AI is supercharging professional services in incredible ways, and tax is no exception. As one of the most complex and underserved domains, tax has long been ripe for innovation.

Over $25 trillion in global capital allocation hinges on fast, accurate tax advice. Tax is the invisible infrastructure behind nearly every financial decision. Whether it’s a cross-border transaction, a government grant or an equity plan, every move triggers a tax consequence. It’s foundational, not optional.

Yet the systems powering tax advisory are outdated. Professionals still rely on opaque rulings and constantly shifting regulations. Much of the work is manual, which is unsustainable as complexity rises and the talent pool shrinks. The industry doesn’t need another tool. It needs leverage.

That’s exactly what Ben Alarie and the team at Blue J are building. Blue J is a GenAI-native platform that transforms tax law into structured data and delivers fast and accurate answers to nuanced tax questions. It’s a research engine, a reasoning partner and a productivity multiplier that helps tax professionals serve clients better and faster.

The company’s deep domain expertise is exactly why OpenAI has collaborated with Blue J to help train GPT-4.1 on real-world tax scenarios. Tax is rules-based, constantly evolving, and unforgiving of error–making it a perfect test case for high-precision reasoning.

For these reasons and more, we are proud to co-lead Blue J’s $122M Series D alongside Oak HC/FT as the team redefines how tax work gets done.

AI That Understands Tax Law

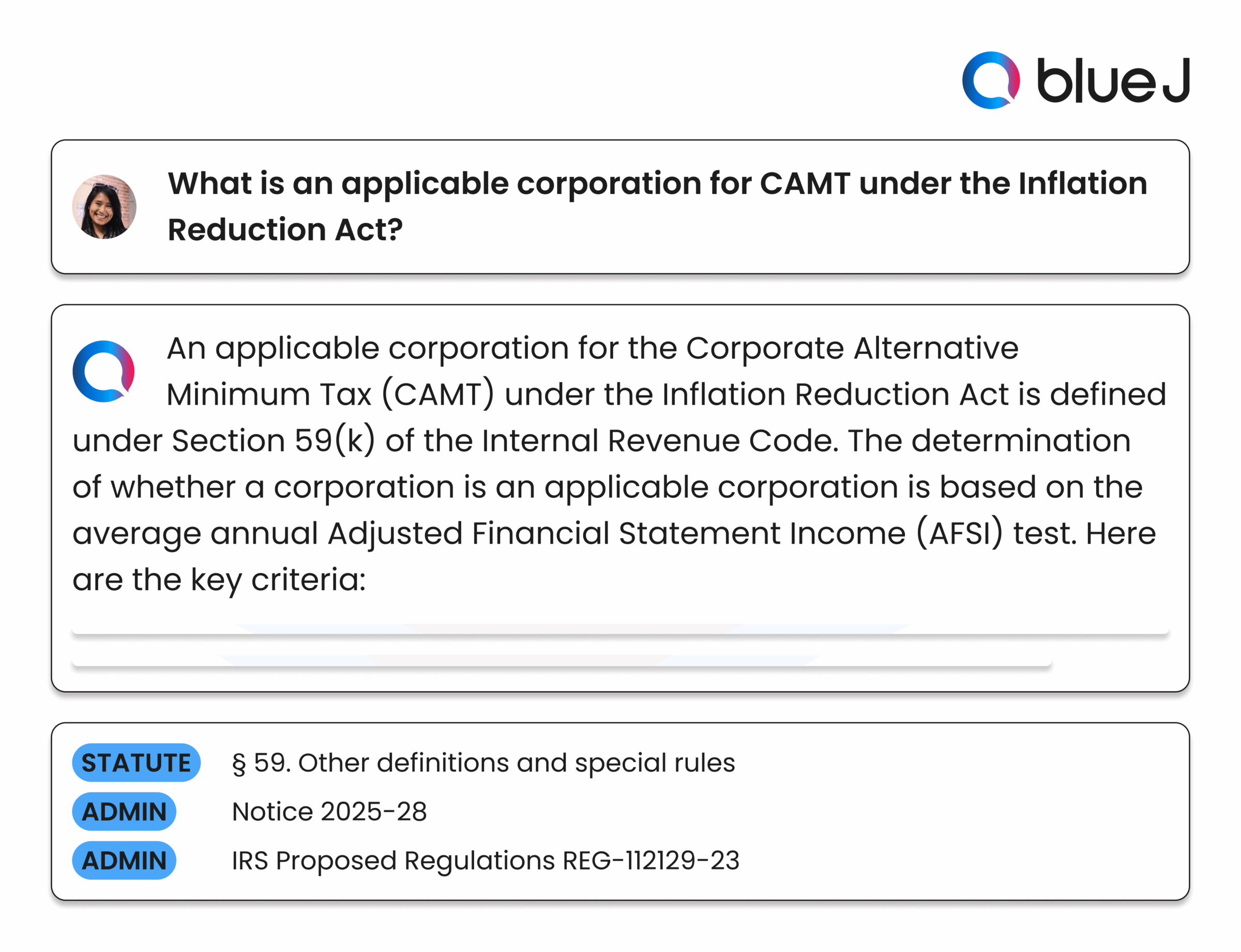

Blue J has built a specialized AI platform that delivers fast, accurate, audit-grade answers to complex tax questions. Its system is powered by a continuously updated, highly structured legal dataset covering statutes, regulations, rulings and court decisions. This data is curated daily from both exclusive proprietary data sources, as well as public sources. Blue J’s data is validated, tested and purpose-built for tax.

But it’s not just about data. Blue J has also built advanced prompt engineering specifically for tax use cases. By optimizing how questions are interpreted and framed, the system consistently delivers more accurate, context-aware responses than generic LLMs.

That’s what we believe sets Blue J apart. General-purpose models do not keep pace with the speed and complexity of tax law. Rules change constantly. Accuracy requires both domain-specific data and the intelligence to use it.

Since launching its GenAI platform in late 2023, Blue J has onboarded over 2,500 firms. Just recently, the company signed a US-wide deployment with its second Big Four customer (in addition to KPMG), signaling that Blue J is becoming a core solution for tax and accounting professionals who need to deliver high-quality work with fewer resources.

What’s Next: From Co-Pilot to Cognitive System

What excites us most is the path ahead. Blue J is evolving from a smart assistant into a true cognitive system. It won’t just answer questions–it will drive end-to-end workflows. Think issue spotting, memo generation and deep reasoning.

From our perspective, this shift unlocks new strategic value:

- Mid-sized firms will gain leverage as senior talent retires

- Global firms can scale tax expertise across borders

- SaaS platforms can embed trusted tax logic into financial tools

Blue J turns tax from a chokepoint into a growth engine.

Meet the Founder: The “AI Taxman”

Ben Alarie,

Ben Alarie,

CEO, Blue J

Ben Alarie isn’t your typical founder. He’s a law professor with deep tax expertise and an unusual curiosity for technology. We believe his credibility in the field, paired with a clear product vision, makes him uniquely suited to lead this transformation.

Over the past year, we got to know Ben and his team well. We saw the product in action, felt its impact and embraced Ben’s unofficial nickname: the AI Taxman. (Yes, we used Suno to create a Pearl Jam-inspired song. Yes, we printed T-shirts too.)

At Sapphire Ventures, we back vertical AI platforms with proprietary data and mission-critical workflows. In our opinion, Blue J fits that thesis completely, alongside companies like EliseAI (housing/healthcare), Supio (legal), Rewst (MSSP), AskSage (government) and Medable (life sciences).

We believe Ben and his team are building the future infrastructure for global tax cognition, and we’re excited to support them in making it real.

If you’re interested in learning more about the company or exploring opportunities to join the rapidly growing team, you can find more information here.

Legal disclaimer

This article is for informational purposes only. Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire. Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of investments made by Sapphire’s Growth strategy is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this virtual event may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.