Seeing the rise of open banking and evolution of solutions from rudimentary screen scraping to integrating open APIs in Europe, our search began for a visionary team that could power the open banking and open finance capabilities of fintech companies. The first time we met Stefano Vaccino, founder and CEO of Yapily, and his team, everything just clicked. The team is hungry, experienced and stacked with strong engineering and payments talent, and they impressed us with their deeply thoughtful, humble and infrastructure-first approach.

At Sapphire, we have a long history of investing in and building companies of consequence in the API-first category, having backed Apigee (acquired by Google), Auth0 (acquired by Okta), Mulesoft (acquired by Salesforce), Segment (acquired by Twilio), Contentful and Project44, as well as in the fintech and payments industry, having backed AvidXchange, Currencycloud, Current, IEX, OnDeck, Paytm, Square and Wise. We’ve been interested in fintech innovation for some time now, and more recently have been excited about the European payments landscape in particular. In fact, we just published a blog about why we think the European payments market is hotter than ever. The timing was therefore perfect when Yapily started talking to us about their intentions to raise their Series B.

Covering more than 90% of accounts in major European countries, Yapily provides a single API for companies to embed the power of open banking within their products and services. For example, Yapily enables companies to access, create and execute payments on behalf of their users from one bank account to another. Without Yapily, those companies would have to integrate with, and maintain connections to, each individual bank – a significant resource and time intensive task.

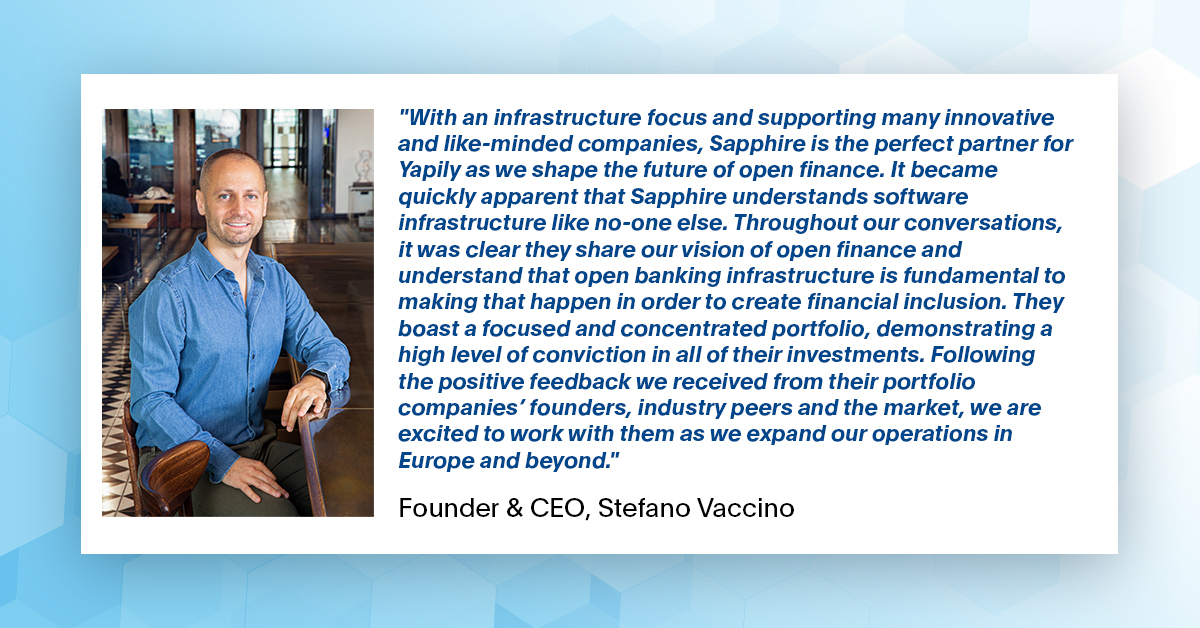

Yapily is helping companies create better financial services for everyone, which is why we are thrilled to back Yapily, and lead their Series B, joining our friends at LocalGlobe, Lakestar and HV Capital. We look forward to supporting Stefano and the entire Yapily team on their journey to power the open banking and open finance infrastructure of third party fintechs and build a company of consequence.

Here’s why we’re excited to partner with Yapily:

A Huge and Rapidly Growing Market

European regulation such as PSD2 in the EU and Open Banking in the UK has forced financial institutions to open up their data to third parties. This began with providing individuals access to their personal banking information, but has quickly led to a number of applications that connect the otherwise siloed and fragmented elements of the banking ecosystem together.

Driven by open banking and open finance, Europe is at the forefront of fintech and payments innovation. A massively growing industry, the open banking market at its inception in 2018 was worth $7.2B and is expected to grow to $43.2B by 2026. This projection aligns with our thinking as we believe there will be an expansion of product use cases into additional market segments (such as pensions, insurance, etc.) as open finance is further adopted.

To date, the vast majority of activity in the open banking landscape is related to data. It’s our belief that the opportunity in the payments market is also considerable with a widely held industry view that open banking payments will take significant market share from card payments over the next few years. Yapily offers two core products across the data and payments segments of open banking, and the company is already seeing the benefit of the strong market tailwinds across both.

An infrastructure-only approach for open banking

Yapily is unique in its product positioning as an infrastructure-only player. This means, Yapily provides only the API and tooling features to their customers, unlike other open banking providers that are building applications. Additionally, Yapily takes an API-first approach and focus–they haven’t built legacy technology such as screen-scraping or reverse API engineering. This architecture difference allows Yapily to scale quickly, extending coverage wherever it goes, while providing more flexibility, reliability and security to their customers.

Perfect Market Timing

Although open banking has been a much talked about concept in Europe for the last few years, most companies have started to implement and capitalize on open banking in their product offerings in only the last 12-24 months, and even more recently for payments use cases. As a newer entrant to the market, Yapily has been able to develop their infrastructure in parallel with the increasing adoption of open banking APIs, and didn’t need to build out additional revenue streams to tide them over until the market was sufficiently ready.

A Visionary Leader with Strong Industry Experience

Founder and CEO Stefano Vaccino brings with him deep expertise in the payments and fintech industry, and has recruited a seasoned management team across both commercial and technical roles, including executives from Stripe, Google, Modulr, Currencycloud and WEX Europe.

We are humbled by the ambition of the Yapily team to build a company of consequence within open banking and open finance more broadly and are excited to back their next phase of growth!