Open source software has taken over the world. From contactless mobile payments to online grocery shopping, open source plays an important role in enabling the tech stack of every major company. However, a significant pain point is the complex infrastructure and system management involved in implementing and running the specific open source technology. Instead of dealing with configuration and infrastructure administration, companies and their developers prefer to spend resources on activities related to core business applications.

Fortunately, end users can now bypass complex infrastructure tasks as open source companies roll out fully-managed cloud products. The shift to the cloud has resulted in significant efficiencies for open source providers including faster monetization and scale. This is a critical development in the evolution of open source as a commercial model: the open source cloud.

While not every software company is open source, any infrastructure software company can take a page from the open source cloud playbook. Before we dive in, it’s important to understand how open source has evolved as a commercial model.

The evolution of open source as a commercial model

In the 1950s and 1960s, almost all software was written by academics and corporate researchers. Open source software was typically offered as a free add-on with hardware purchases. Projects were generally distributed under the principles of openness and cooperation. This meant that source code and modifications were made freely available for developers to share knowledge, fix bugs and create new functions. In fact, software was not considered copyrightable before the 1974 Commission on New Technological uses of Copyrighted Works (CONTU), which argued for the extension of copyright laws to computer programs.

Nevertheless, as operating systems and compilers evolved, software production costs dramatically rose relative to hardware. To increase revenue, selling software under a proprietary license became the norm, and the conventional wisdom was that open source would not work as a commercial model. After all, it’s hard to charge for “free” software. In addition, there is the classic tragedy-of-the-commons problem where most developers who use open source never contribute back meaningfully, according to Stack Overflow’s 2020 developer survey.

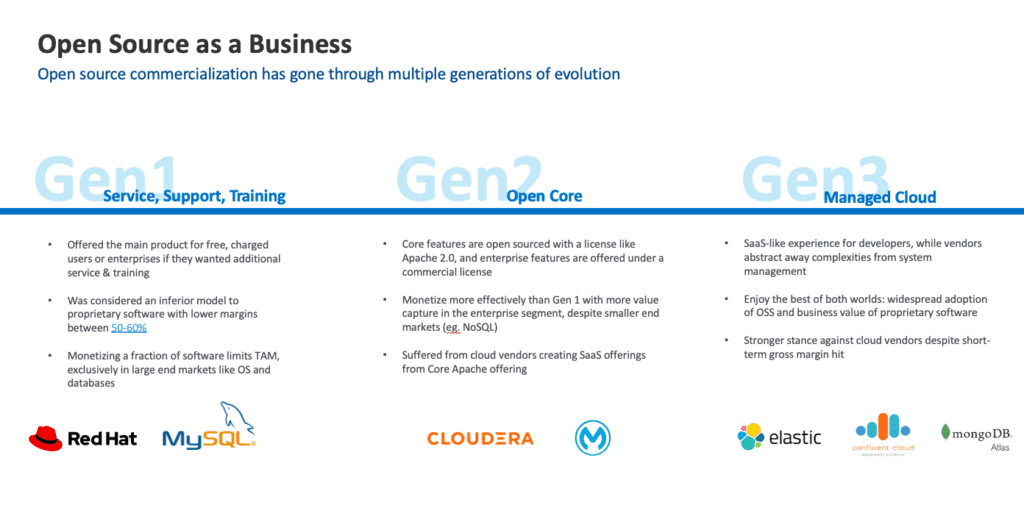

However, starting with Red Hat, open source companies have come a long way over three generations of monetization models. Let’s take a look:

- The first generation (Gen 1) of open source was all about selling technical support and training around the proprietary software. This approach helped address enterprise concerns regarding using open source at a large scale. But from a commercial standpoint, Gen 1 largely sold services and thus only captures a fraction of the total addressable market.

- The second generation (Gen 2) introduced the Open Core model, which provided a way for open source companies to productize open source by surrounding core open source technologies with proprietary enterprise features (think fleet management, RBAC, advanced analytics, etc.) As a result, customers got to enjoy an enterprise-ready version of the open source product. While this was a step forward for open source, the onus of running the software package still would fall on the customer. An on-premise open core model precludes companies from getting the full benefits of bottom-up adoption of open source (for example, enterprise-scale deployment still requires heavy IT involvement), resulting in similar drawbacks traditional proprietary enterprise sales models showed. In addition, cloud vendors such as AWS created first-party SaaS offerings around open source projects, which took value away from the original open core vendor.

- The third generation (Gen 3) solves the pain points of the previous generations by providing a managed cloud version of the open core product. The Gen 3 model handles system management of the specific open-core solution so customers and end users can focus on building better core business features with open source without worrying about system management. By centralizing the previously distributed complexity of managing infrastructure, Gen 3 provides open source vendors the best of both worlds: widespread adoption of open source and the business value of proprietary software. Companies realize these benefits by packaging not only an open core product, but also the resources (ex. compute and storage), and infrastructure management expertise (ex. labor savings). The technological complexity is hidden from view and managed by professionals, so customers can just enjoy the results.

Naturally, open source software companies began to shift from the Gen 2 phase to the Gen 3 managed cloud phase much earlier in their enterprise life-cycle. For example, MongoDB and Elastic rolled out a cloud version around the time they went public. The current generation of high-flying open source companies such as Confluent and Databricks made the transition to the cloud when they hit an earlier revenue scale. Fast forward to today, many newer open source companies start by going cloud-only from day one. For example, a new set of companies such as Cypress monetize through an extension model — a separate paid cloud product that serves as a commercial extension to a completely free open source core. The open source product provides the developer a low-friction way to try the product. Once the usage propagates to other team members, the need for collaboration, governance and workflows lead the customer to the commercial product. In this case, the value lies not so much in compute and storage or complex infrastructure management, but in providing a system of engagement that allows end users to tap into best practices

We recognize that not every infrastructure software company can be open source, but we do believe that any software company can learn from Gen 3 open source’s approach by adopting fully-managed, easy-to-use, freemium experiences. By applying the following three strategies, any software company can take a page from the open source cloud playbook to drive up sales velocity and realize better unit economics.

1. Consumption Pattern: Streamline monetization with resource-based pricing

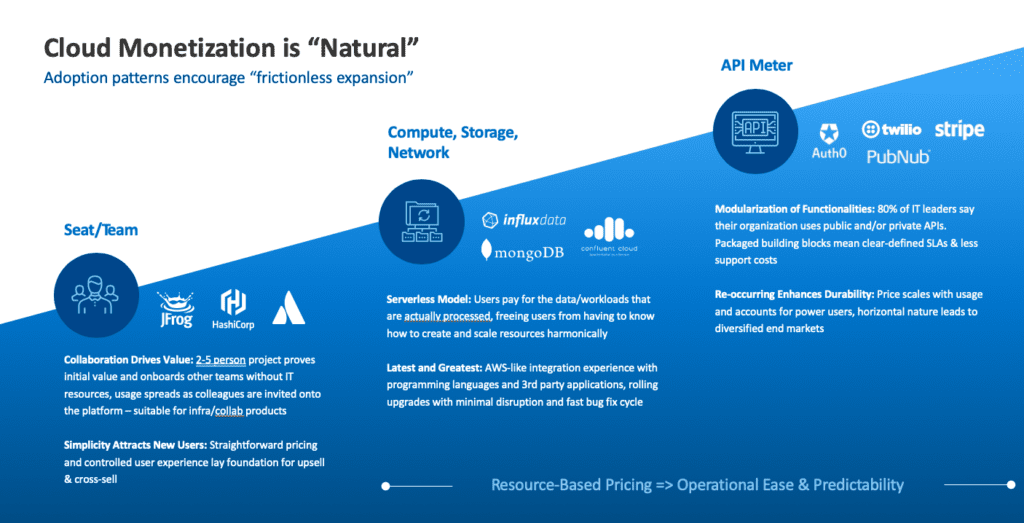

As open source companies move to a managed model, frictionless deployment and maintenance become key benefits. Enterprise end users demand turnkey solutions that deliver fast time-to-value and low ongoing overhead. By helping developers seamlessly bring projects to production, Gen 3 startups are also driving up sales velocity.

Simplified adoption streamlines the monetization experience for first-time users. Under a more traditional per-seat model, customers typically begin onboarding with a free version of the software, and value organically increases as they invite other team members.

While some Gen 3 companies adopt more traditional pricing models, managed cloud models also lead to the proliferation of resource-based pricing. Monetization begins as users pay based on workloads, as well as processed and stored data. Although resource and usage-based pricing has traditionally been sold at a discount compared to subscription models due to potential volatility, the model better aligns customer value and pricing. Because of stronger alignment, companies such as MongoDB (Atlas) and Twilio have built very effective land-and-expand models and are seeing consistently high net dollar retention rates.

Done well, resource-based pricing enables companies to better capture the upside of expansion. “What we find is customers may just have one app and then that app grows,” said Dev Ittycheria, CEO of MongoDB. “But more typically, we find as soon as they launch one app, they very quickly start launching other apps because they find the value [of Atlas, MongoDB’s cloud database service] so compelling.”

The bottom line is that the cloud expands the total addressable market for open source offerings. The freemium model drives usage, and shifting to the cloud helps monetize that usage. Here’s how the cloud streamlines monetization:

- Bottoms-up model drives monetization for free users — One of the hardest psychological monetization thresholds is to convert users from paying nothing to paying something. Cloud streamlines that experience and creates the potential to grow with the customer.

- Accessible to companies that don’t have systems management — Cloud enables faster time-to-value, and managed products boost customer retention rates. End users love trying new products, but don’t enjoy deploying and managing infrastructure. Enterprises don’t want to invest in another generation of system administrators.

- Ride the wave of enterprises moving to the cloud — Due to COVID-19, enterprises have accelerated their move to the cloud for both greenfield projects and mainframe offloads. By simplifying the transition to the cloud, cloud products increase project success rates for those in pre-production. As a result, they become a department or firmwide application.

2. Product: Design products that deliver immediate value and reduce complexity

What makes open source so powerful is that it’s driven by a passionate end user community. There’s a constant feedback loop enabling customers to work with open source cloud companies to improve the overall user experience. While the community aspect is very unique to open source, every company can design the product for their customer journey with the cloud acting as the feedback loop, providing granular visibility into future adoption and user behavior.

At the adoption phase of the customer journey, the cost of implementation is a key inhibitor to adoption. In some ways, the best counter-example is Amazon Web Services (AWS), whose 1st-party SaaS products “check the box,” but usually don’t match all of the features a best-of-breed vendor offers. Nevertheless, AWS oftentimes becomes the preferred choice because of the advantages associated with an out-of-the-box integration. Companies find that the seamlessness makes up for the nice-to-have features. Providing a product that offers low cost implementation, or low cost integration is crucial to adoption and driving immediate value.

We witnessed how product design can drive customer value with MuleSoft (a Sapphire Ventures investment that was acquired by Salesforce in 2018), which provides integration software for connecting SaaS and enterprise applications in the cloud. At the time of our initial investment in 2011, MuleSoft only provided an on-prem solution, which was the case with most vendors in the ecosystem. The integration market was largely off cloud. So the strategy to roll out an Integration Platform as a Service (iPaaS) based on the Mule open source ESB known as MuleSoft’s CloudHub was not an obvious strategy. Starting as early as 2012, MuleSoft CloudHub went to market with what were then-fledging, but are now public SaaS ISVs, providing out-of-the-box integration from their SaaS application to other SaaS applications or on-prem systems like Oracle or SAP.

Coinciding with the rise of SaaS, MuleSoft’s CloudHub provided a cloud-age value prop: lightweight modules, pre-built turnkey connectors and a managed experience. This quickly drove faster adoption for MuleSoft and positively impacted the business. For large customers who weren’t ready for the cloud, MuleSoft introduced the Anypoint platform, which enables node deployment across on-prem and cloud. This flexible deployment approach removed friction by including a full platform for architectural flexibility, giving unlimited non-production cloud cores for free and showing consistent ROI measurements that beat the model and accelerated the jump to ELA (Enterprise License Agreement). In this case, MuleSoft didn’t lead with cloud in the sales pitch, but the cloud was a key enabler for faster adoption and expansion.

Product Design: Control Plane & Data Plane

That said, abstracting complexity away from the customer has its costs. By managing the complexity of running a specific service for the customer, vendors are indirectly taking control away from the customer. The cloud product itself has to have a solid data plane, providing capacity (as in CPU, memory, network, storage, etc.) so that the core application can actually run. The main challenge in building the data plane is to get the right set of infrastructure personnel (oftentimes very different from the core application team) who know how to architect the cloud product for performance, scalability and availability requirements.

On the other hand, despite getting less attention, the control plane, which decides how the service operates and exposes APIs to define, deploy and lifecycle a platform or service is equally important. Vendors have to give customers the right level of control. This is especially true for the enterprise developer and end user community who want a simple, well-integrated user experience. The analogy here could be buying sneakers. For most customers, a 0.5 increment between size 7 and 8 is good enough. However, your most sophisticated customer (who might be willing to pay more) might demand size 7.2225, and have complete control over their cloud experience. Balancing simplicity for the majority of customers while satisfying optimization needs for sophisticated users is an important consideration. Ultimately, the product should give customers the option to toggle between price and capacity, and provide a consistent experience across different deployment models.

3. GTM economics: The free trial is the holy grail

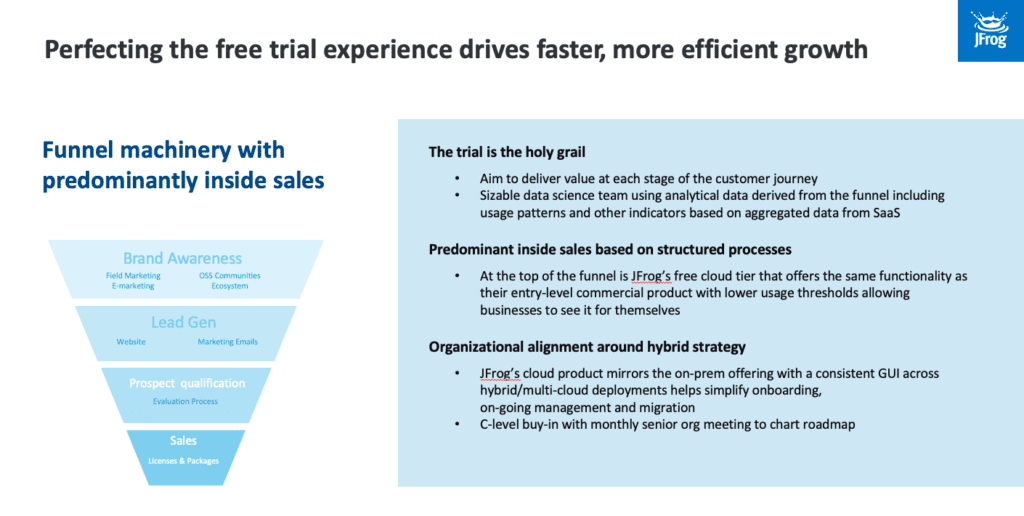

The cloud offers granular visibility into the customer journey. This feedback loop allows companies to see how customers navigate the signup process, how usage changes, and when customer success should get involved. That’s why the freemium model becomes a critical part of the go-to-market process. Perfecting the free trial experience is critical to generating strong usage and engagement, which in turn streamlines the sales process and leads to greater expansion opportunities down the line.

JFrog, a Sapphire Ventures portfolio company, is a DevOps software startup that has mastered the freemium experience, in our opinion. A vast majority of customers start using JFrog through the open source or free trial. These can be consumed either as a self-hosted downloadable solution, or as a SaaS cloud service. The company has built a predominantly inbound sales motion based on structured processes with a sizable data science team using analytical data derived from the funnel including usage patterns and other indicators based on aggregated data from SaaS. This funnel machinery allows JFrog to deliver value at each stage of the customer journey.

To reduce friction, at the top of the funnel is JFrog’s free cloud tier that offers the same functionality as their entry-level commercial product with lower usage thresholds allowing businesses to see it for themselves. The next solution tier addresses the needs of enterprises and their premium solution is for organizations looking for a complete DevOps platform that contains all of JFrog’s product offerings. JFrog aims to generate awareness and usage amongst developers and technical buyers as part of their software delivery toolchain and DevOps processes. This includes support for open source initiatives and memberships with foundations like the Cloud Native Computing Foundation and the Continuous Delivery Foundation, and open source programs such as GoCenter, ChartCenter and ConanCenter. This flexibility and openness of the platform means that in the end, JFrog can integrate with and empower a full DevOps ecosystem.

For customers who are moving to the cloud, the JFrog Platform delivers tools in an all-in-one experience that empowers organizations, developers and DevOps engineers to meet increased delivery requirements. The fact their cloud product mirrors the on-prem offering with a consistent GUI across hybrid/multi-cloud deployments helps simplify onboarding, on-going management and migration. While customers can be on different points of their cloud journey, JFrog offers a single pane of glass to fit their heterogeneous environments. This includes on-prem, private cloud or public clouds, and across workloads and applications — from legacy apps to cloud-native microservices. As a result, JFrog has the ability to scale and support customer’s needs regardless of their size, location or environment.

Cloud Economics: LTV/CAC

In the end, a well-run managed cloud model drives better LTV/CAC (Lifetime Value/Customer Acquisition Cost). A welcoming freemium experience creates a strong customer community and lowers sales friction, thus driving down CAC. As developers become aware of open source cloud solutions and begin evaluating services for free, the option to upgrade to a paid enterprise customer becomes simpler. Managed cloud solutions provide faster time to production and the ensuing renewal and expansion discussions are lower-touch than a traditional wine-and-dine sales model.

On the LTV side, one drawback of the managed cloud approach is that software companies will see a short-term hit to gross margins. However, over the long-term, adopting a freemium-based open-source cloud strategy will drive greater lifetime revenue. Pay-as-you-go pricing and reduction in resource requirements drive expansion and sustainable revenue growth. On the COGS (Cost of Goods Sold) side, higher utilization will grow into fixed costs. In addition, higher margin products such as marketplace apps and data connectors create opportunities to expand top-line growth. Over time, the short-term tradeoff in gross margins pave a path to more sustainable long-term revenue uplift.

What are you building?

Two things can be true at the same time:

- The full benefits of the open source commercial model will not be replicated. And we can expect the open source that we know today to continue to evolve and thrive.

- Non-open source companies can take a page from the commercial open source playbook.

The three strategies discussed can be applied to any non-open source business.

Here at Sapphire Ventures, we’ve been fortunate to partner with many open source companies. We have also been fortunate to partner with non-open source companies that have adopted some open source principles. To check out all of Sapphire’s investments, visit: https://sapphireventures.com/companies/

If you’re building an open source company or a company that adopts open source software principles, we’d love to hear from you: https://sapphireventures.com/contact/