There is nothing like being ten years fashionably late to a party, though given VC interest investing into crypto[1], it seems like a good time to discuss what LPs think about crypto as an investment opportunity.

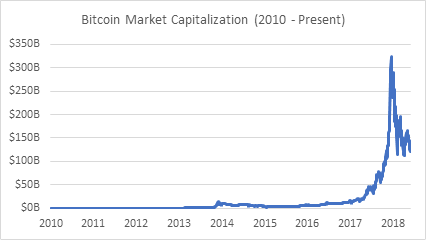

Simply put, there has been massive value creation of cryptocurrencies since 2010 as illustrated by proxy through the growth in bitcoin’s market capitalization.

And, the majority of this value creation happened in 2017, taking bitcoin’s price from $998 to $14,166.

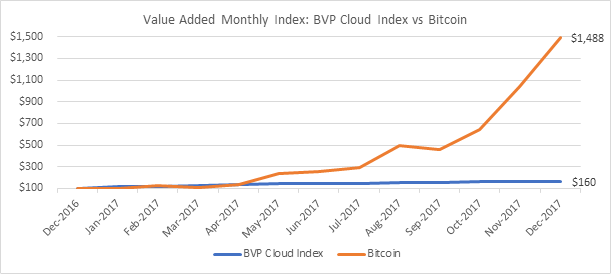

Given that blockchain has reached a significant scale in a short period of time, it shares the venture characteristic of high growth value creation, making the asset interesting to those LP institutional investors looking to access those high growth characteristics. When you ask yourself what software companies have generated $100B+ in market capitalization since 2008, the growth story is even more compelling. One particularly stark visualization is juxtaposing the SaaS index to the cryptocurrency performance in 2017.

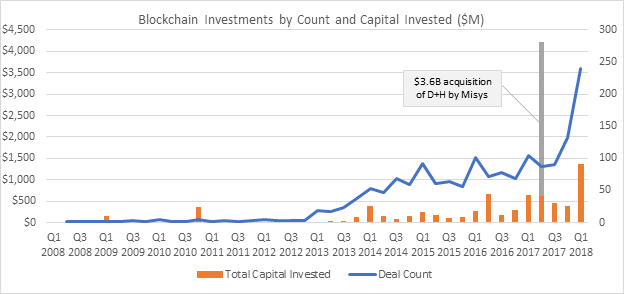

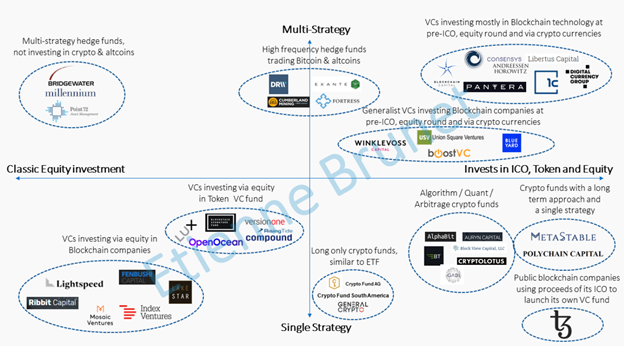

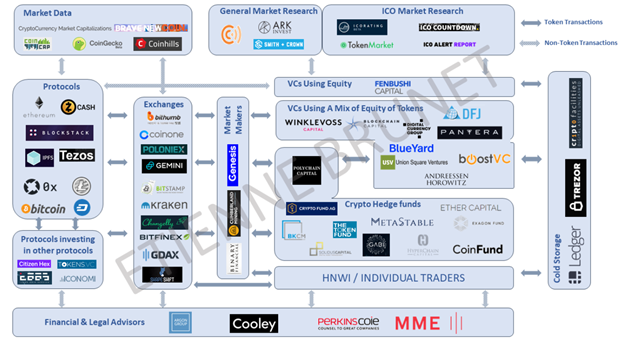

LPs are taking note that some of these investors are putting up very attractive (and liquid) performance, and are jumping into the space to understand how they can access trustworthy partners that will provide access to leading blockchain investments. Specifically, there are a number of VCs and other types of funds investing in blockchain related companies. According to Pitchbook, in 2017 alone, there were 718 investors investing over $5.2 billion in blockchain related companies.

Some are funds like USV, A16Z and Sequoia are investing in blockchain related companies, while others are new entrants to the space that have an access or experience advantage (e.g. Polychain, Placeholder or Blockchain Capital).

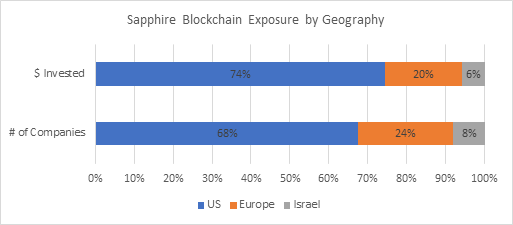

Several LPs, like Sapphire Ventures, for example, already have exposure to blockchain related companies. Specifically, because Sapphire invests as an Limited Partner (LP) into venture capital funds, we have had exposure to blockchain for several years. Sapphire invested in several of the funds that are regarded as leaders in the blockchain world before the recent rise in value of cryptocurrencies. By the end of 2017, Sapphire’s portfolio had over 35 blockchain related companies and cryptocurrencies. Coincidentally, many of the VC “early adopters” in the blockchain space were based in Europe, Israel and other places outside Silicon Valley (at least in the Sapphire portfolio).

As seen above, Sapphire already has some exposure in the portfolio to blockchain, but now the opportunity set has widened.

Given the fast pace of development of blockchain, it’s not only LPs aiming to invest in funds. General Partners (GPs) have begun to invest in funds investing in blockchain to accelerate their learning curves. Publicly, firms such as USV, A16Z, Sequoia, Bessemer and Founders Fund are investing into funds. There are many other VC firms that are following suit in order to get some grasp of the opportunities in this fast scaling area. By the end of 2016, there were collectively 644 cryptocurrencies representing $16.1 billion of total market capitalization (according to CoinMarketCap). By the end of March 2018, there were 1,551 cryptocurrencies representing $328.5 billion of total market capitalization. That’s over 20x growth in market capitalization in one year. With this pace of growth, it’s difficult to keep track of developments without key partners, especially those that are specialists exclusively focused on crypto and blockchain technology.

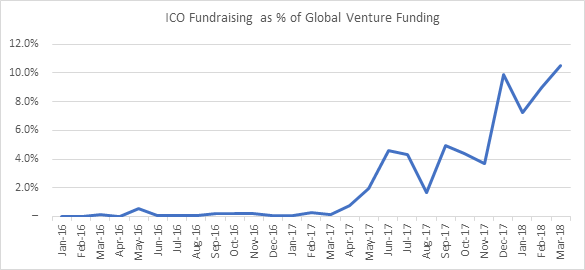

The fundamental VC model of how companies raise capital has been tested by blockchain, in particular Ethereum, which enabled the rise of ICOs.

While there is a clear opportunity to invest, there is a less clear opportunity to invest in opportunities that have appropriate levels of AML/KYC, security, custody, and appropriate vetting of the founding team.

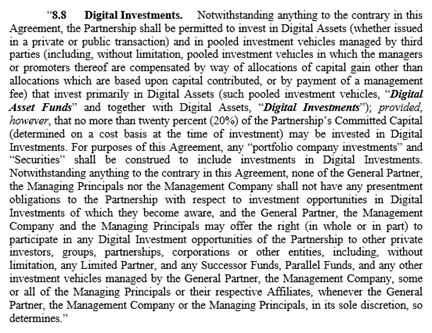

Given the potential for money laundering and detrimental consequences of fraud, LP investors are particularly cautious. Sometimes this has meant LPs continuing with their existing relationships as these VCs expand the strategy to investing in tokens and cryptocurrencies. Typically, this has required the VC to add an amendment to the Limited Partnership Agreement (LPA) so that it is possible to invest in tokens and cryptocurrencies. Most VC funds are restricted in the types of securities in which they can invest, therefore, many have to adjust existing funds to access the blockchain opportunity. Most new funds are adding this language directly into the LPA, expecting these types of investments to continue. Many times, this would look like this:

Investing in blockchain requires a different set of knowledge for LPs. In particular, as LPs are getting up to speed with new terminology, such as hash function, ERC-20, tokens, SAFTs, Dapp, DAO and Turing Complete, there are still existing concerns with the technology itself, including the possibility of a 51% attack, the limited number of transactions per second, and the significant compute power required for the technology generally. LPs, along with VCs, are taking a leap of faith that the technology will continue to improve and become more commercially viable.

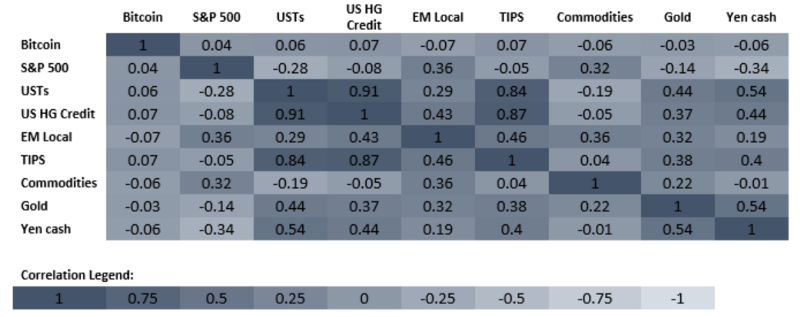

Despite these considerations, there are also positive aspects that LPs are excited about. Specifically, blockchain has enabled significant value creation through cryptocurrencies and has the potential to enable business process change that could unlock efficiencies and cost savings in traditional businesses (e.g. Ripple). As well, the fund opportunity for LPs may offer faster timelines for value creation and shorter timelines for liquidity than traditional VC (cryptocurrencies do not share the same long term lock-up as VC equity), lower fees, and uncorrelated returns to other asset classes.

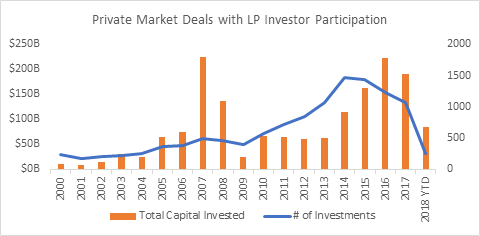

Also, while LPs have increased direct investments in recent years, there does not seem to be an increase in LP co-investments in blockchain assets given how nascent blockchain still is.

And yes, while there have been investments in blockchain applications, the companies that have been successful in terms of creating viable business models are still more the picks and shovels of the industry (e.g. Coinbase/GDAX).

Blockchain is clearly in the lexicon of every LP interested in venture capital after 2017. However, the market generally is still nascent while the opportunity is large. As the market adopts more guidelines and sees more successes, capital will flow into the space, including large amounts of capital from institutional investors searching for high growth opportunities.

[1] Broadly defined to include all crypto assets and blockchain-related companies.

Special thanks to Thomas Moon for helping with the analysis.