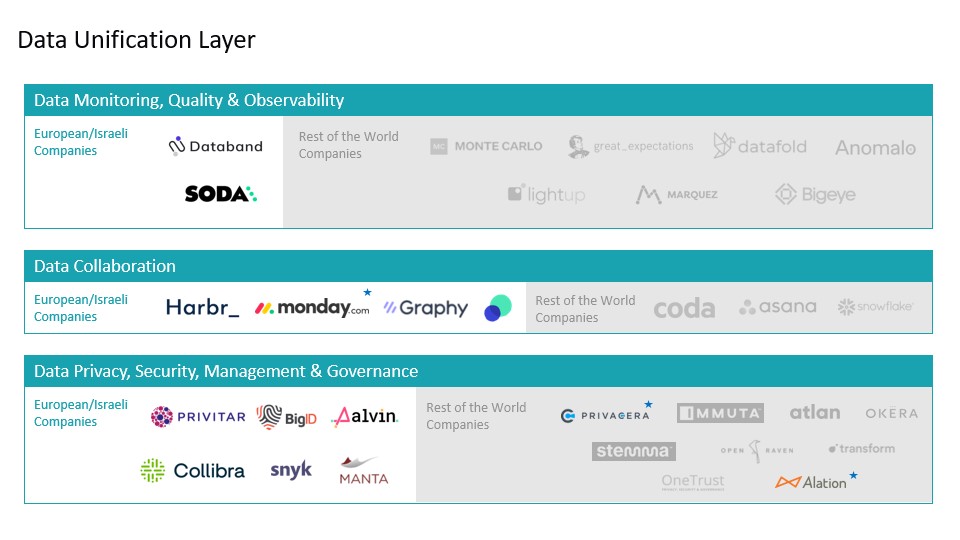

Over the past decades, we’ve seen data within the enterprise evolve from monolithic systems with limited data capture, processing and storage capabilities to a more robust, scalable and open data ecosystem. We’ve also seen machine learning and artificial intelligence gain momentum across use cases within the enterprise to drive better insights. And we are now witnessing the emergence of a “data unification layer” across the increasingly fragmented and modular modern stack with new data tooling solutions helping data scientists, engineers and business analysts analyze, share, protect and manage data. These new data solutions address the ongoing data-related challenges faced by enterprises and are reshaping the data tooling market entirely.

At Sapphire, backing emerging players supporting the data ecosystem has been core to our investment strategy from the start, and we’re proud to have supported dozens of companies of consequence across the data stack. Most recently, we’re thrilled to have reaffirmed our commitment to data-focused European startups by once again backing our portfolio companies Matillion and Adverity as they move on to their next stages of growth. Manchester-based Matillion has emerged as a company of consequence in the extract, transform, load (ETL) space, and we are excited to continue to support their growth with their recently announced $150M Series E financing. We’re also excited to continue to support our Vienna-based portfolio company Adverity, which is building the industry-leading intelligent marketing analytics platform, in their $120M Series D financing.

When looking at the newest trends in the data ecosystem, we are particularly excited by the ambitious founders building new data tooling companies in Europe and Israel, as we believe there has never been a better time to build a data tooling company here.

Global Trends Across the Modern Data Stack

Globally, more enterprises are adopting a modern data stack as companies move their processes from on prem to the cloud and collect more data across disparate sources. As a result, we are seeing several key trends across the modern data stack take shape:

- Data sources and storage solutions are moving to the cloud

- Data manipulation, reporting and dashboarding are becoming more available to non-technical users

- Data security, privacy and governance are becoming more central to the full data stack

- The modern data stack is increasingly fragmented and modular leading to the rise of data ops tooling and a data tooling unification layer

In particular, we are seeing an explosion of startups in the emerging data tooling unification layer across:

- Data monitoring, quality and observability – Address poor-quality data through discovering, prioritizing and resolving data issues

- Data collaboration – Facilitate better insights and sharing of data internal and external across teams and companies

- Data privacy, security, management and governance – Protect, govern and secure data across an organization

The European & Israeli Data Tooling Landscape

Our approach to investing in the data space is to back the best company in the market no matter where the team is located. That said, we’ve been paying close attention to the developments in the European and Israeli ecosystems, so we wanted to share our view of the data tooling landscape with a special focus on what we believe to be standout companies coming out of these regions:

Starred companies represent current or exited Sapphire investments. Snowflake is a Sapphire investment at IPO

European and Israeli startups are building new tools across the modern data stack providing better solutions for companies across all industries. We are seeing these companies expand internationally and become global category winners. We expect that European and Israeli entrepreneurs will continue to lead on creating innovative solutions and that these ecosystems will continue to be hotbeds for the next generation of data tools.

Top Predictions for the European & Israeli Data Tooling Ecosystem

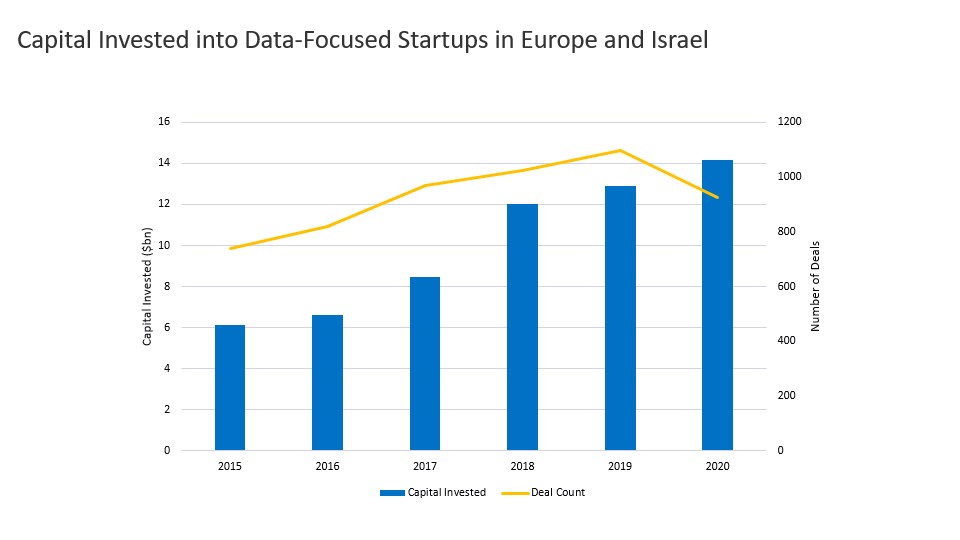

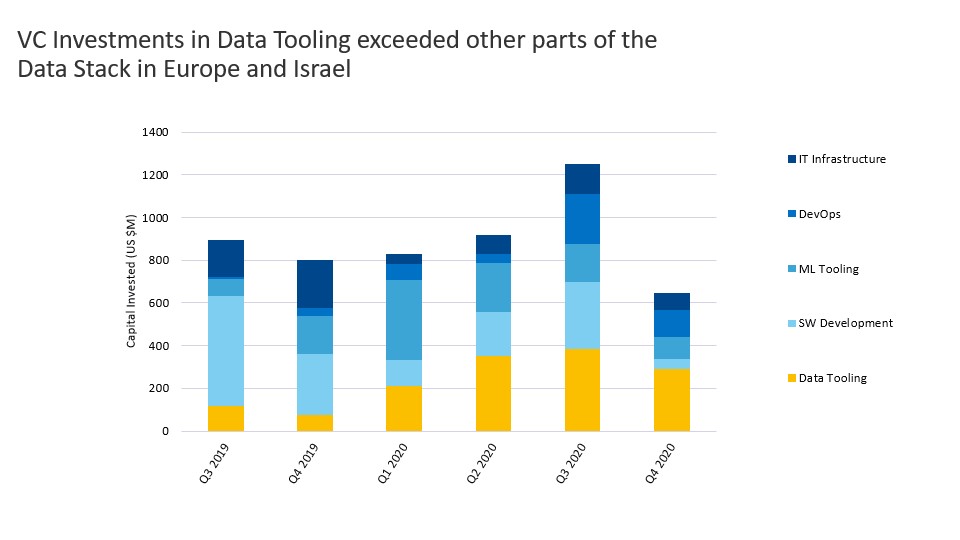

- Data tooling will attract huge amounts of investment – It’s not surprising given the many ambitious founders we meet in the data space that capital continues to pour into data-focused startups in Europe and Israel with over $14B invested in 2020, according to PitchBook data from July 2021. We expect this number to dramatically increase even further this year, with deal sizes also increasing due to more ambitious founders tackling data-related problems with novel solutions.

- The data ecosystem will see a human capital flywheel – As the tech ecosystem continues to mature, we will see more employees leave large tech companies and scale-ups to launch their own data-focused companies. A clear example of this is Maarten Masschelien, who left Collibra to co-found and launch Soda. We expect to see more examples of founders like this starting their own businesses in the future. Additionally, given the strong technical depth in the European ecosystem, we expect to see the community of buyers and data engineers, scientists and analysts continue to flourish.

- Product-led-growth will become a popular GTM strategy – Already, we are seeing that next-gen data startups are adopting product-led growth strategies to drive adoption and momentum. The approach removes the need for expensive on-the-ground sales forces in new markets and provides a fast time-to-value for enterprises. In parts of the data tooling sector, top-down enterprise sales will remain a necessity, but we believe that more and more solutions offering a free entry version and/or being built on top of open-source projects and bottom-up adoption will permeate into enterprises.

Get in Touch

We’re proud to have backed companies across the full data stack and believe that innovative opportunities will continue to emerge as companies adopt modern data tools. If you are building a company in this space, we’d like to hear from you. And if there are innovative data tooling solutions that we may be missing in our landscape, please don’t hesitate to let us know at: [email protected].

Special thanks to Tyler Crown for his help in researching and publishing this piece.