£3.50. Tap. Tasty coffee. £49.99. Click. Snazzy new shoes.

For consumers, convenient digital payments have become a part of everyday life. Long gone are the days of carrying wads of cash or *gasp* writing paper checks. For businesses, payment methods – and the technologies that power them – are changing rapidly. It is becoming easier than ever for merchants to accept different payment methods and for businesses to efficiently complete transactions.

At Sapphire, we have a long history of investing in and building companies of consequence in the fintech and payments industry, having backed AvidXchange, Currencycloud, Current, IEX, OnDeck, Paytm, Square (NYSE: SQ) and Wise. Speaking of Wise, we’re thrilled to celebrate the company’s IPO listing on the LSE last week, and we’re looking forward to backing more European category leaders in the payments space going forward.

Why Payments?

Despite representing a trillion-dollar global market, payments infrastructure has historically been hard to understand, plagued by confusing terminology and restricted by unclear regulation. However, recent regulation (Open Banking & PSD2) combined with astute marketing strategies from players such as Monzo, Revolut and N26 has increased accessibility to fintech, making it “cool” and relevant to everyday consumers and businesses.

At Sapphire, we are excited about the startups disrupting incumbent payments infrastructure players. We see Europe playing a central role in this unbundling, which has been driven by regulation, the expansion of the digital economy and an increasingly global-from-day-one merchant customer base.

Why Europe?

Europe itself is a diverse market made up of 24 official languages, 50 countries and 25 currencies, so it is no surprise that the level of payments maturity across Europe varies greatly.

To illustrate, in 2019, the total share of cash in POS payment transactions was 88% in Albania, 63% in Germany and just 15% in the UK. Despite its differences, or perhaps because of them, Europe continues to be a hotbed for payments innovation. At Sapphire, we see this innovation being driven by six key themes:

- Regulation, specifically PSD2 and Open Banking: Taking effect in 2016, PSD2 forced banks to provide access to Account Information Service Providers and established a standard for payments data transmission, ISO20022, which makes it easier for all payments players to interact with each other. Open Banking in the UK took this one step further by requiring standard APIs and applying additional regulatory pressure on banks to open up.

- Real-Time Payments: Unlike in the U.S., the EU’s payments infrastructure benefits from real-time payments (where payments are processed nearly instantly), enabling greater liquidity, driving innovation, reducing fraud risks and payment costs and improving long-term customer relationships between parties.

- Expansion of the digital economy and changing consumer behavior: The rise of e-commerce and mobile/digital payments have driven merchant demand for more complex online and omni-commerce payment systems and technology.

- Increasing global economy and customer base: Players such as Shopify and Squarespace have made it quick and easy to launch an online store and thus reach a global customer base. Meanwhile, companies such as TaxDoo enable a merchant to scale cross-border while maintaining sales tax compliance. As a result, it has increasingly become the default for digital commerce platforms to support an international customer base from day one, whereas previously merchants and payment infrastructure players were more likely to serve regional customers.

- B2B Innovation: Consumer expectations of payments technology have bled into the B2B world too (SMEs + enterprises). Businesses now expect the same ease and simplicity in their banking and payments infrastructure as they do in their consumer experiences. As such, we are seeing an acceleration in growth in the SME segment, B2B2C business models and new customer areas such as cross-border e-commerce (and money movement services). This growth is, in part, driven by the increasingly globalized nature of the world economy.

- COVID-19: The pandemic accelerated the move from physical to virtual banking. In Europe, ATM withdrawals declined and geographic and age group differences in shopping behavior greatly reduced as many consumers turned to online shopping for the first time. For example, Switzerland reported an increase in the share of debit-card spending from 65% to 72% between Jan-May 2020, mostly at the expense of cash. And in the U.K., month-over-month declines in ATM withdrawals averaged 46% from March to July 2020.

The Growth Potential of European Payments

So how much bigger will this $380B revenue industry grow as market forces continue to exert pressure?

While exact answers vary, what’s clear is that there is a large and expanding total addressable market with significant runway for growth. Prior to 2020, European payment revenues were growing at a CAGR of 3.1%. Projecting this growth rate forward and not accounting for the swifter rebound from the pandemic that Europe will likely experience, as anticipated by McKinsey, European payment revenues will reach $450B in 2025.

What does the current infrastructure look like?

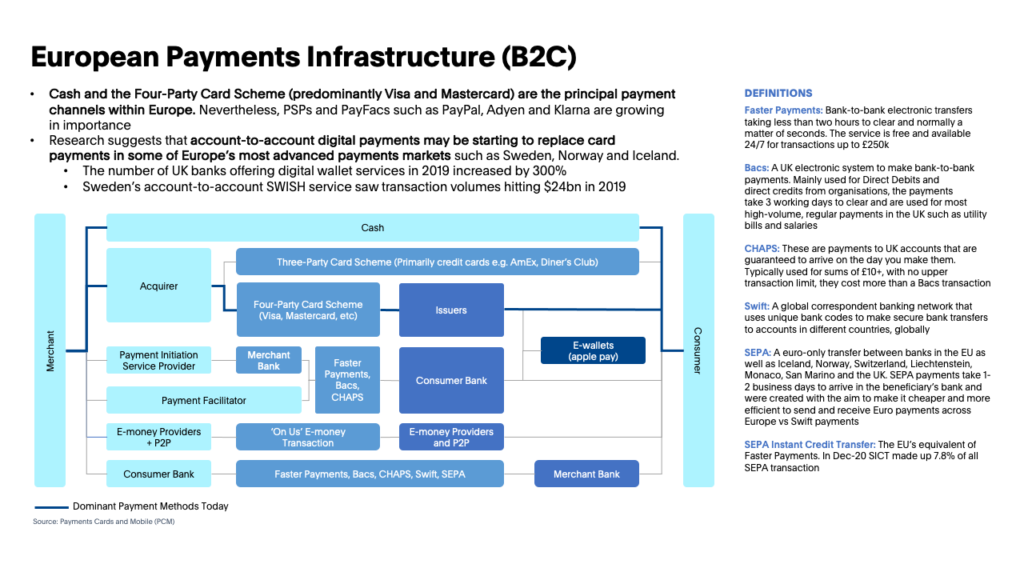

As shown in the graphic below, there are effectively six core ways payments can flow consumer-to-merchant or merchant-to-merchant. Cash and the Four-Party Card Scheme (predominantly Visa and Mastercard) are the principal payment channels within Europe.

Nevertheless, PSPs and PayFacs such as PayPal (market cap $303B), Adyen (market cap $57B) and Klarna (post-money valuation $31B) are growing in importance. Additionally, account-to-account digital payments are starting to replace card payments in some of Europe’s markets such as Sweden, Norway and Iceland, with Sweden’s account-to-account SWISH service transaction volumes hitting $24B in 2019.

Current Consumer-to-Merchant Payment Methods

Within B2B payments, which accounted for 80% of the value of all U.K. payments in 2019, Bacs Direct Credit and Faster Payments are the dominant payment methods making up 74% of payment volumes in 2019.

Within B2B payments, which accounted for 80% of the value of all U.K. payments in 2019, Bacs Direct Credit and Faster Payments are the dominant payment methods making up 74% of payment volumes in 2019.

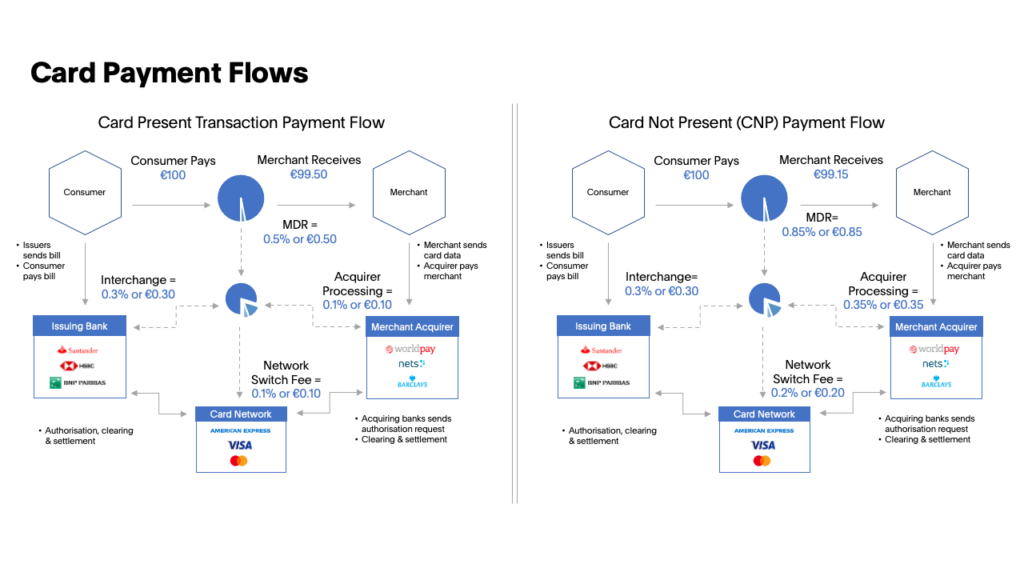

To illustrate a typical payments flow, we will use the Four-Party Card Scheme flow as an example. As payments flow from the consumer to the merchant, each party takes a small fee, as seen in the graphic below. Card-Not-Present (CNP) transactions typically charge a higher absolute fee to merchants versus Card-Present transactions due to greater fraud risk.

Example: Card-Present and Card-Not-Present Payment Flow

The current European landscape

Over recent quarters, VC investments into European payments startups have grown an astonishing 942% between Q1’20 and Q1’21. Some notable rounds in the last few months include:

- Checkout.com: $450M Series C at a $15B post (Jan-21)

- GoCardless: $105M Series F at an undisclosed valuation (Feb-21)

- Truelayer: $70M Series D at an undisclosed valuation (Apr-21)

- Mollie: $106M Series B at a $1B post (Sep-20)

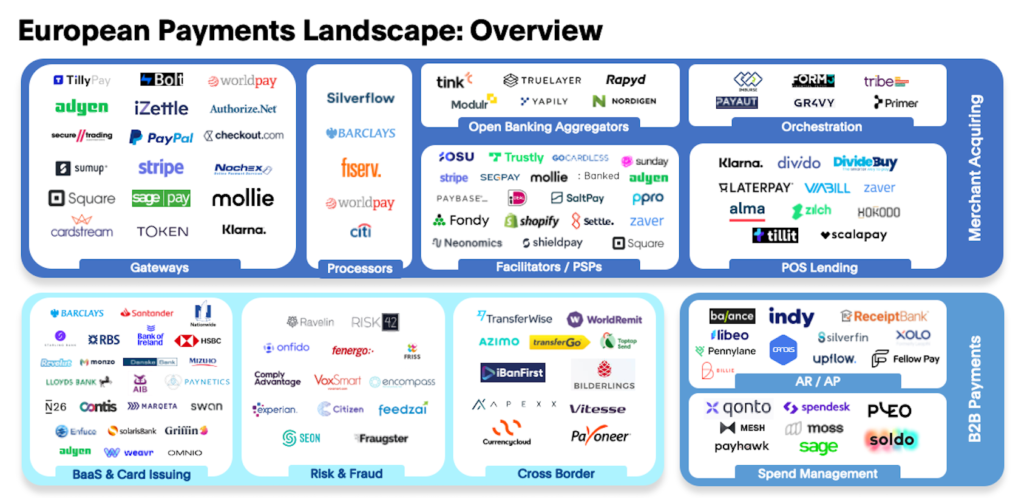

At Sapphire, we segment the European payments landscape into five distinct categories:

- Merchant Acquiring

- Issuing

- Risk & Fraud

- Cross-Border

- B2B Payments

Merchant Acquiring

Here, we use the term ‘merchant acquirer’ loosely to cover all players acting within a payment flow, as often key players take on multiple roles and thus can’t be strictly segmented into one bucket. Innovation across the flow is substantial so for ease of understanding we’ve broken out where we see the opportunities across six key areas.

- Payment Gateways: As the dominant entry point for a transaction, payment gateways continue to be hit by waves of disruption. Paypal introduced a gateway for the web, and Square (a Sapphire IPO) innovated on the POS reader by enabling one’s phone to act as the gateway. But opportunity in this space hasn’t been exhausted yet. We are excited to see a new wave of players innovating such as Checkout.com, Mollie and Token.

- Payment Processors: Payment processing infrastructure continues to be based predominantly on legacy platforms that are inflexible, costly to maintain and require lengthy onboarding processes, ultimately slowing down innovation of the whole card payments infrastructure. We are therefore excited by disruptors such as Silverflow that are building a cloud-native platform that offers simple APIs and streamlined data flows to directly integrate into the card networks.

- Payment Facilitators: Mastercard and Visa introduced the payment facilitator model in 2011 with early adopters such as Square, Stripe and Paypal proving its viability. Historically, a complex and costly market to enter, the recent emergence of new software platforms and API stacks have eroded barriers to entry and enabled a new wave of players such as Mollie, Sunday, SaltPay and Payosu to compete with the aforementioned first-movers.

- Open Banking Aggregators: Last year we wrote about our excitement around Open Banking. We continue to believe PSD2 and Open Banking have opened up many new possibilities for both consumers and businesses. However, in practice, integrating with each bank API is a big task. Thus, we see continued opportunity for players such as Tink, Truelayer and Yapily— companies that are building off open banking infrastructure and acting as aggregators in the market.

- Orchestration: A relatively new opportunity driven by the explosion of payment methods, players in the payment orchestration space are just starting to emerge and gain traction. Those sitting in this space don’t touch funds, but act as the platform bringing all the different payment flows together. This means they don’t need to be regulated and as such and can serve a global customer base from day one. Companies such as Gr4vy and Primer are building no-code orchestration platforms that replace the in-house payment teams that typically manage this manually, thus making payments effortless for merchants.

- POS Lending: The traction of older online services like Klarna, Affirm and Afterpay have paved the way for more recent entrants such as Scalapay and Alma. This, combined with the surge in e-commerce usage and the impact of the pandemic on consumer finances, makes installment payments more attractive and has ensured continued opportunity for new entrants in this market.

Issuing

Until recently, the complexity of building highly regulated financial products has been a great constraint on financial innovation among non-fintech companies. However, the emergence of Banking-as-a-Service (BaaS), banks that provide non-financially regulated companies with white-labeled banking services, has driven innovation in the embedded finance space.

Through simple, easy and fast-to-integrate APIs, BaaS players let companies embed white-labeled banking features into their products and customer experiences, unlocking new opportunities to grow revenues, margins, retention and so on. Notable companies in this space include Railsbank, Solarisbank, Swan.io and Griffin, and Enfuce for issuing use cases.

Risk & Fraud

All businesses that accept Card-Not-Present (CNP) payments are at risk of fraud, with Juniper Networks estimating that CNP fraudulent transactions will cost e-commerce $50.5bn by 2024. Such fraud incurs chargebacks, costing merchants bank admin fees and potentially putting them on card network operators’ risky list. It is therefore no surprise that several players have emerged to help merchants tackle this problem, such as Feedzai (Sapphire investment), ComplyAdvantage and Seon.

B2B Payments

Payments made by businesses accounted for 80% of the value of all payments made in the U.K. in 2019 while only representing 12% of the total number of payments. Even though the B2B payments space has experienced far less innovation than the consumer space, the industry is in the early phases of disruption and the opportunity is vast. We’re excited to observe a new wave of disruptors in B2B payments taking on incumbent solutions, including AvidXChange (Sapphire investment), Pleo, Spenddesk, Soldo, indy and balance.

Cross-Border

For many businesses and consumers in Europe, making cross-border payments is a necessity. McKinsey estimates the global cross-border payments flow to be $140T. Like for many geographies, in Europe cross-border payments have been controlled by traditional banks. But traditional banks have been slow to respond to changing consumer demands for embedded FX solutions.

New players have emerged to take advantage of these opportunities such as Wise (formerly Transferwise) and Currencycloud (both Sapphire investments). We expect that with the rise of additional fintech solutions that the need for efficient, reliable cross-border payments will not go away.

In short

Europe has and continues to be a hotbed for payments innovation driven by regulation, real-time payments, changing consumer behavior, globalization and B2B innovation. Standing at $380B today, we believe that the market is only going to grow larger off the back of these trends.

At Sapphire Ventures, we are hugely excited by the array of opportunities to build companies of consequence across B2C and B2B payments infrastructure and would love to hear from you if you are building a company in the space! Please reach out to [email protected].