Last week Sapphire Ventures and NFX joined forces to co-host our 2nd annual PropTechCEO Summit. It was a pleasure, as always, to team up with Pete Flint and host this special invite-only gathering of more than 175 entrepreneurs and investors. It was great to see so many familiar faces, and welcome many new ones, into the expanding PropTech community.

We had an amazing lineup of speakers again this year including:

- Eric Wu, CEO/Co-Founder of OpenDoor;

David Chiu, California assembly member in a conversation with Paul Levine about affordable housing - Ivy Zelman, CEO of Zelman & Associates;

- David Chiu, California State Assembly member;

- Adena Hefetz, CEO/co-founder of Divvy Homes

- Court Cunningham, CEO of Perch

A lot has changed in a year. The on-stage conversation focused on reading the macroeconomic tea leaves, discussing the impact and implications of WeWork’s failed IPO on the flex office market, and the growing recognition of the impact of income disparity and the need for affordable housing. Rather than summarizing our great speakers, we’ll be posting the full-length session videos so you can see the content for yourself.

It was great to wrap up the day with a wide-ranging discussion with Pete and Clelia Peters on what we see as the emerging trends for proptech in the coming year.

And the Survey Says?

Continuing a tradition we started last year, we conducted a pre-event survey to capture our attendees’ perspective and provide additional fodder for the day’s conversation. The complete results of the survey can be found here but a few data points I think are most interesting:

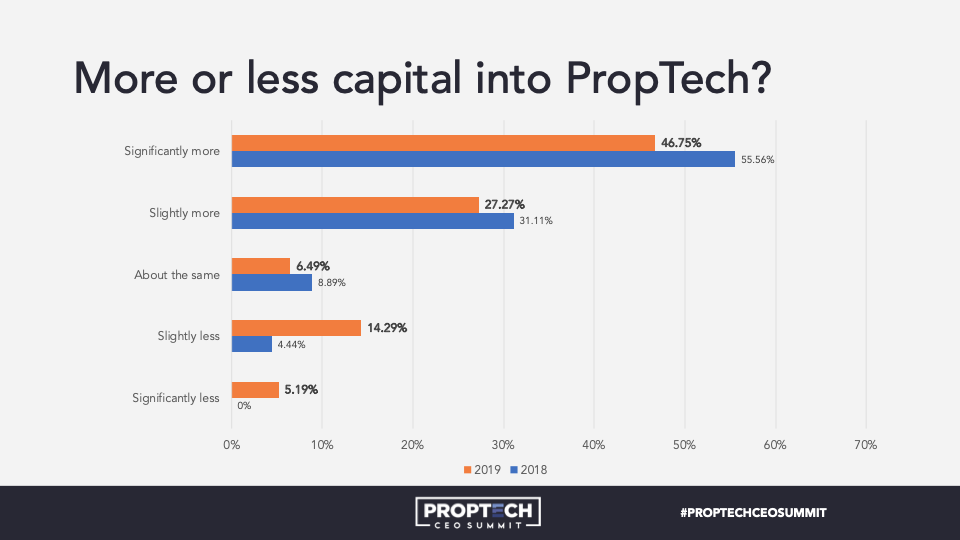

- 47% of respondents felt that there would be significantly more venture capital going into PropTech this year, and only 19% expect less. (Gotta love the optimistic inclination of founders/CEOs).

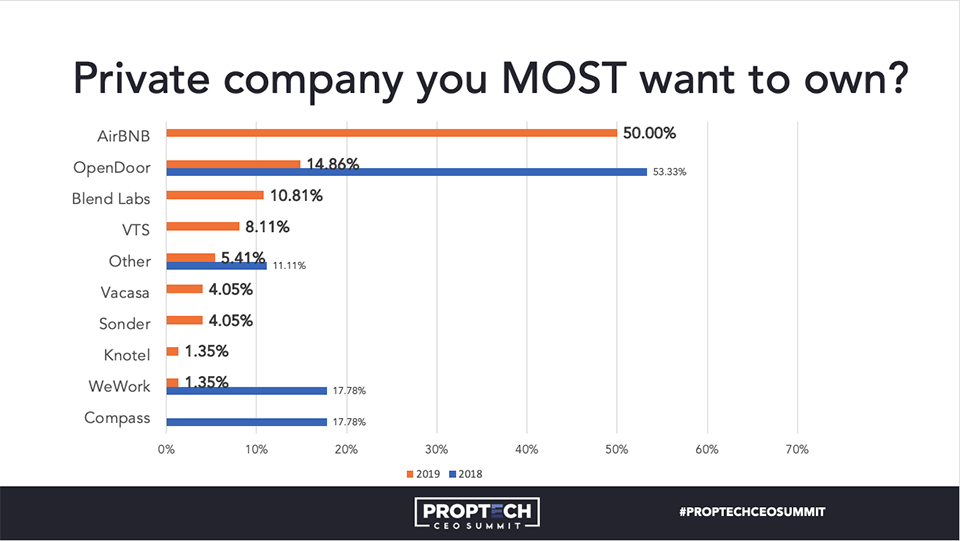

- The landscape of Private companies attendees would most like to own have shifted significantly. In 2018, the top three companies people wanted to own were OpenDoor, WeWork and Compass. This year, we expanded the list of nominated companies, and people said they most wanted to own AirBNB, OpenDoor, Blend Labs, and VTS. More telling is that WeWork and Compass fell to the bottom of the list of private companies people want to own.

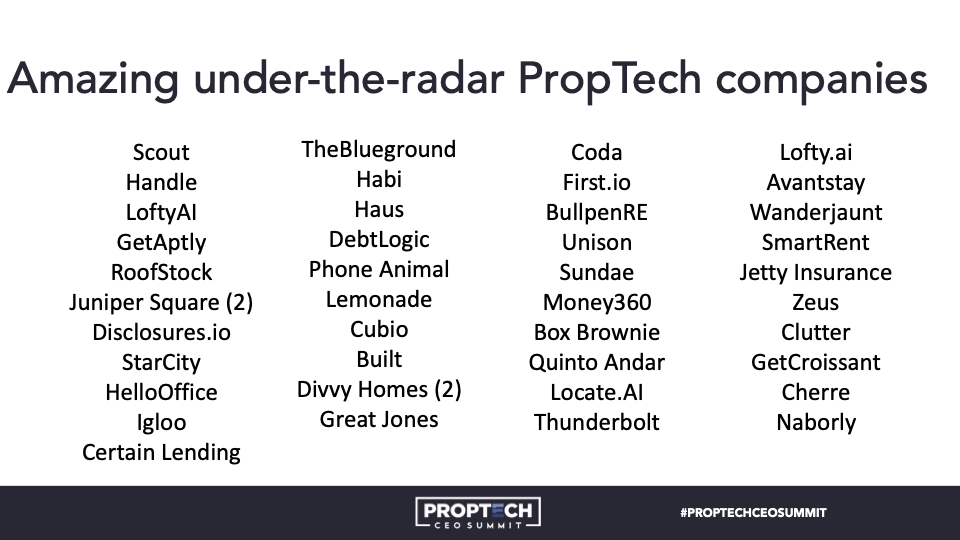

- Finally, I think in an indication of how strong and diverse the innovation in the PropTech space is right now, the number of startups that attendees identified as “amazing, under-the-radar” companies to watch grew by almost 40% from last year.

In all, it was a fantastic day spent with the best and brightest in PropTech. We’re looking forward to continuing the conversation when we publish the videos, and we’ve already started planning for next year’s Summit!