The rise of cloud platforms such as AWS, Google and Azure, and the growth of companies such as Cloudflare, Datadog and Snowflake, has shined a spotlight on usage-based pricing (also known as resource-based, utility and pay-as-you-go pricing). In fact, it’s the second most prevalent pricing model being used today by enterprise technology companies according to a recent KeyBanc SaaS study.

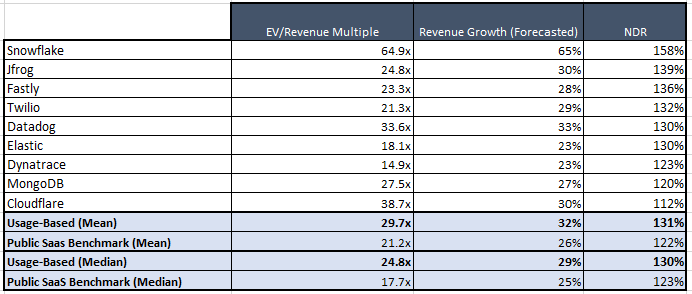

In the table below are the public companies with elements of usage-based pricing models, which are expected to grow revenue at a faster rate and are growing more efficiently compared to a broader list of 50 public high-growth SaaS companies. As a result of usage-based pricing, these public companies are experiencing faster and more efficient growth than their public SaaS peers are being valued at a premium (24.8x vs 17.7x) by the public markets.

Usage-based pricing not only provides business benefits, but it also helps improve your customers’ experience:

- It better correlates product usage with pricing thus eliminating the potential “black box” of other pricing models.

- With a well designed usage-based pricing model you can shift cost control to the customer, providing them with maximum flexibility.

- It avoids customers having to buy a solution package that is typically oversized to meet their occasional peak demand period for your technology.

- Provides a low entry price point and allows customers to experience the full product regardless of company size.

- Customer retention is built into the usage-based pricing model since it does not require customers to cancel their plans during periods of lower usage.

To successfully implement a usage-based pricing strategy, companies should consider the following four key factors as they design and execute this pricing strategy:

1. Identify the right value metric and start simple

While usage-based pricing is typically priced around technical metrics (i.e. API calls, number of queries, etc.), they should be designed around value-based pricing principles. In short, the metric you are charging against should correlate as closely as possible to the value your customer extracts from your product, and the price should be predicated as a percentage of that value creation.

One of the advantages of usage-based pricing is it takes a traditionally monolithic pricing approach and allows you to create a composable system that provides different features, which can be monetized in your solution. Ultimately, a usage-based pricing model can make value-based pricing easier as it becomes a packaging exercise as the value dimension- usage -is now variable.

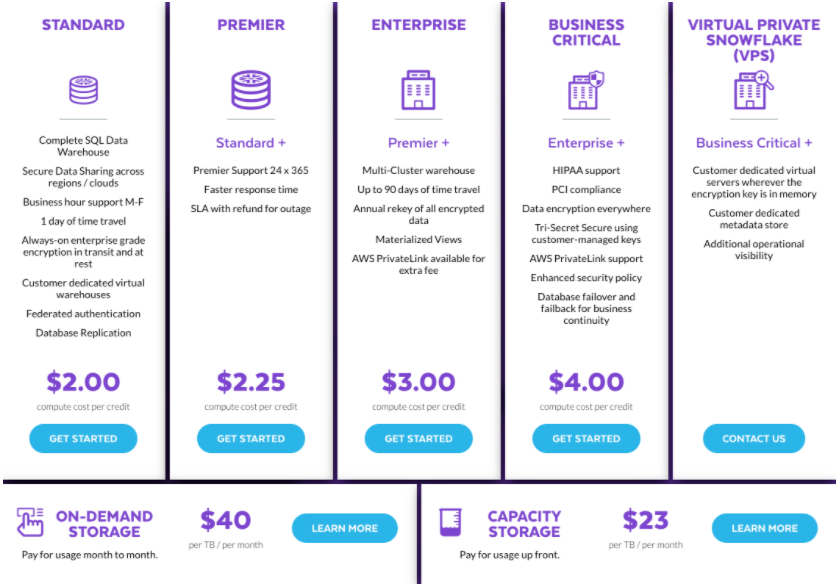

Sam Lee, Head of Pricing at Snowflake put it this way, “For example, a typical user subscription model offered by many SaaS companies oftentimes package their offering based on service levels (e.g. good, better, best) and on user/role types (e.g. Lite User, Reader, Fulfiller, etc.). This can create a very complex licensing regime for their customers and leads to mislicensing and procurement frustration. Usage-based pricing models may help collapse those complexities into a unified pricing model by eliminating user roles with one variable usage metric.”

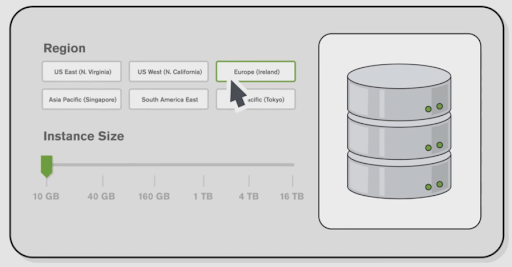

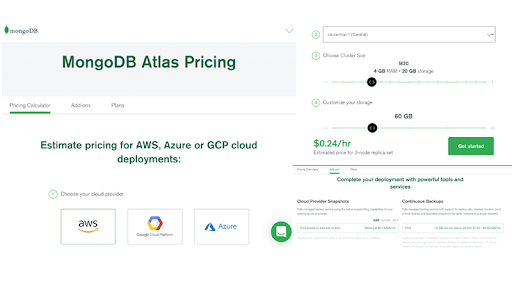

Once you have identified your primary value metric, move on to building a usage-pricing program around that. As you scale, mature and add features, expand usage-based pricing vectors within your solution. A great example of a company that’s progressed this way is MongoDB, which in 2016 launched Atlas and priced it based on region and instance size. Looking at their pricing page today shows a much more robust offering, which allows users to generate pricing based on cloud provider, region, cluster size, storage amount and additional add-ons.

How it started:

How it’s going:

2. Build Customer Monitoring, Alerting and Reporting

Due to the elasticity of usage-based pricing consumption, and in theory, unlimited consumption capability, you will want to deliver a certain level of monitoring, alerting and reporting to help customers manage costs, performance and the adoption of your solution.

For example, large enterprise customers will want to monitor and allocate technology consumption by department so that they can bill back costs to business units and departments. Furthermore, system administrators of your solution will want you to provide email alerts and the ability to automatically suspend service to users after consuming a certain percentage of credits to help manage their user’s consumption.

The last thing you want is for a potential customer to receive an unexpectedly high bill after a certain period of usage, which will make them feel like they have lost control of your technology within their organization. Usage-based pricing is meant to convey the exact opposite impression to your customer.

3. Reimagine the Roles of Sales

The nuances of sales and customer success will be different with a usage-based pricing company. While customers can pay-as-you-go, it’s more common, especially for enterprise customers, to purchase annual usage commitments in advance to lock-in discounted pricing with payment upfront or as they are utilized.

In this scenario, questions might arise on how to compensate your sales team on commitment contracts. Should quota be retired against the quarter that the customer’s commitment was made, or compensated on commitment amount as they are burned down per quarter? Furthermore, how should sales reps be compensated for those accounts as their consumption potentially grows in future periods, or for those that start off small and grow in value? Typically, with usage-based pricing, the initial sales lands are small with significant expansion opportunities ahead, so sales compensation needs to be adjusted accordingly. It also means that it’s critical to help ensure customers are successful in order to land potential large expansion commitments later on.

Consider these 3 changes to your sales organization when moving to a usage-based pricing model:

- Due to typically lower contract lands, quotas for new accounts should be adjusted slightly down for your sales team to reflect this dynamic.

- Consider allowing reps to keep accounts for longer than 12 months or until the first renewal to allow them to take ownership of that critical initial expansion of the account.

- Compensate sales reps by offering a blend of committed consumption spend and realized revenue/usage during the period to strike a balance and help incentivize proper sizing of commitment contracts.

In an extreme, yet successful example Snowflake has no customer success team as account teams are responsible for driving commitments and then ensuring customers burn down those commitments to obtain quota retirement.

As you adopt a usage-based-pricing model, you’ll want to prevent incentivizing sales teams from having customers sign-on for commitments that are frequently oversized. Customers who continue to underutilize their commitments will become frustrated, resulting in uncomfortable conversations about how you can make them whole on unused credits. This can be done by rolling over credits to the next year with in turn a higher commitment on consumption, which may only exacerbate the problem and put added pressure on your team to ensure they burn down their credit allocation.Ultimately such behavior isn’t aligned with the company’s financial interest anyway – since the company can only recognize revenue after the credit has been consumed. In fact, AWS and Azure comp their reps 100% based on consumption not commitment to better align interests with their customer and promote a focus of customer credit usage with their sales team.

4. Explore Ways to Help Your Customer Budget

With usage-based pricing it can be difficult for new customers to forecast how much they may consume in a given period. For example, a new user may struggle to understand how much to budget for a service that charges $0.0075 per HTTPS request. It requires your customer and sales team to do some math and have the technical knowledge to forecast the estimated usage of your solution.

You never want to put extra work on the customer to adopt your solution so here are 3 pricing strategies you can leverage to help alleviate this friction point:

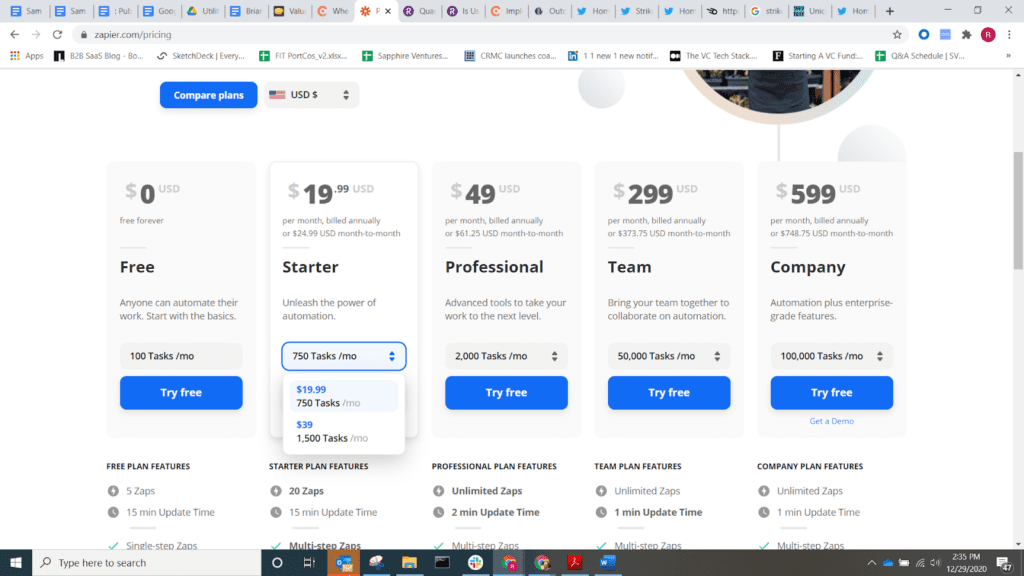

- Hybrid Pricing: Charge a tiered subscription price for a certain threshold of technology services with additional per usage charges on overage. Basically a combination of a tiered, subscription and utility pricing strategy. Zapier has a hybrid approach with an offering that combines elements of tiered and usage-based pricing.

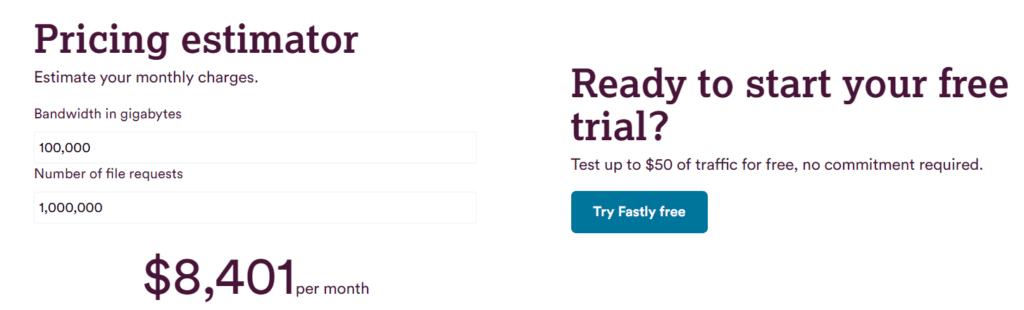

- Pricing Calculators: Develop tooling on your website to help your customer easily forecast monthly, annual or unit-based costs by providing a pricing calculator. Below is a view of Fastly’s pricing estimators on their website. It’s simple and makes it very easy for a customer to understand and forecast the cost for your service. For more complex technologies or customer environments, you may have to pull in a solution engineer from your team to help the customer forecast consumption and cost.

- Simplicity: As noted above, keep it simple. Charging across four different user metrics and three different service level offerings can lead to potentially 36 different pricing combinations

Brian Mullen, VP & GM of Cloud at portfolio company InfluxData, says of their usage-based program strategy, “With InfluxDB Cloud we sought to eliminate unanswerable pricing questions for our customers. For example, with a database, the duration of a query is tough to forecast. Developers know their own workload in data and query volume, but would be hard-pressed to guess query duration on infrastructure they can’t even see. So we decided to charge by query count, which is knowable by the customer, instead of query compute duration, which is not.”

Usage-based pricing can be a great way to align incentives, improve customer retention and simplify your offering to customers. A successful pricing strategy requires thoughtful execution and coordination across your company. If your solution is very scalable, incurs highly variable usage, and has a clear, measurable transaction that aligns with value for customers then it may be a pricing methodology worth pursuing. Hopefully, the factors outlined above will help provide context in often overlooked implementation considerations of this strategy.