Cybersecurity remains one of the hottest categories in all of technology. Why do we believe that is the case?

Security is a top CIO priority, in terms of both spend intention and project defensibility. It’s the only category that has remotely kept pace with AI on both dimensions over the past few years. In fact, 87% of CIO’s plan to increase security spending in 2025, which will support further expansion of the already $270B global market.1

The cost of security failures continues to rise: Major hacks now seem to surface almost weekly, recent examples including breaches at Coinbase, Samsung, and United Natural Foods, each causing hundreds of millions in economic damage and causing significant disruptions to supplies and customers.

The attack surface continues to expand: For all of its benefits, AI is also a major risk factor and has dramatically increased the attack surface for many organizations, while also providing more sophisticated tools to cyber-criminals to optimize and scale their attacks.

Geopolitics: The current moment of fraying alliances, increased conflicts across the world, and more advanced AI-enabled offensive technology is causing nations to rethink defense strategy and increase investment in operational resiliency.

Investment in Cybersecurity

All of these factors are leading to more investment in cybersecurity by IT departments, big tech acquirers, and venture capital investors alike. Case in point, 2024 was the fifth straight year where over $10B in venture capital was deployed into security startups, and the category accounts for the two largest enterprise software acquisitions of the past five years, including Google’s record $32B deal for Wiz earlier this year.2

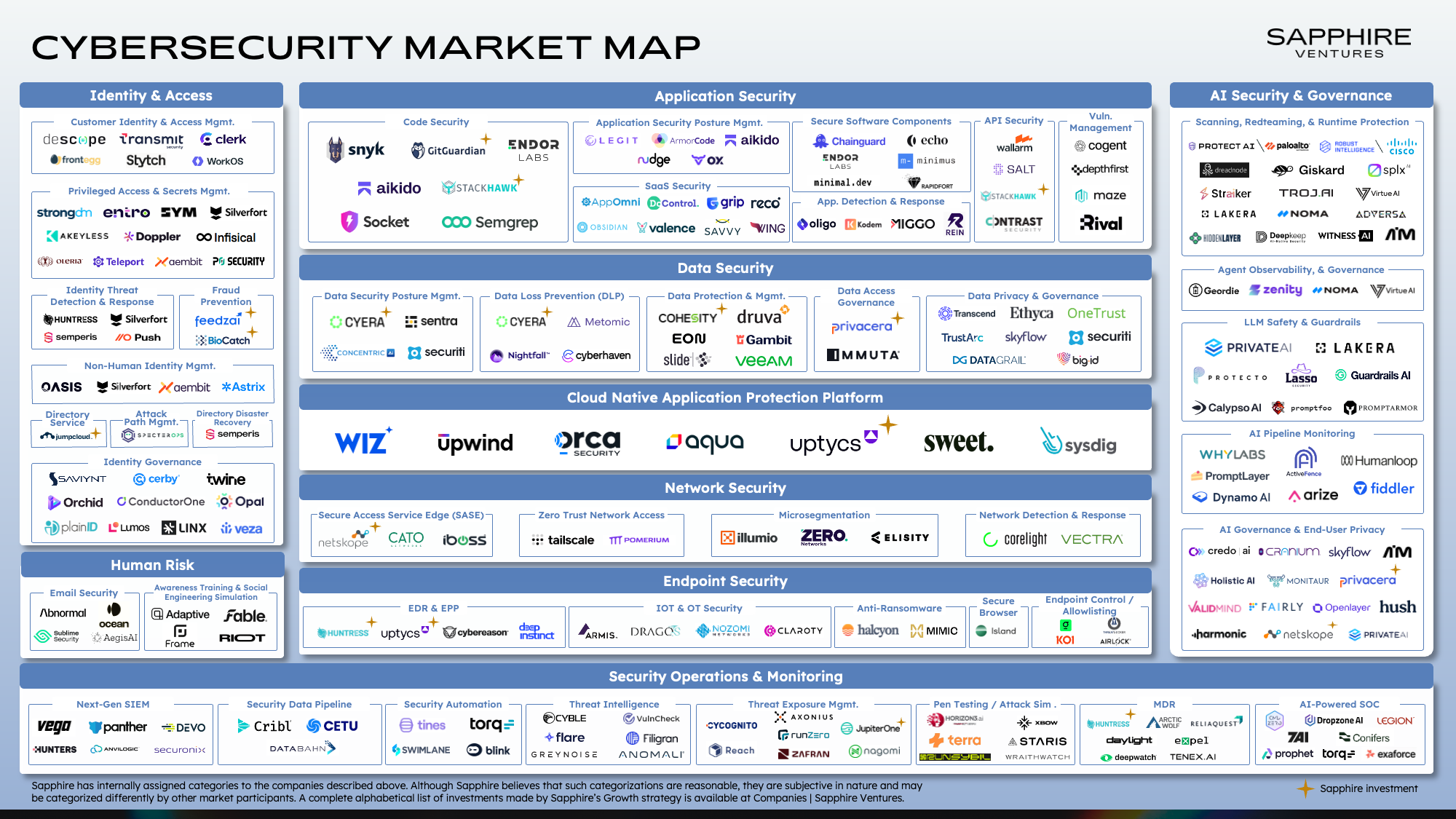

At Sapphire, we have a long tradition of investing in leading cybersecurity companies, including Cyera, Huntress, Netskope, Cohesity, Auth0… and we remain as convicted as ever about the opportunity for companies building across the cybersecurity landscape. A few themes that we are currently tracking closely include:

- AI Agents for the SOC — Security operations are strained by alert overload, fragmented tools, and a shortage of skilled analysts, creating a demand for AI agents that can autonomously triage, investigate, and defend against threats in real-time.

- Data Security — With GenAI adoption accelerating and sensitive data flowing through SaaS, cloud, and LLM interfaces, enterprises face growing pressure to prevent exposure and maintain compliance. Modern data security platforms offer real-time classification, access control, and encryption to reduce leakage risk and enforce governance across distributed data workflows.

- AI Model Security — AI applications are expanding the attack surface and introducing new attack vectors (e.g., prompt injections, model theft, data leakage). Many incumbents are encountering these challenges for the first time and are seeking specialized services that can help them get ahead of these new threats

There is so much more to be excited about in the security space, including themes like cloud security, non-human identity management, anti-ransomware, and next-gen security awareness training (an underrated category in an era of more advanced phishing attacks and multi-modal deepfakes).

If you are a builder or fellow investor in cybersecurity and want to talk, please reach out to Anders, Casber, or Justin.

Sign up for our newsletter