In the spirit of Mark Twain, reports of the death of the tech IPO have been greatly exaggerated. A quick review of popular tech articles reveals that the tech IPO was declared dead in the years 2020, 2018, 2015 and 2002. And it probably won’t be the last time that the so-called “smart money” tries to banish IPOs to the dustbin of history in favor of direct listings, SPACs or the next great recession. If we look at data from Keybanc Capital Markets, tech IPOs were up a median of 13% YTD as of July 31, but came roaring back into the post-Labor Day market to be up 27% YTD. Those numbers don’t look dead to me!

Here at Sapphire, our mission is to invest in companies of consequence and we believe there is no better marker ofsuch a company than a successful transition to the public markets. Since 2011, we have backed 30 private companies that have gone public, including six in the past three months: monday.com, 23andMe, Integral Ad Science, Wise, Kaltura and Cazoo. We believe (and have always believed) tech IPOs–particularly software IPOs–are here to stay. And that’s good for everyone involved, including entrepreneurs, VCs and individual public market “Main Street” investors. Let’s look at the evidence.

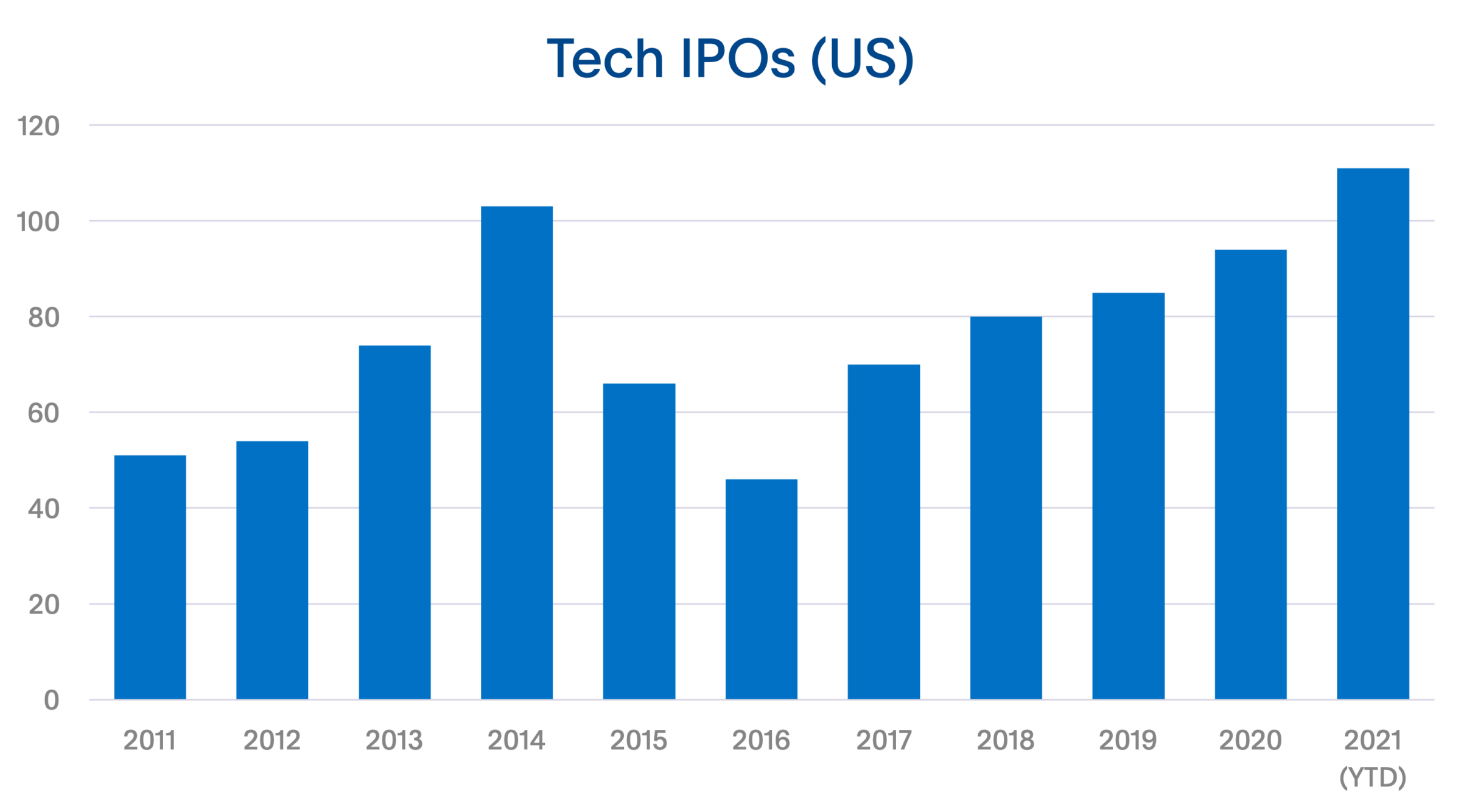

Despite a slow start to the year due to COVID-19, 2020 saw 94 tech IPOs, the second most in the past 10 years. In looking at 2021, the pace of IPOs has increased to record levels, reaching 111 so far. We predict the pace of IPOs will continue, and could break the record for most tech IPOs in a year. Anecdotally speaking, we expect to see the public debut of next-gen restaurant software provider Toast in the coming week and IPO roadshows launching in the near-term for high-profile names such as Freshworks, Remitly and many others.

So now that we’ve cleared up that tech IPOs aren’t dead and are in fact on the rise, let’s explore what has caused the continued acceleration? We think it’s driven primarily by two factors:

- Software businesses continue to outperform other types of businesses. Software businesses have several advantages:

- First, software revenues tend to be more predictable, as they often employ a software-as-a-service (SaaS) subscription model that allows public investors to forecast future revenues with a high degree of confidence. Investors typically reward these SaaS companies with higher valuations and multiples.

- Second, SaaS software companies are the beneficiaries of howling secular tailwinds, as we have written about previously, more and more IT is moving to the cloud. This means that these tech companies, in addition to having predictable revenues, are growing at faster and faster rates, enabling a “beat and raise” cadence of quarterly reports.

- The pipeline of eligible private companies is stronger than it has ever been. We’ve seen record amounts of funding flow into the start-up ecosystem. Over the last four years, venture funds in the U.S. have raised ~$250B in capital. More capital in the ecosystem means more funding for promising tech start-ups. As institutional investors continue to increase their allocation to venture funds, the flywheel continues. More next-gen cloud solutions get funded, expanding the pipeline of companies that will eventually become IPOable companies of consequence.

One mantra we often hear as venture investors is that the influx of capital into the venture ecosystem is bad for public market investors because it enables companies to stay private for longer, allowing venture funds to capture the outsized returns associated with the growth of high-flying start-ups (and leaving scraps for Main Street investors in their stock and retirement accounts).

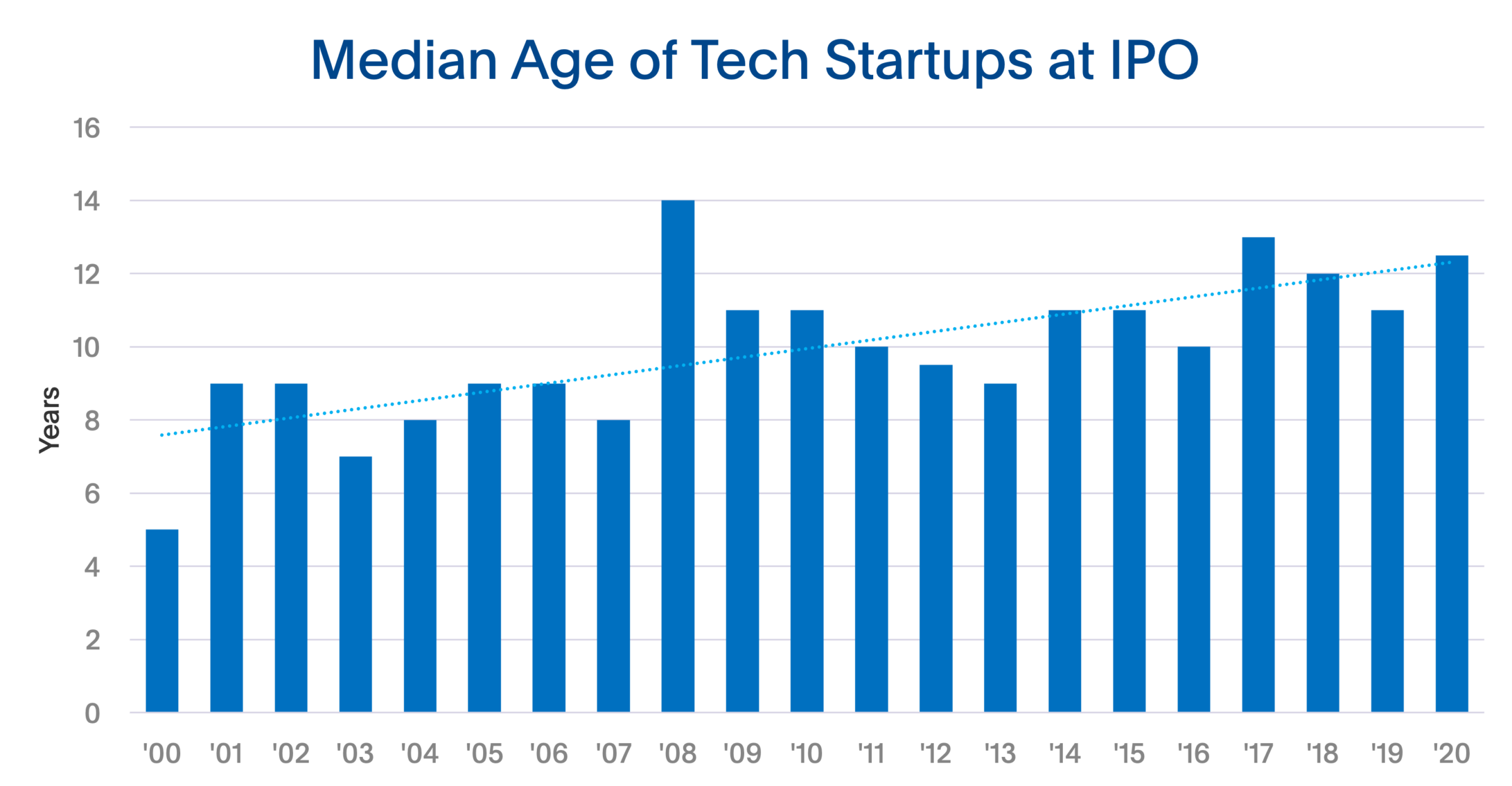

It turns out that the first part of this claim is true. Companies are staying private for longer before IPOing. But the second part of the claim (that VCs reap all the rewards) is surely not. Data collected by Jay Ritter at the University of Florida shows that the median age of tech companies that went public in 2020 was roughly 12 years. Per the chart below, this represents a steady increase in median age of IPO’d companies over the last 20 years.

We think this is a positive trend. Why? Because companies don’t have to go public before they are ready to do so. And when they do go public, Main Street investors now have access to a set of more mature, well-built companies. We believe the companies that go public today are fundamentally better than the companies that went public in the past. They’ve been able to work out the kinks while staying private, and have a clear-eyed view of what to expect as a public company.

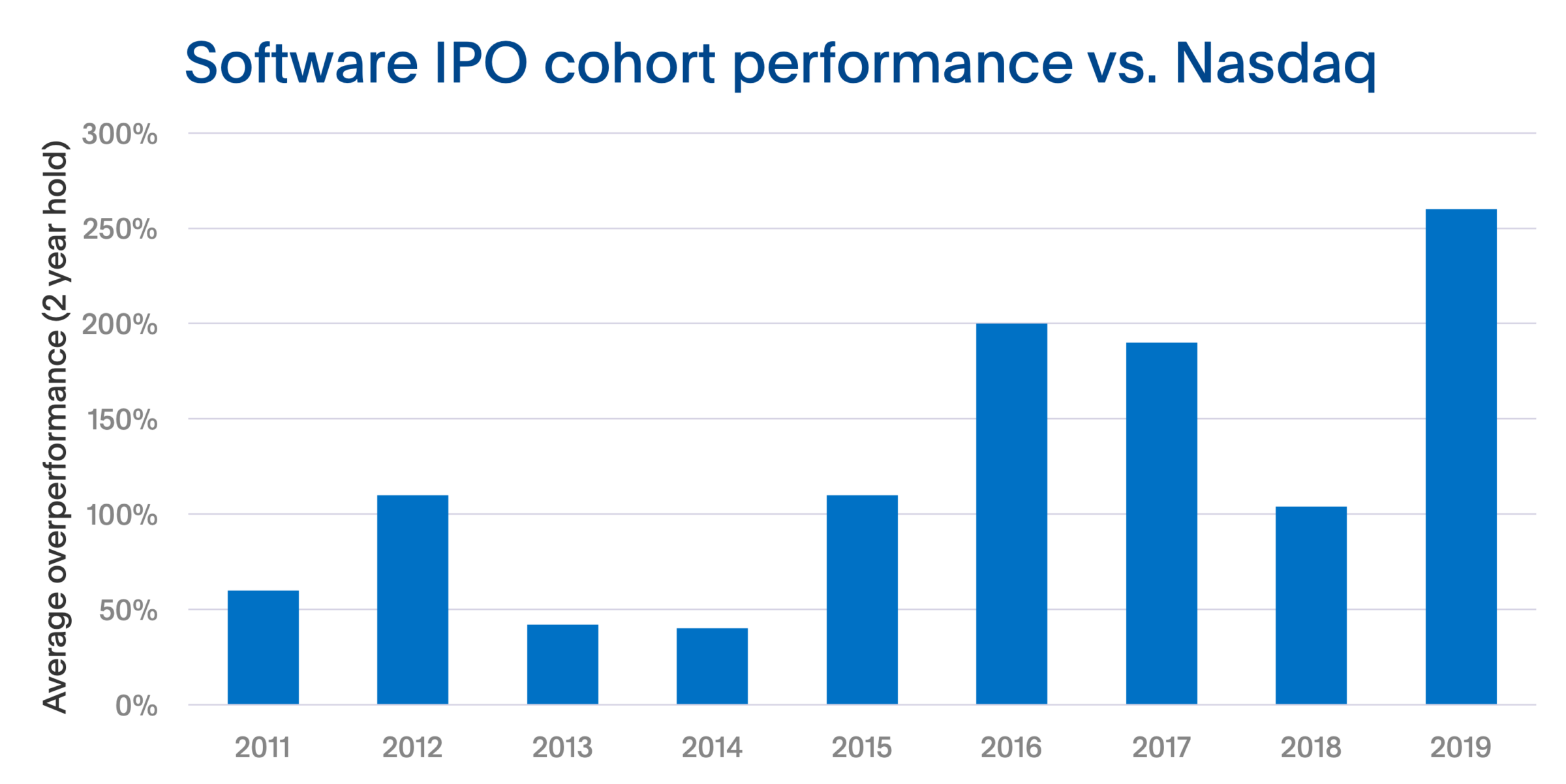

Furthermore, public market investors can generate venture-like returns by investing at the IPO and holding. We performed a detailed analysis on the dataset of all venture- and private equity-backed software IPOs over the last 10 years and compared average returns to those of Nasdaq writ large. If you invested at the IPO price and held programmatically for exactly two years, you would not only have significantly outperformed the Nasdaq but you would have achieved “venture-level” (or higher) returns of >50% IRR.

These results are startling. The median software IPO outperformed the Nasdaq over a two-year holding period by 60%. Let’s look at an example to help illustrate: Dynatrace went public in July 2019 at $16 per share. Two years later, it was trading at $64 per share, good for a ~300% return. Over that same timeframe, the Nasdaq appreciated about 80%–good by any measure, but nowhere close to the performance of Dynatrace. Put another way, our analysis shows that if investors adopted a strategy of “buy a portfolio of software companies at IPO and hold for two years,” they’d be able to generate venture-like returns, just like VCs do investing in private Unicorns. By our calculation, investing in all software IPOs since 2011 and holding exactly two years has yielded an IRR of ~56% and a ~2.5x MoM across ~125 software IPOs. This should put to bed the myth that VCs are capturing all the gains.

As we head into what is shaping up to be a frenetic end to the 2021 tech IPO market, it’s worth pausing to remember that while there will always be down cycles as public investor sentiment shifts, IPOs are the lifeblood of the innovation economy. At Sapphire, we remain long the future of tech and software IPOs. Based on what we’ve been seeing, we feel there are too many promising companies at the Series B and later stage with compelling visions and strong metrics that will spawn the next generation of great public companies. Long live the tech IPO.

The author would like to give special thanks to Andrew Vogeley for research and drafting assistance, as well as the equity capital markets team at Keybanc Capital Markets for supporting data. All quoted data excludes China-based U.S.-listed companies.

1Keybanc Capital Market, “Technology IPO Performance: Offer to Current”, September 2021

2Pitchbook, September 2021

3Pitchbook, September 2021

4Proprietary analysis conducted by Sapphire Ventures, August 2021; Source: Keybanc Capital Markets, Pitchbook