As the world slowly reeled back from the impact shock from COVID-19, our team at Sapphire Ventures was flooded with inquiries from portfolio companies about a topic we all know is important, but often sits backseat to new customer acquisition, it’s much flashier sister.

What I’m referring to, of course, is customer success (“CS”). “When should I hire a VP of customer success?” “Who should that person report to in my organization?” “Should customer success be responsible for upsells, as well as churn mitigation?” These were some of the common questions we were asked. While it wasn’t surprising that business leaders were asking for help around improving customer success practices, it was surprising that there weren’t many publicly available resources available.

To fill that gap, Rico Mallozzi, who formerly oversaw GTM initiatives as part of Sapphire’s Portfolio Growth team, and I spoke with over 20 CS leaders across companies including LinkedIn, Okta and monday.com (a recent Sapphire IPO) to produce the Startup’s Guide to Nailing Customer Success. In the playbook, we dug into why we believe successful SaaS companies prioritize CS just as much as they focus on new sales acquisition and key strategies for rolling out CS at a high-growth subscription based company.

Why are We Talking about Customer Success Again?

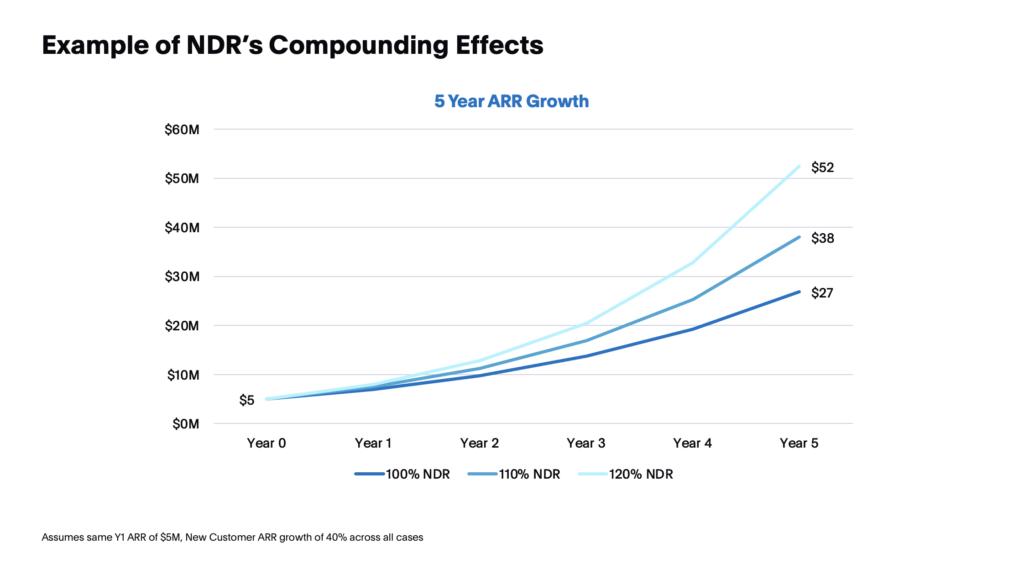

There are many good reasons why organizations care about investing in customer success, but an obvious one comes down to math. If we compare three different companies that have the same starting point in year 0 and have identical new ARR growth rate of 40%, but varying rates of net dollar retention (“NDR”) of 100%, 110% and 120%, by year 5, ARR will be 1.4x and 1.9x greater than the 100% NDR company for the 110% and 120% NDR companies, respectively. In other words, having a strong CS organization that can drive NDR compounds growth dramatically.

NDR rates, as it turns out, are also tightly correlated with valuations for public companies. I mapped the % NDR to TEV/NTM valuation multiples below, and it can be seen that for the public SaaS companies we looked at, those with higher net dollar retention generally receive higher valuation multiples, albeit with some outliers.

When it comes to SaaS metrics, LTV/CAC is an important efficiency metric. CAC (customer acquisition cost) is spent upfront on marketing, sales and onboarding to acquire and to bring on a new customer. For enterprise SaaS companies, it often takes more than a year to break even on these costs. Churn and expansion are both direct drivers of LTV, and customer success teams play an important role in increasing company valuation and making a big impact on SaaS efficiency metrics.

New Dog, Old Tricks

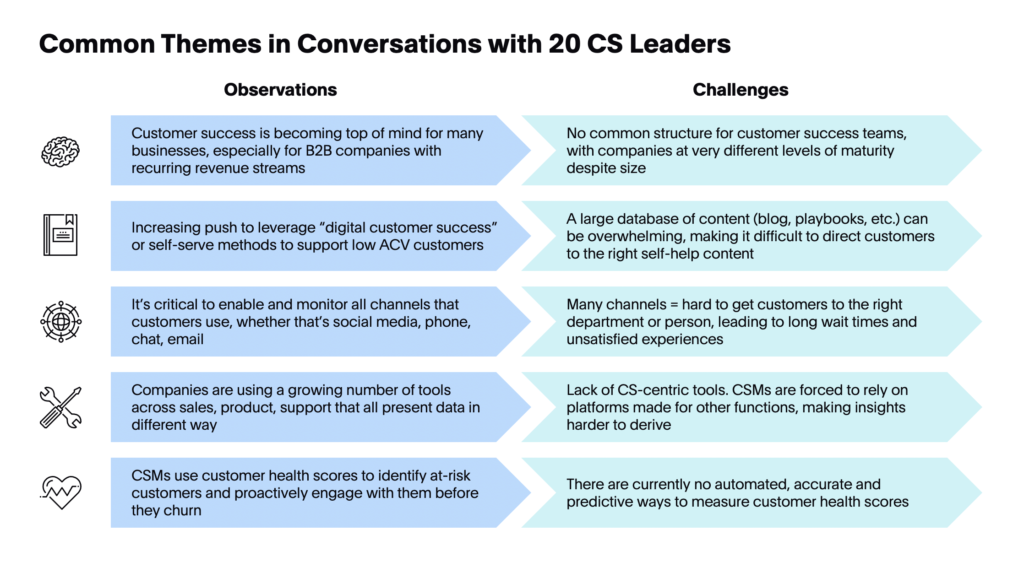

What we learned in our conversations with CS and revenue leaders was that customer success was very much top of mind (hello, COVID!), but rapidly changing business models like product led growth (“PLG”) go-to-market motions were changing the game and making it difficult for legacy customer success practices to keep up. On top of that, customer data was littered everywhere in the organization and across many, many systems–customer data that could be immensely valuable to not only CS, but to sales, marketing and product, is instead splintered and unusable.

Customer success as a function has grown in importance alongside the rise of subscription business models for both B2B and B2C companies. Adobe (2012), Microsoft (2013), Splunk (2013), Apple (2015) and Tableau (2017) all adopted subscription models within the last decade and that evolution is still ongoing. At the same time, we’re seeing more and more companies adopt a subscription model from the start.

Prior to the last decade, CS was generally thought of as a cost center and key metrics tracked were focused on CSAT and NPS, collected via simple feedback surveys. Sophisticated companies eventually graduated to tracking analytics driven “health scores” that were configured manually by CSMs (customer success managers) within a rules based paradigm. However, product usage and user behavior naturally change making it very difficult to keep health scores accurate.

A Shortage of Purpose Built Tools for CS

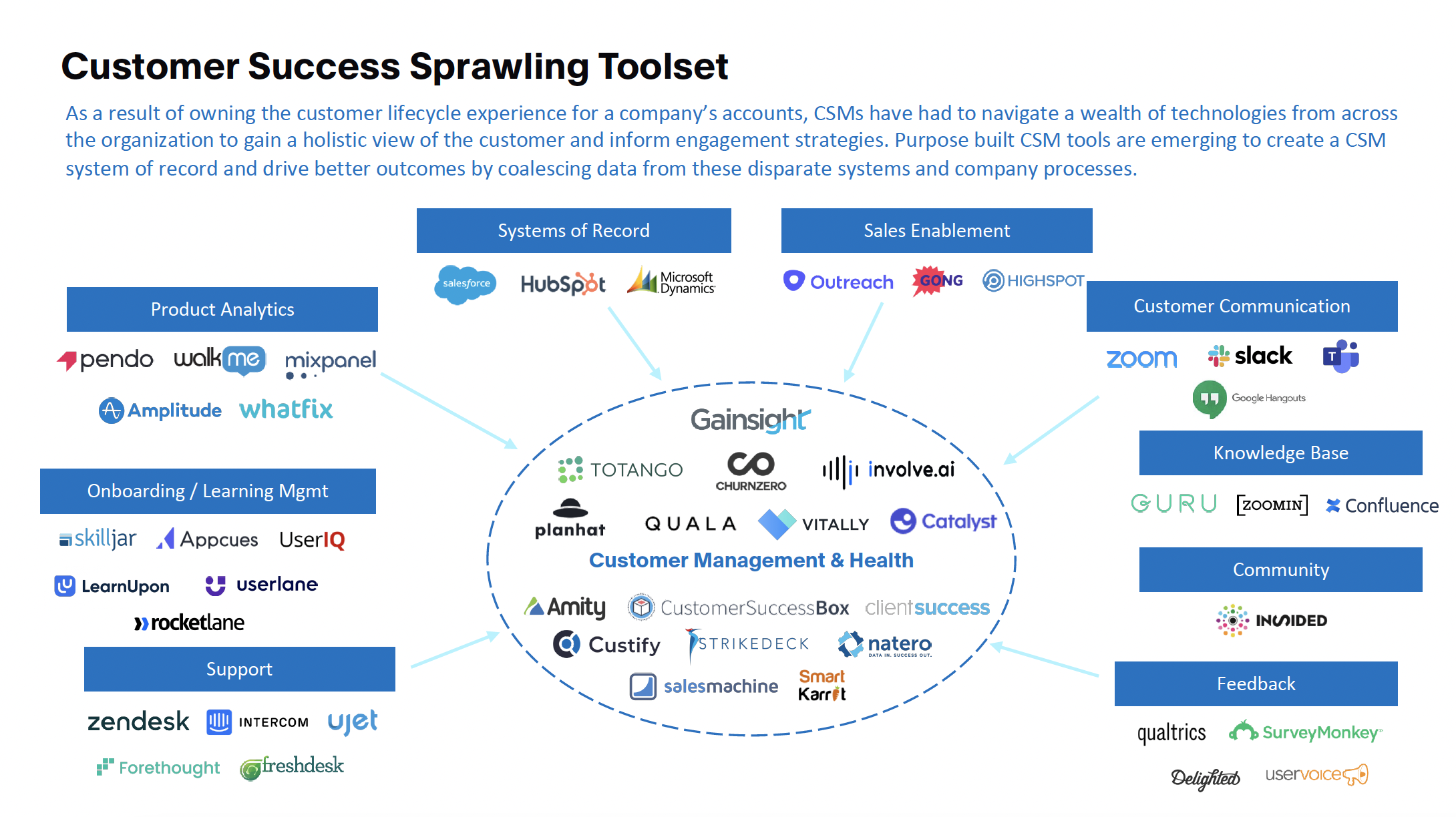

One of the biggest challenges that CS organizations face is the sprawling toolset an individual CSM needs to use to manage and report on customer relationships.The CS industry also lacks purpose built tools for CSMs, which is a major opportunity for emerging players. CSMs own the customer lifecycle experience and have to navigate through a multitude of solutions owned by other functional groups (including product, support, sales, etc.) to gain a holistic view of the customer and inform engagement strategies.

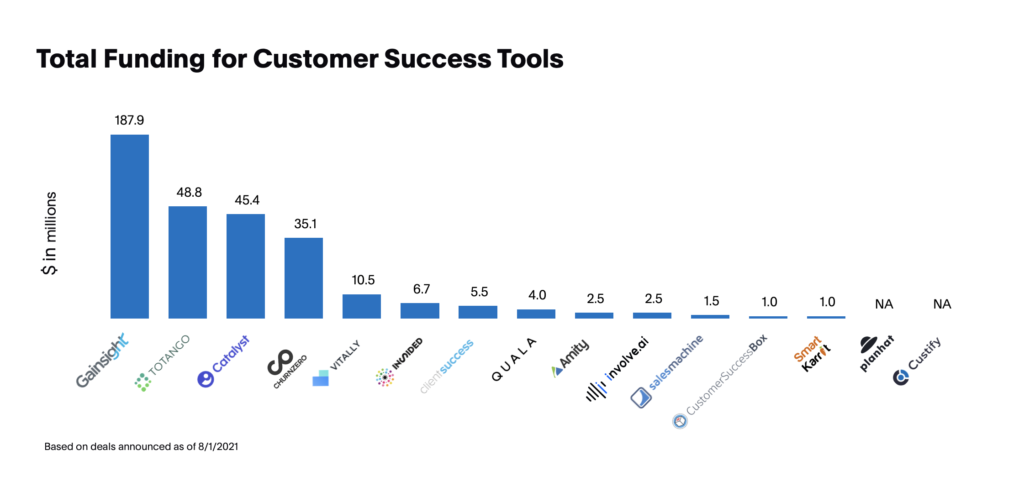

While Gainsight in many ways created a category around CSM tools, it’s been around since 2009. Another company aiming to help CS organizations is Totango, but it too is more than a decade old. More recently, ChurnZero (2015) and Catalyst.io (2016) have come on to the scene, but there’s clearly a shortage of new technologies in the market dedicated to helping CSMs better do their jobs.

When compared to the number of start-ups in the rest of the customer experience stack (sales and marketing enablement, support and so on), the number of new companies that have been funded in CS is woefully low. I believe that this will soon (and has already started to) change as a confluence of factors, including the rise of product-led GTM motions, improvements in AI and increased awareness of the importance of CS, will create opportunities and budget for startups building solutions targeted at CS teams.

To illustrate, here’s a graphic representing the funding to-date for customer success focused startups:

AI is the Next Frontier

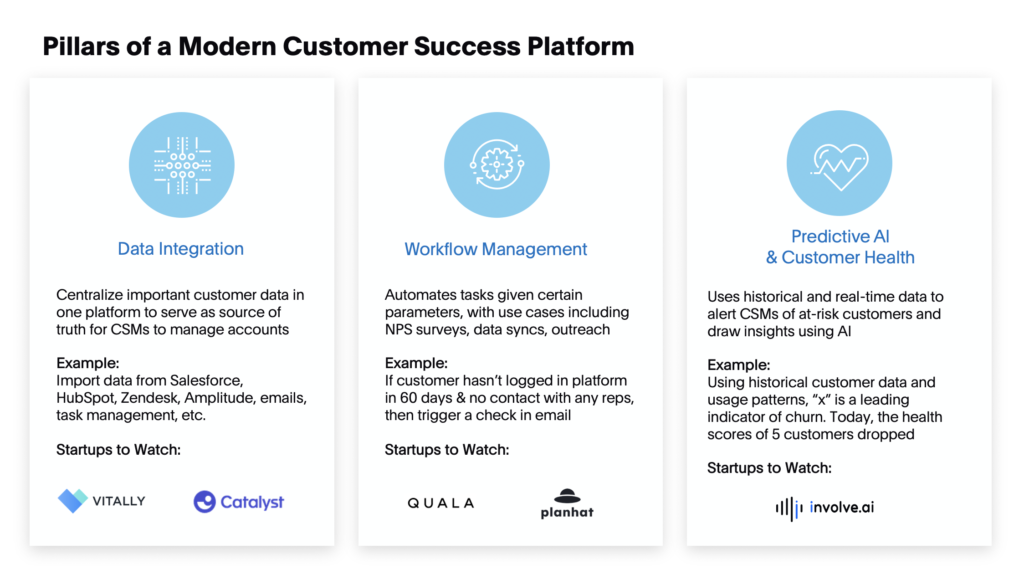

Based on our research, there are three core pillars of a modern customer success platform: Data integration, workflow management and predicative AI.

Most platforms have focused on the first two pillars and haven’t gone as far as to leverage AI to predict customer health in order to act as an “early warning system” to inform what the best next action should be. In looking at dozens of companies in the customer success space, Involve.ai, a young company based out of Santa Monica, is one of the only companies we’ve seen hone in on leveraging AI today.

Here are a few reasons why AI has the potential to be a game changer for customer success:

- Weaponize customer data. Customer data lives everywhere. Every interaction with a customer, whether digital or in-person, leaves bread crumbs about how the customer feels and what the customer thinks. This information can live in Zendesk tickets, emails, Slacks and many other places. Using advanced NLP, these shards of information can be stitched together to create a dynamic narrative around the state of customer health.

- Data-driven results. AI-based tools can provide objective insights instead of relying on individual CSMs who are often managing anywhere from 10 to over 100 accounts at once. With an early warning system, CSMs can focus on the accounts that are a churn risk or ones that are ripe for expansion.

- Digital or “tech touch” CS. How to scale CS teams at rapidly growing companies is always the #1 question. Depending on the average ACV of customers, savvy companies are leveraging technology to automate CS, making it vastly more scalable and flexible as the number of accounts grows.

At Sapphire, we have a deep history of investing in the customer experience space for many years including companies like Segment (data), Contentful (CMS), Pendo (product), UJET and Gorgias (support), Podium, Highspot and Outreach (sales and marketing). In following the overall industry closely, it’s clear that there’s an acute need for customer success focused solutions that will be able to work alongside other tools, enhance them and share back critical customer insights to the rest of the organization.

If you’re a customer success leader, building a product for customer success or just have a passion for all things CS, feel free to reach out to me. Let’s chat! Email me at: [email protected].

Special thanks to my colleagues, including Eileen Qian, for their help in writing this post.