In enterprise SaaS, 2024 was a year of contrasts – an AI-driven rebound in VC funding, a sharply divided public market, and an exit environment that, despite improving, remained defined more by anticipation than action. Private markets saw highly concentrated funding, with $1 billion-plus “ultra-round” financings for AI-natives, and public markets saw growth and margins trending in opposite directions.

We’ve spent the last few weeks analyzing 2024 data and have considered the year ahead and what we expect to see across the enterprise SaaS landscape in 2025. The result is our 2nd annual State of the SaaS Capital Markets Report, which we are excited to publish today. We recognize the world is awash in Year-in-Review reports and prediction pieces, but we think ours is still worth including on your reading list if you are a serious builder, investor or follower of enterprise SaaS for a few reasons:

- Our analysis covers both private and public SaaS markets in detail, including many proprietary views on sub-categories and investment trends.

- We focus exclusively on the state of the SaaS capital markets (vs. the broad technology landscape), including valuations, capital allocation and exits.

- Our predictions are (a) data-driven, based not only on a thorough look back at what happened in 2024, but also over the course of the past decade, and (b) specific enough to allow a straightforward assessment of whether we are right or wrong.

To check out the full report click here, or read on for a summary of our top 10 predictions for enterprise SaaS in 2025.

Sign up for our newsletter

Top 10 Enterprise SaaS Predictions for 2025

Prediction 1: VC funding Will Accelerate in 2025, Growing at a Double-Digit Rate for the First Time Since 2021

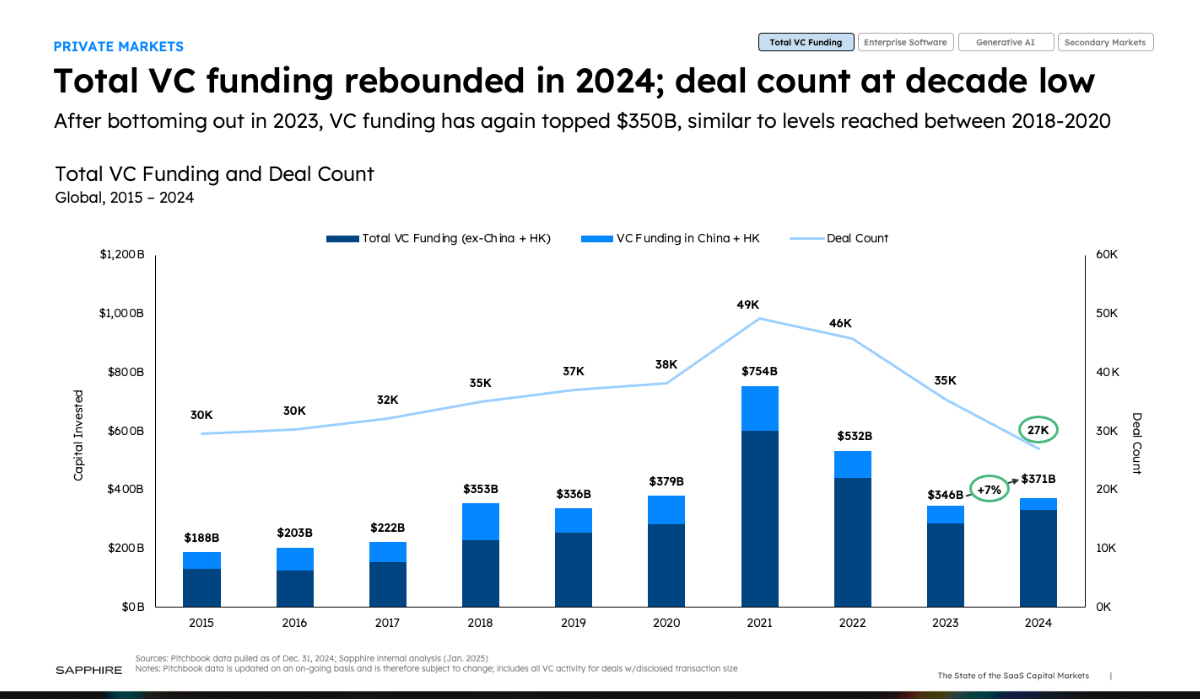

In 2024, global VC funding increased 7% thanks to a Q4 surge in funding that included four of the 10 largest VC-led deals of all-time (Databrick’s $10B Series J, OpenAI’s $6.6B round, xAI’s $6.0B Series C and Waymo’s $5.6B Series C). With $113 billion invested in Q4, total funding for the year hit $371 billion – almost exactly in line with 2020’s level and roughly 10% higher than 2019’s figure. However, deal count was down again, hitting a 10-year low, while deal concentration spiked to new all time highs due, in large part, to the quantum of capital invested in the compute-hungry AI research labs.

We think this trend will continue in 2025 and predict a year of double-digit growth in global VC funding, pushing total investment above $400 billion for the third time in five years. Our view is based on the expectation that investment in AI remains robust (see more below) and that we see more growth in capital–intensive categories like defense, climate and energy. We also see the potential for rebounds in consumer and crypto during the year, particularly as the latter seems poised to benefit from shifting regulations. Additionally, while we do believe the exit environment will improve in 2025 (again, see more below), we believe many of the scaled, late-stage players will likely need to tap the private markets for large rounds of pre-IPO capital. With $500 billion–plus in dry powder, VC’s will be ready to meet these needs, and their activity will put us fully back on the pre-pandemic trendline of annual VC investment.

Prediction 2: Enterprise Software Will Gain Share of Total VC Investment

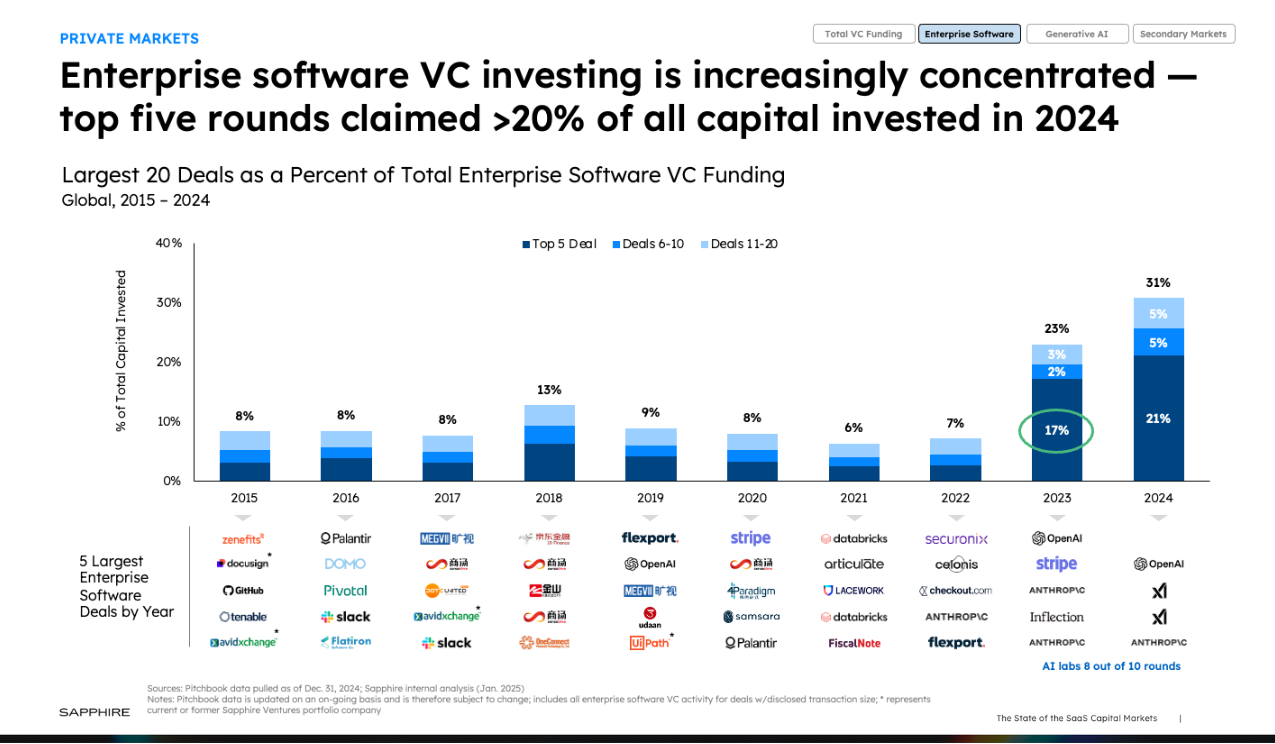

Global VC investment into enterprise software companies outpaced the broader market trend, as total capital deployed grew 27% to $155 billion in 2024. At this level, enterprise software companies claimed 42% of all VC investment during the year, a new all-time high.

As referenced above, much of this growth came from massive financings of the leading AI research labs, resulting in a highly concentrated funding environment. How concentrated? The top five deals for the year represented 21% of all investment into enterprise software companies, while the top 20 represented nearly a third.

As enterprise software specialists, we unsurprisingly remain bullish about opportunities across the landscape. We believe we will see enterprise software increase its total share of venture investment again, a trend we’ve seen since 2016. While we don’t expect another big spike like we saw in 2024, or in the 2020-2021 period, we believe enterprise software is poised to grab another 1-2% of share, particularly as many of the conditions described in our first prediction around later-stage capital needs are more pronounced for enterprise companies.

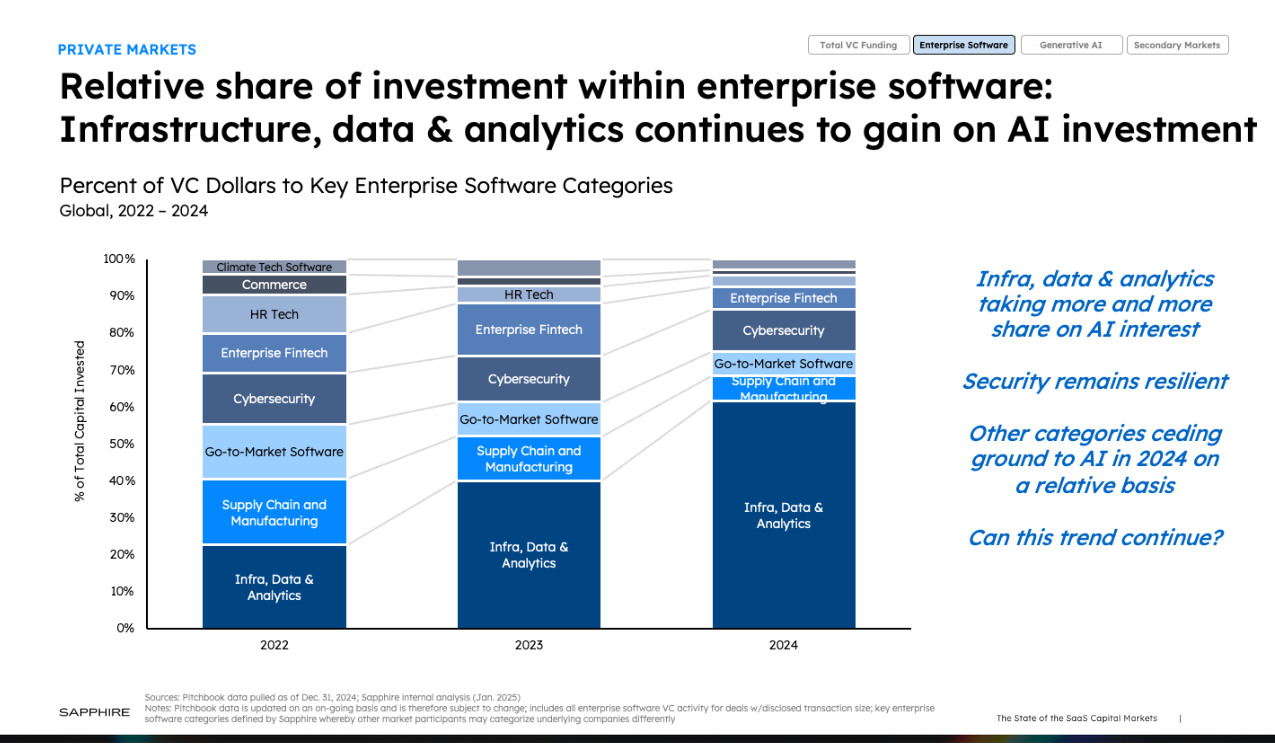

Prediction 3: Breadth of VC investment Will Improve in Enterprise Software, as “Infrastructure, Data, and Analytics” Cedes Share

The surge of investment in AI labs building frontier models, alongside significant investment in companies focused on data, has propelled the “Infra, Data and Analytics” category to unprecedented heights. In 2024, this category claimed 62% of all investment into enterprise software, up from only 23% in 2022.

We think the category has, at least momentarily, peaked and that we will observe greater breadth in 2025. Specifically, we think biz apps will see increased levels of funding in 2025, alongside security and enterprise fintech. While infra, data and analytics will remain a popular theme, we anticipate a slightly less bifurcated market than we have experienced over the past two years.

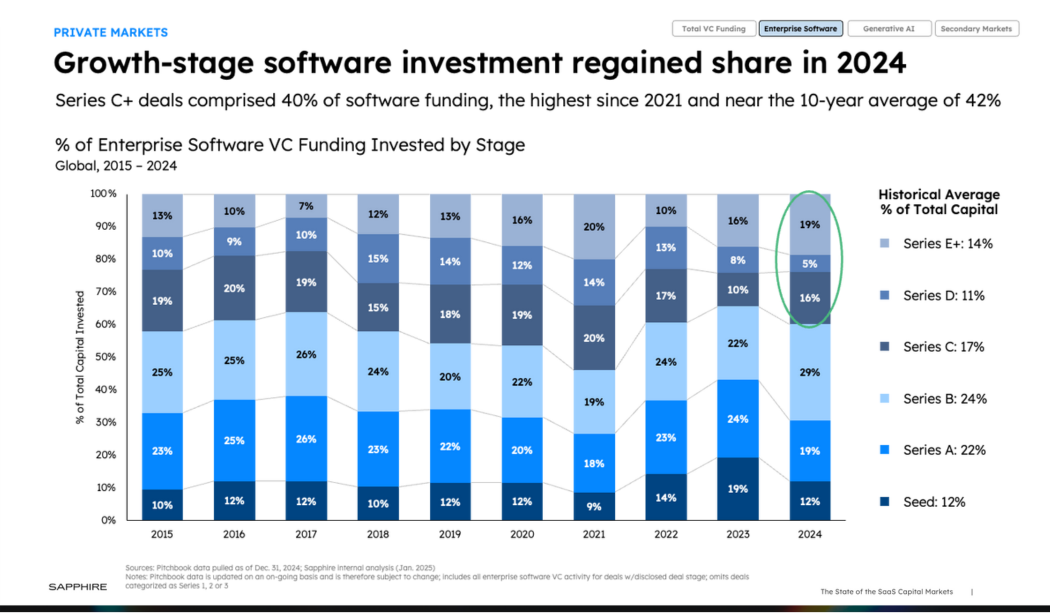

Prediction 4: Growth-Stage Investment (Series C+) Will Gain Share, Exceeding the 10-Year Average of 42% of Total Funding

After two years of decline, culminating in a 10-year low in 2023, growth–stage investment in enterprise software rebounded nicely in 2024. We think this is another trend that will continue in 2025 and expect to see growth–stage close in on its 10-year average of 42% of funding. There are a few factors underpinning our view. First, the backlog of enterprise software unicorns that haven’t raised capital in the last 18 months has climbed to 412 companies. The overwhelming majority of these companies would fall into the late-stage bucket, if they were to raise capital again in 2025. We believe many will do so this year. Second, a number of high–growth AI-native companies, many of which have raised multiple early–stage rounds in rapid succession, will also be entering this stage in 2025.

Finally, we believe the last two years have ushered in an era of $1 billion-plus financings. We are calling these 10-figure deals “ultra-rounds,” and they dominated the investing environment in 2023 and 2024. Case in point: 15 of the 20 largest enterprise software VC deals of all time took place in the last two years, with fivefour months! While not all ultra-rounds go to late-stage companies, they do tilt in that direction, and we expect their oversized impact to support growth–stage share of investment going forward.

Prediction 5: GenAI Funding Will Not Double Again in 2025; Application Layer Will See the Largest Relative Increase in Funding

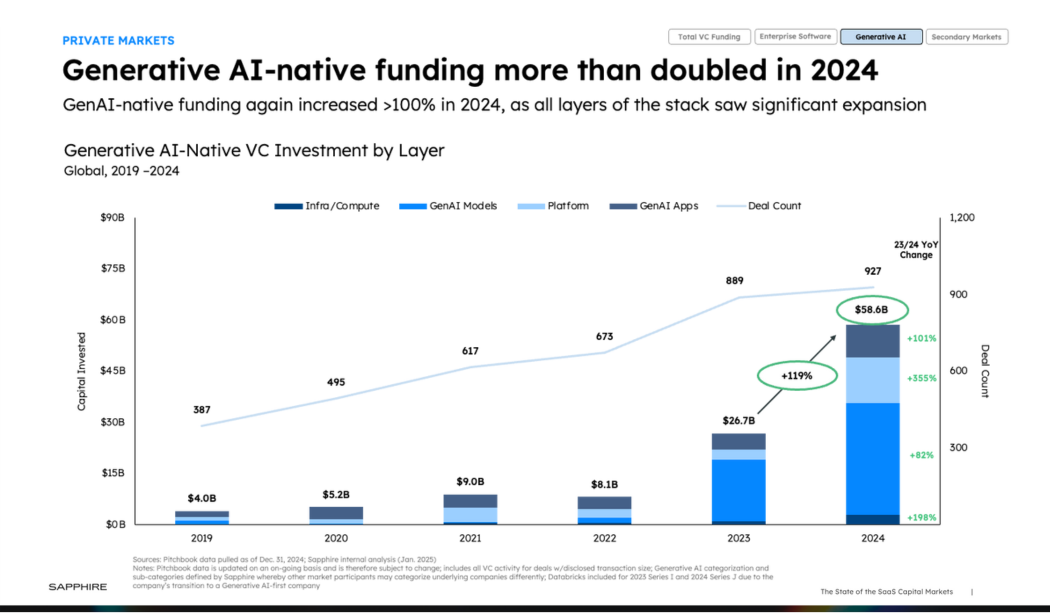

At Sapphire, we have developed our own proprietary view of generative AI–native funding, which we have been updating quarterly over the past two years. This exercise is more complex than it may seem, given the increasingly blurred lines between AI-native and AI-enabled companies. We also think this distinction will matter much less over time as AI becomes much more deeply embedded into all companies’ products and operations. That said, by our count, GenAI–native funding increased 119% in 2024 to reach ~$59 billion globally, following a 230% growth rate in 2023.

While we think investments in GenAI companies will remain very strong in 2025, we predict that total growth in investments will come in under 100%. This is hardly a bearish sentiment, just an acknowledgement of the law of large numbers. We expect to see growth at all layers, though our bet is that applications will see the greatest expansion of investment on a percentage basis (note: it’s tough to imagine the AI labs not consuming the most total capital as they press ahead on the next generation of models, especially if the rumors around Softbank putting up to $25B into OpenAI are true). Our bullish view on the application layer is predicated on a few beliefs, including:

- An accelerated transition from experimentation to deployment across a broad range of use cases.

- The first generation of agent products begin to show traction, particularly in well-structured vertical use cases.

- The marginal cost of intelligence continues to fall precipitously making it easier and cheaper for application developers to imbue their product with new AI capabilities (note: this last view seems to be playing out even more rapidly now amidst the DeepSeek releases).

As our report highlights, companies at the application layer that have proven product/market fit and are scaling rapidly have been tapping the market frequently for fresh capital. We expect to see much more of this in 2025.

Prediction 6: Public SaaS Multiples to Climb, Reclaiming the 10-Year Ex-COVID Average

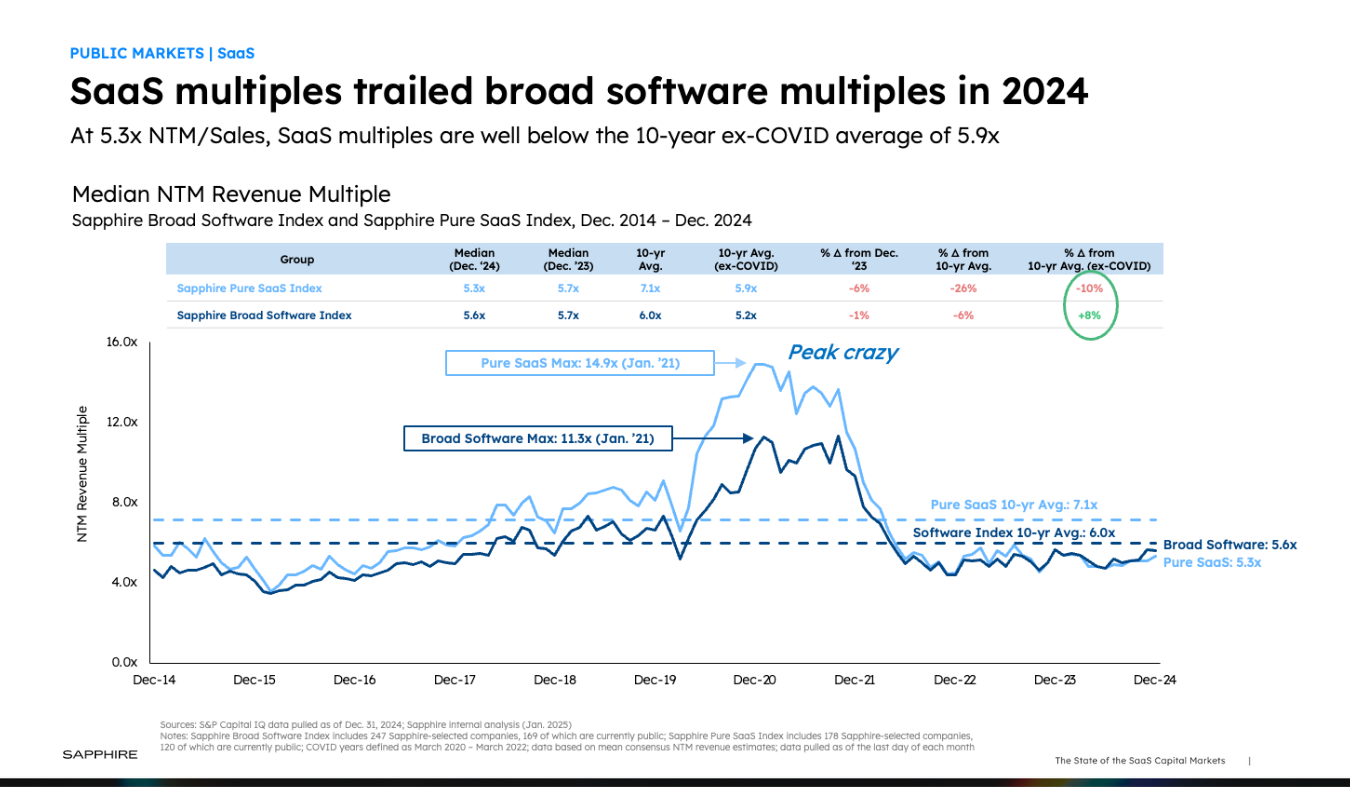

Public SaaS multiples remained below their 10-year average, even after running up slightly during the second half of the year. Although we got this prediction wrong in 2024, we return to it with more confidence in 2025. We believe that after a couple years of choppy movement, SaaS multiples will break higher in 2025 and reclaim, if not surpass, their longer-term historical average.

This optimism is based on our view that growth will improve incrementally and that companies will continue to operate more efficiently, as evidenced by the strong, sustained upward trend in GM and FCF observed over the past few years. Investor appetite shifting to “AI adopters” from AI infrastructure providers should also support many public SaaS names.

Prediction 7: After Bottoming Out, Public SaaS Growth Will be Neutral to +1-2% Higher in 2025

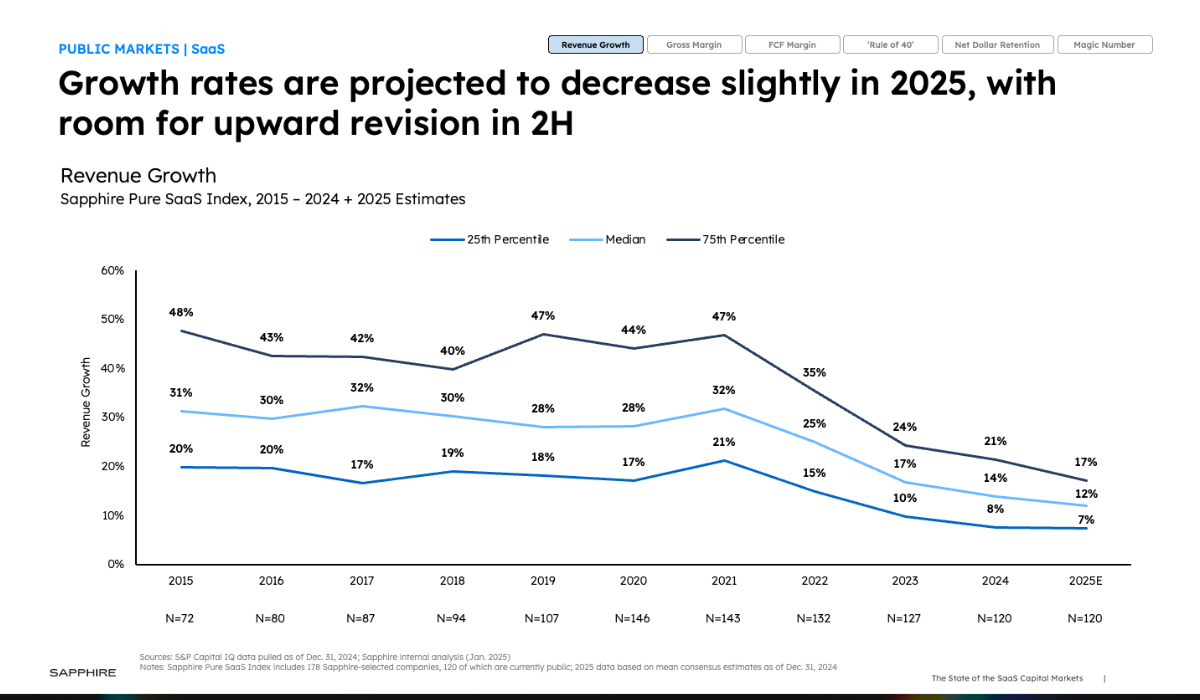

In last year’s Capital Markets report, we predicted an upward inflection in SaaS growth rates. Instead, the median rate of expansion for SaaS companies retreated from 17% in 2023 to 14% in 2024. Heading into 2025, projections indicate a further decline from 14% to 12%. However, we’re doubling down and going against the consensus once more, predicting that 2025 will produce neutral to slightly incremental growth for SaaS companies. Our optimism stems from the following key factors: the economy remaining resilient, expanding IT budgets staying consistent with the most recent CIO survey data, and we are beginning to see more material impact from AI-native services.

Prediction 8: Investors Will Continue to Focus More on Growth in 2025, Lifting the Relative Value of Growth/FCF Margin to 2.5x+

We are entering a third straight “year of efficiency” and share the consensus view that more profitable growth will remain in favor with investors. However, as the back half of 2024 demonstrated, the investor class appears to be incrementally increasing their focus on the top-line. To support this, we note that the relative importance of growth/FCF margin ended 2024 at the highest ratio we saw all year (2.3x), while the median 2025 revenue multiple for companies projected to grow 25%+ improved to 10.7x exiting the year, compared to 9.1x 2024 revenue at the end of 2023. We predict this trend will continue into 2025, with relative importance of growth/FCF margin surpassing 2.5x. While still below the COVID-era peak, this shift is indicative of an increasing appetite for higher sales growth.

See pages 52-54 in our report for detailed analysis on this topic.

Prediction 9: We Will See At Least 10 Enterprise Software IPOs in 2025, Setting the Stage for a Big 2026

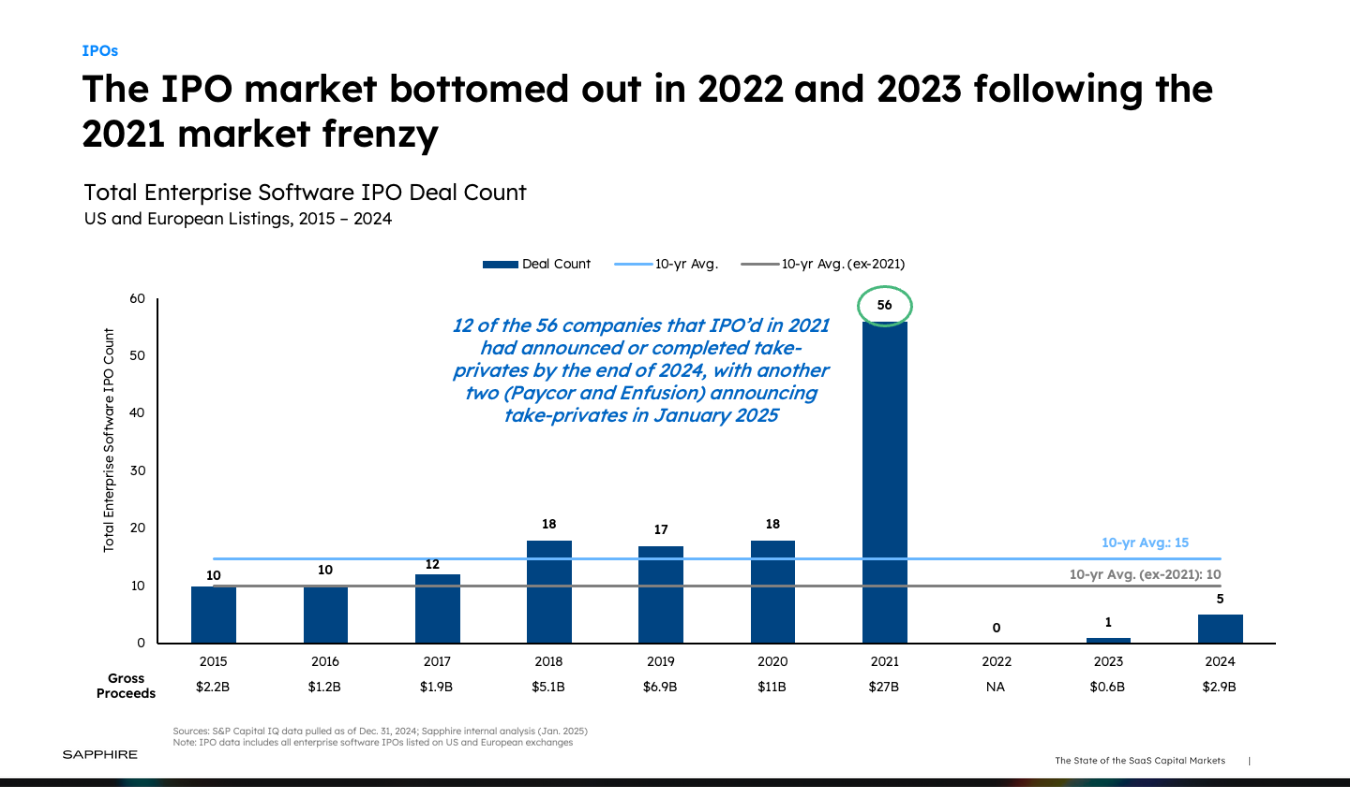

It’s rare for activity in any market to quintuple in a given year and still remain 50% below the 10-year historical average, but that is the exact dynamic we just experienced in the market for enterprise software IPOs. Granted, the base was incredibly low, with only one IPO in 2023 vs. the five we saw in the past year.

That said, it was still a very quiet year for new issuance, which we predicted in last year’s Capital Markets report. As we said at that time “The real action happens in 2025,” and we continue to hold that view. We predict that we will see at least 10 enterprise software IPOs in 2025, which would bring us back to the 10-year average for new listings. We are confident in this prediction based on the strong performance of the recent IPO cohorts, the growing backlog of scaled candidates (e.g., Databricks, Stripe, Scale AI, CoreWeave) with increasingly IPO-ready financial profiles, and the improving sentiment we’re hearing from our capital markets and CFO networks. We think 2025 will be a return to normalcy that sets us up for an even bigger year of debuts in 2026!

Prediction 10: M&A Transaction Volume Will Increase More Than 20%, With Several $10B+ Software Deals Being Announced in 2025

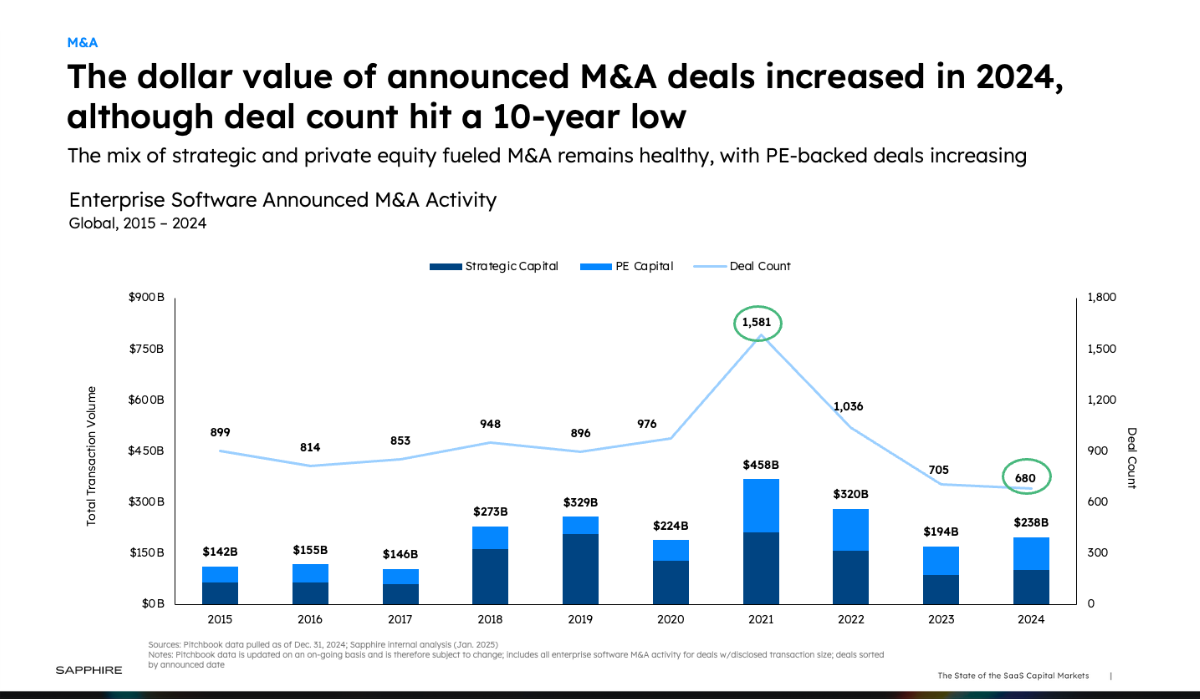

Enterprise software M&A increased in 2024, as we expected; however, it was far from a banner year for deal-making. While $238 billion in committed capital was announced during the year – a 23% increase over 2023’s level – deal count fell to a 10-year low. Absent a couple of large strategic deals – such as Synopsys’ $35 billion bid for Ansys and Siemen’s ~$10.6 billion purchase of Altair (which together represented almost 20% of the committed capital for the year) – we could have seen a third consecutive year of decline in M&A on a dollar basis as well.

In addition, the market’s focus seemed to shift toward rumored deals that didn’t materialize (e.g., Google/HubSpot, Salesforce/Informatica) and “extracti-hire” transactions for AI talent (e.g., Inflection, Character.AI, Adept).

We predict 2025 will see a spike in deal-making activity by at least 20%. We also expect a return of large acquisitions. Our optimism is grounded in several key factors:

- The removal of the election overhang in the U.S., with the potential for a more deal-friendly regulatory environment.

- Financial and strategic buyers sitting on near record piles of cash, with many in the latter group also able to leverage greatly appreciated stock prices.

- A potential pivot by Big Tech companies away from AI CapEx, freeing up capital to pursue acquisition targets.

- A large backlog of private unicorns that have not raised capital in the past 18 months, many of which are not yet IPO candidates and may look for an exit via M&A.

With these dynamics in play, we believe corporate development teams, private equity firms and investment bankers will be busy in 2025.

Looking Forward: 2025 and Beyond for SaaS

That’s a wrap for our summary. For deeper insights and a closer look at all the data, we encourage you to download the full report so you can dig into all the data views yourself.

As you explore it, please don’t hesitate to reach out to let us know what you think about the report and our predictions – we’d love to hear from you about what you think we got right, where you might disagree and what we may have missed.

Feel free to reach out to Steve Abbott ([email protected]) or Kevin Burke ([email protected]) with any thoughts or questions.

Legal disclaimer

Disclaimer

Nothing presented herein is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures, LLC (“Sapphire”). does not solicit or make its services available to the public. Prospective investors may rely only on a fund’s confidential private placement memorandum or an official supplement thereto. An investment in a Sapphire fund is speculative and involves a high degree of risk.

Information provided reflects Sapphires’ views at a point in time. Such views are subject to change without notice; as of January 28, 2025 unless otherwise noted.

Certain information contained in this presentation including any prediction or projection may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof, or comparable terminology. Due to various risks and uncertainties, actual events or results, or the actual results may differ materially from those reflected or contemplated in such forward-looking statements, and no assumptions should be made that any such strategy or investments were or will be profitable. Sapphire provides no assurance or no guarantee that any such prediction will ultimately occur.

This Presentation has been prepared from original sources, or other cited data, and is believed to be reliable. However, no representations are made as to the accuracy or completeness thereof. The information in this Presentation is not presented with a view to providing investment advice with respect to any security, or making any claim as to the past, current or future performance thereof, and Sapphire expressly disclaims the use of this Presentation for such purposes. The inclusion of any third-party firm and/or company names, brands and/or logos does not imply any affiliation with these firms or companies. None of these firms or companies have endorsed Sapphire or its affiliates. References to specific companies in this Presentation are for illustrative purposes only and should not be considered a recommendation to carry out securities transactions. It should not be assumed that recommendations made in the future will be profitable or will equal the performance discussed herein.

“Internal Sapphire Analysis” described within respective graphs above refers to observations of the ”Sapphire Internal Public SaaS Index” which is an internal paper composite maintained by Sapphire is for informational purposes only and is in no way intended to constitute investment advice. The index consists of individual SaaS related public equities chosen at Sapphire’s discretion. The index is not investable and does in no way represent any investment offering to be made in any fund managed by Sapphire. While Sapphire has used reasonable efforts to present observations from analysis of the index, Sapphire makes no representations or warranties as to the accuracy, reliability, or completeness of observations presented within any analysis described or the index itself. All metrics and observations described in relation to the index must be considered academic and hypothetical in nature and are in no way guaranteed in actual practice. While Sapphire has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented within the index or this article. No assurance can be given that all material assumptions have been considered in connection with the analysis of the index, therefore actual results may vary from those estimated therein and are subject to change. No assumptions should be made that any investments described above were or will be profitable.

The content in this Presentation has not been reviewed or approved by the Securities and Exchange Commission.

Past performance is not indicative of future results.