Sapphire Ventures has had a long history of investing in fintech companies around the world, having backed Square (NYSE: SQ), IEX and OnDeck in the US, one97 in India, and Currency Cloud and Transferwise in the UK. As fintech companies continue to bring innovative solutions to the market around the world, we’ve recently taken a closer look at the fintech infrastructure sector. Over the next couple of months, we plan to share our perspectives on this topic in a three-part series covering fintech in the European market, global payments and core banking. Here, we begin with part one focused on European developments.

Europe as a Global FinTech Leader

The same global trends that impact fintech infrastructure globally apply to Europe. Banks and financial institutions are serving an increasingly international customer base and their offerings are being unbundled.We believe fintech is shifting from a vertical to a horizontal sector as companies move to embed financial products into their offerings. This is a trend we believe is here to stay and relies on the development of a robust infrastructure layer.

Europe has been at the forefront of fintech infrastructure innovation due in part to the role of regulation. The European Union enacted PSD2 (Payment Services Directive 2) requiring banks to open up their data to third parties, and the UK implemented a similar regulation with Open Banking. It goes without saying though, one cannot generalize advancements across the entire European continent. The European market is a summation of distinct markets with differing characteristics. There are nuances between economies and cultures, as well as varying levels of adoption of fintech solutions.

However as a whole, Europe has moved faster than other geographies to embrace an open and API-centric banking model. According to Tracxn, 53 percent of Open Banking startups worldwide are headquartered in Europe. As a critical hub in fintech, Europe continues to push the frontier of innovation.

The Rise of Open Banking

Over recent years, we’ve seen a rise of Open Banking startups building out a connectivity layer between traditional financial institutions and fintech companies to aggregate and share banking data. Solutions have evolved from rudimentary screen scraping to incorporating open APIs made possible by PSD2 and Open Banking.

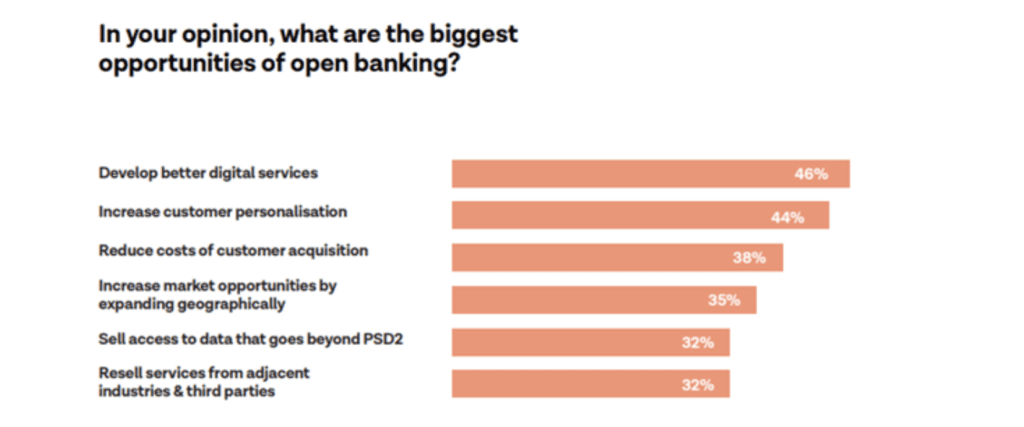

These new companies benefit consumers and businesses by providing greater control over financial data, easier access to financial services and facilitating the creation of new products. A recent survey conducted by Open Banking startup Tink found financial executives across 17 European countries were positively inclined towards the Open Banking movement with 46 percent believing that the development of better digital services is one of the biggest opportunities.

As of today, the European Open Banking landscape remains heavily fragmented. Startups are mostly working with banks and financial institutions in their home market before expanding internationally. Out of the Nordics, there are players like Tink and Nordic API Gateway; out of the UK, there is Truelayer and Yapily; and out of Germany there is Deposit Solutions, Ndgit and FinTec Systems. We predict that in the short to medium term there will be consolidation in the pure connectivity space. In fact, we’re already seeing the beginnings of this with Tink’s recent acquisition of Eurobits in Spain.

The Shift to Open Finance

As the Open Banking sector continues to develop, the new adjacent space of Open Finance is emerging around it. There is a tremendous opportunity in this new space for the businesses and services that are being built on top of the connectivity layer made possible through Open Banking.

There are a number of different approaches to this new and broader space extending beyond Open Banking. Almost all of the existing Open Banking players are introducing value-add services, such as KYC/AML credit scoring and others on top of their API networks. There are also a number of Banking-as-a-Service (BaaS) players that are providing easy access to third-party services and applications like Bankable and Solarisbank, for example. Other players are focusing on specific use cases like FidelAPI with loyalty points and Bud with analytics, amongst others. In the bank-to-bank payments space, new companies like Primer and Banked are developing new infrastructure to take on PayPal and the other payment giants. And in accounting and financial tools, startups like Codat are expanding API connectivity beyond banking to accounting data.

Although there are varying approaches to a more holistic Open Finance offering, the difference between where value is created versus captured in the fintech infrastructure sector is clear. The first wave of Open Banking focused companies are creating value through exposing and connecting banking data. But the next wave of players building applications and services utilizing this data are better positioned to capture the value of the vast market opportunity in Europe.

What’s Next?

As this next wave of startups mature, Sapphire Ventures is looking to continue to partner with entrepreneurs to build Companies of Consequence in the fintech space. We welcome the opportunity to connect with European teams building Open Banking or Open Finance. Please reach out to us here: https://sapphireventures.com/contact/

And stay tuned for parts two and three of our deep dive covering payments and core banking infrastructure coming soon!