We’re witnessing a seismic shift in finance. In-house teams are increasingly asked to deliver dynamic analytics and support decision-making across the business in real time, while external accounting firms and the broader financial services ecosystem face mounting regulatory complexity, shrinking talent pools and the pressure to win market share while protecting margins. Despite growing demands on finance teams and financial service providers, many of the tools and processes remain decade(s)-old, painfully slow, error-prone and not built for scale. Finance desperately needs an AI makeover.

At Sapphire Ventures, we see AI driving the most significant transformation across three core areas in finance:

- Democratizing Financial & Operational Data for Executives and Functional Leaders

Finance has evolved from a “controllership” focused on historical reporting to supporting decision-making in real time across all corners of the organization, requiring CFOs and their teams to run more complex analyses across a greater volume and variety of data than ever before. While the business demands ever more from finance, the core tooling to aggregate data scattered across systems and answer critical questions has remained largely stagnant with analysts still relying on SQL and spreadsheets, which lack in usability, collaboration and governance. This has created a major gap between data and decision-making, where only a small group of subject-matter experts can access data and are further slowed by the tedious, manual work required in legacy apps like Excel.

A new generation of platforms is emerging to close this gap:

- Summation pairs a modern SQL backend with a conversational AI front end, enabling analysts, functional leaders and executives at large organizations to ask financial and operational questions in natural language and receive answers in real-time.

- Sapien creates a governed metrics layer that harmonizes definitions across ERPs, CRMs and billing systems, ensuring every team operates from the same standardized calculations and logic, with a natural-language interface that exposes only validated, CFO-approved outputs.

- Translucent takes a vertical approach, equipping healthcare organizations with a conversational copilot that unifies data across the electronic health record, ERP, CRM, etc. to automate core finance workflows and answer any question about the business in natural language.

- Accounting Firms Adopting AI to Expand Staff Capacity and Increase Higher-Margin Advisory Work

Accounting firms are dealing with an impending talent squeeze. Nearly 75% of CPAs are at or near retirement age, and the supply of new talent is shrinking with accounting graduates down about 30% since 20131. Meanwhile, accounting work is only growing more complex with burdensome reporting requirements like ASC 606, evolving regulatory environments, and the expanding footprint of digitized financial data. As a result, firms are being forced to rethink how they operate, with AI as a central lever to offload manual work and extend staff capacity.

Agentic platforms like

Basis, Artifact and

uiAgent are automating the most manual, labor-intensive workflows within the outsourced bookkeeping practice like journal entries, financial statements and bank reconciliations.

Blue J (a Sapphire portfolio company) applies AI to tax law to accelerate technical research – one of the most complex and time-consuming tasks within the tax practice. By offloading the “execution layer” across accounting and tax to AI, firms can address near-term capacity challenges while upleveling their staff to provide more strategic advisory services, which are inherently higher-margin.

- Automating Labor-Intensive Workflows for In-House Accounting Teams

The largest concentration of headcount within the CFO organization typically sits within accounting in addition to outsourced BPO support. These teams manage the transactional backbone of the business, including accounts payable and receivable, reconciliations, the period-end close, audit and compliance. Much of this work is repetitive and rules-based but highly company specific, making it well-suited for AI automation.

We see two approaches to deploying AI for in-house accounting:

- AI orchestration on top of the existing ERP: FloQast (a Sapphire portfolio company) and Maxima deploy AI agents that execute month-end close on top of the existing general ledger. Tabs and Sequence unbundle revenue accounting from the ERP with a modern, AI-enabled suite of products across the order-to-cash cycle. Maximor combines revenue accounting with close-automation and a series of accounting modules to provide a comprehensive automation layer on top of the ERP. These tools offload work in the highest-impact areas while remaining agnostic to the underlying ERP, providing greater flexibility to serve larger, complex organizations where ERPs are deeply entrenched.

- AI-native ERPs become the system of intelligent action: Campfire, Rillet, DualEntry and Doss are collapsing the traditional finance system-of-record with the workflow layer. The result is an interoperable, agentic ERP that “does the work” with close-automation, revenue recognition and more natively built in. The “all-in-one” approach is very effective in finance where centralized stewardship of data accelerates reporting cycles and ensures high data accuracy and completeness, but the key question for organizations looking to adopt a new, intelligent system-of-record is the feasibility of replacing their existing, mission-critical ERP.

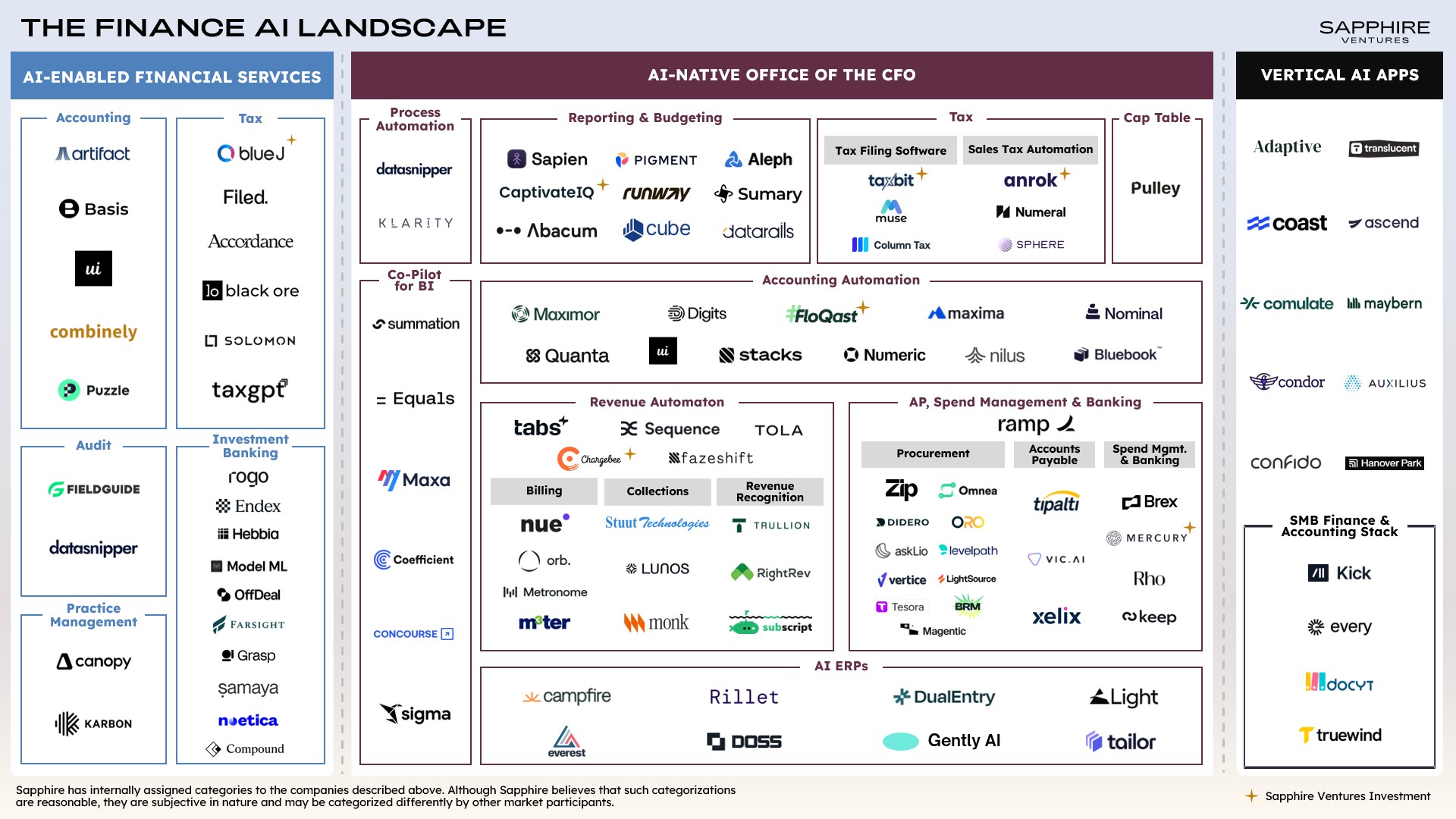

The Finance AI Landscape

AI for finance and accounting is one of the most active startup categories today, with a fast-growing ecosystem emerging to reinvent the entire stack. The following market map highlights the innovators we believe are shaping the future of finance and accounting.

Key Debates We See in the Market

- Unbundling vs. Rebundling: Building The Modern, Best-in-Class Finance Stack

Over the past decade, the finance stack has unbundled into specialized tools across billing, spend management, FP&A, tax, incentive compensation and close-management. Now, credible contenders are building rebundled, deeply integrated platforms (i.e., AI ERPs, Ramp, etc.). Whether best-of-breed or consolidation wins will depend on the complexity of the underlying business. We believe companies with highly dynamic pricing models or complex multi-ERP setups will initially opt for specialized platforms, while those with relatively simpler operations are more likely to consolidate into bundled systems that provide adequate depth across multiple workflows.

- In-House vs. Outsourced: As AI Proliferates, Where Does Finance and Accounting Work Shift?

As AI agents gain adoption across internal accounting teams and accounting firms, the mix between in-house vs. outsourced work is likely to shift. For bookkeeping, greater business complexity and scale increase the incentive to bring workflows in-house, especially if AI meaningfully reduces the operational burden. At the same time, demand for accounting services largely exceeds supply in many segments. As AI improves efficiency for firms and enables them to price competitively, they will be better positioned to capture more business downmarket and serve a greater set of customers with even better margins.

The value firms provide, however, extends far beyond simple accounting workflow execution. They deliver compliance, strategic guidance on accounting policy and financial decisions and most importantly, peace of mind—all essential even if AI automates the mechanical close. We also expect certain functions to remain outsourced by design, including audit and specialized tax or complex transactions that require deep, situational expertise.

The Road Ahead for AI in Finance

AI is redefining how finance and accounting teams operate–from how data is accessed to how core workflows run. Solutions that demonstrate high accuracy, consistency and quantifiable ROI will earn a coveted and enduring spot in the next generation finance and accounting stack.

If you are building or investing in this space, we would love to connect — reach out to Rajeev, Adi or Jasmine.

Sign up for our newsletter

Legal disclaimer

Note:

12025 AICPA: Report on Accounting Education

Disclaimer: This article is for informational purposes only. Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire. Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of investments made by Sapphire’s Growth strategy is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.