Prediction season is here for venture, and 2025 gave us plenty of signals. A lot has happened across the AI landscape, validating several predictions from our list last year and lending insights into what may happen in the year ahead.

It’s no shock the surge in excitement around AI continues to dominate the tech industry, financial markets and geopolitical narratives, permeating everything, everywhere, all at once. Below, we break down the top 10 trends we believe will shape AI and enterprise tech in the year ahead.

- The Path Clears for Two $1T+ AI IPOs

- A $50B+ AI Software Acquisition Reshapes the Market

- AI’s Soaring Power Demand Collides With Energy Constraints

- 50 AI-Native Companies Hit $250M ARR as Hypergrowth Accelerates

- AI Takes Over Music & Lands a Grammy

- Open, Small and World Models Gain Significant Market Share

- Robotics Adoption Ramps Slowly as Industrial Use Cases Lead

- AI Becomes an Even More Critical Driver of Modern Defense Strategy

- Cybersecurity x AI – Securing the New Attack Frontier

- The AI Bubble Debate Rages On

1. The Path Clears for Two $1T+ AI IPOs

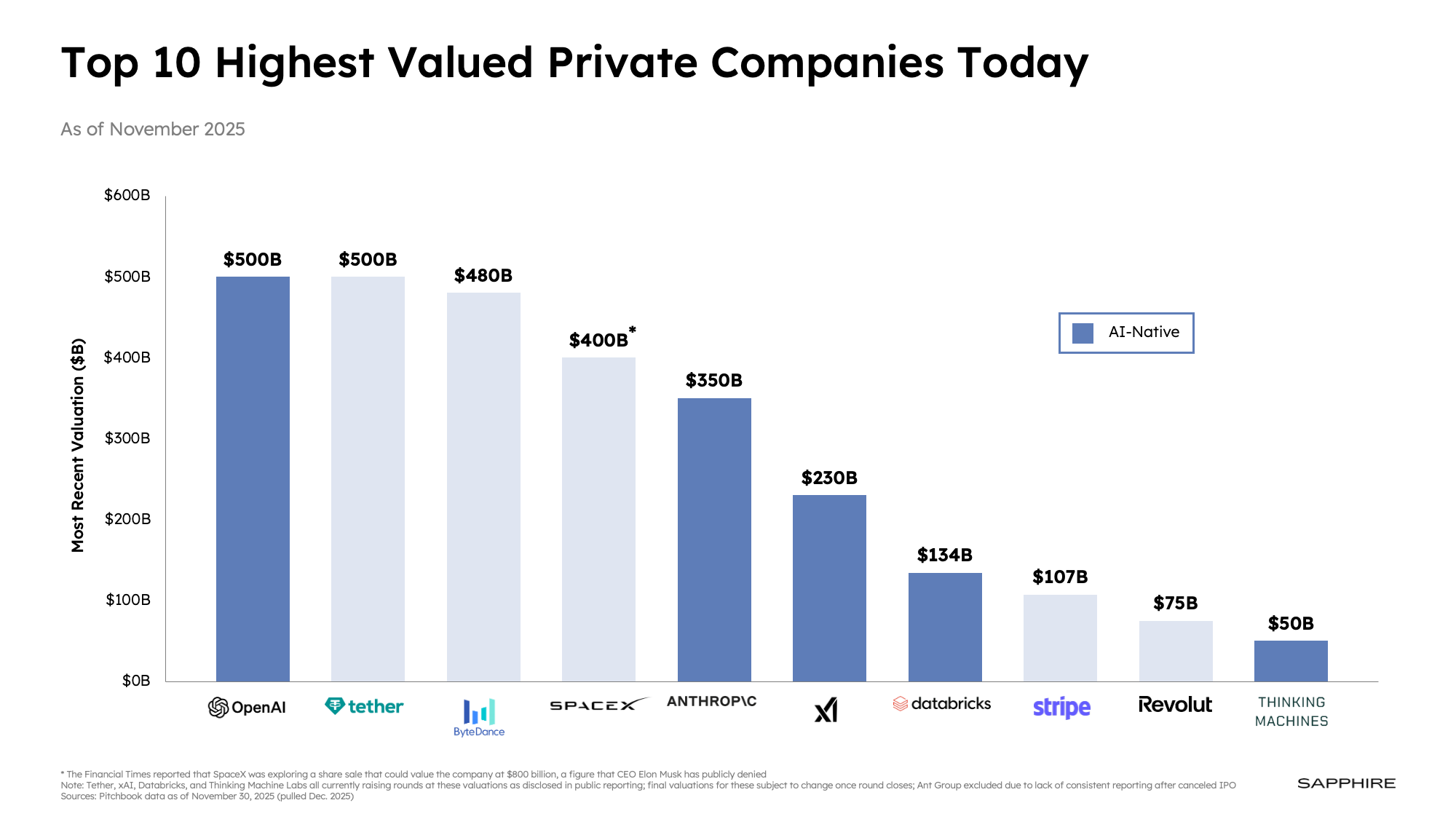

We’ve entered an era of valuations we’ve never seen in the private tech markets. OpenAI ($500B), Anthropic ($350B), and xAI ($230B) already claim ~$1.1T valuation collectively, and are positioned to move substantially higher in 2026. OpenAI maintains pole position in the consumer chatbot space with 800M+ WAU despite negative market “vibes,” Anthropic is leading enterprise adoption and is forecasting $70B ARR by 2028, and xAI is rapidly closing the model performance gap while building world-class compute infrastructure in record time.

The growth of these companies is extraordinary and we believe there’s a strong chance they’ll clear $2.5T in private market valuation next year – which for context, would equal the valuation of Oracle, Palantir, Salesforce, SAP, Shopify, Intuit, Adobe, ServiceNow, Palo Alto Networks, Cadence Design Systems, Workday and Atlassian, combined!

From our perspective, all of this momentum sets the stage for the largest IPOs of all time, with OpenAI and Anthropic likely filing S-1s by the end of 2026. It’s already been reported that Anthropic is pursuing a dual track of early IPO discussions and fresh private financing that could lift its valuation above $300B. AI or not, the next class of public debuts is expected to be truly exceptional. SpaceX’s newly disclosed plan to pursue an IPO in the second half of 2026 and the separate secondary sale rumor at an $800B valuation only reinforces the point.

2. A $50B+ AI Software Acquisition Reshapes the Market

Last year, we predicted more small strategic deals, acqui-hires and the first $5B+ AI acquisition–all of which came true. We are going a lot bigger with our prediction this year – 10X to be precise – as we believe we will see a $50B+ acquisition of a private market software company in 2026. Incumbents have the financing capacity, regulatory conditions remain favorable and any moderation in hyperscaler infrastructure spend would also free up tens of billions of dollars to pursue inorganic growth.

Pressure to show meaningful AI growth also keeps climbing, with investors seeking concrete evidence of how AI is shaping companies’ growth trajectories. If we had to point to likely categories, code assistants, data management, security, fintech and sub-scale labs all stand out as potential candidates for a deal of such magnitude.

3. AI’s Soaring Power Demand Collides With Energy Constraints

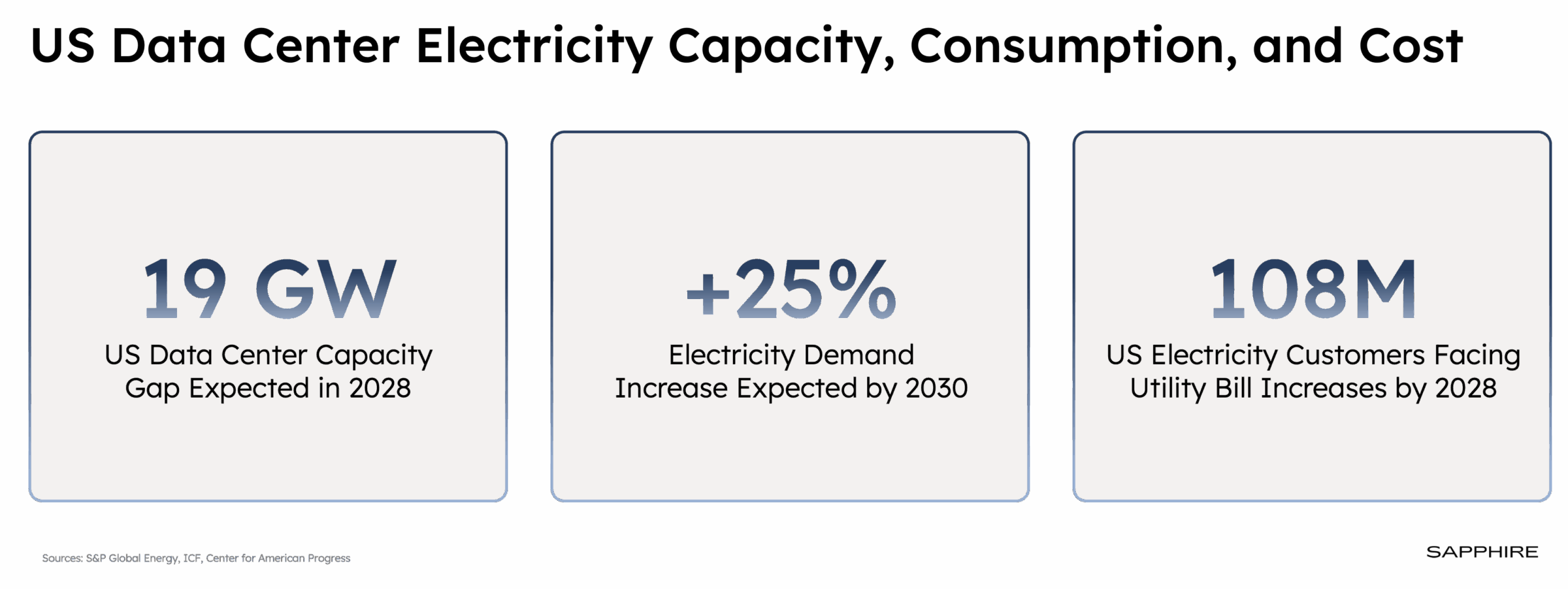

One of the increasingly pertinent questions related to the massive AI infrastructure buildout is, “Will we be able to power all of this new capacity?” Data center energy demand is set to surge with Gartner expecting it to double by 2030, and Wood Mackenzie estimating (as of mid-October) an incredible 245 gigawatts of U.S. capacity already in development or planning. In 2026, we expect both the physical limits of scaling compute capacity and growing political pushback over rising electricity costs to become major points of contention that could slow the planned pace of deployment.

As we look ahead, we expect even more “fusion” between the technology and energy industry as companies look to secure and optimize the power required to support multi-gigawatt compute clusters. Big tech companies are already moving aggressively to secure long-term energy capacity, striking deals with decommissioned nuclear power plants and entering the electricity trading market.

Notably, critical power components are in short supply, and some data centers can’t even come online because they lack grid access. Microsoft CEO, Satya Nadella, recently highlighted this point on the BG2 podcast stating, “…the biggest issue we are now having is not a compute glut, but it’s power — it’s sort of the ability to get the builds done fast enough close to power…So, if you can’t do that, you may actually have a bunch of chips sitting in inventory that I can’t plug in. In fact, that is my problem today. It’s not a supply issue of chips; it’s actually the fact that I don’t have warm shells to plug into.”

4. 50 AI-Native Companies Hit $250M ARR as Hypergrowth Accelerates

Achieving $100M in ARR over 5-10 years used to be the gold standard in SaaS. The best-in-class AI-native companies are now compressing that timeline into 1-2 years, demonstrating truly historic growth rates and shifting the benchmark for breakout success to $500M in ARR.

With this in mind, our 2025 prediction of 50 companies reaching $50M in ARR feels quaint. By the end of 2026, we believe at least 50 AI-native businesses – startups and incumbents – will reach $250M in ARR with many potential candidates poised to cross the $1B mark in the coming year. The evidence is already there supporting our prediction. By our count, at least 60 AI-native products have already reached $100M in ARR.

5. AI Takes Over Music & Lands a Grammy

When we considered how to gauge this prediction, we thought an AI-generated song breaking into the top charts would be a meaningful milestone. Even that proved to be too modest as an AI-crafted song topped the Country music charts just last month.

Momentum across AI voice, image and video is building quickly. We’re already seeing it in the breakout performance of consumer apps like OpenAI’s Sora topping the app store despite an invite-only release, Google’s “Nano Banana” going viral with major quality and control improvements in image generation and Inception Point’s AI podcast network producing 3,000 episodes a week with 12M cumulative downloads and 400K subscribers.

The line between traditional and AI-generated media will become increasingly blurry in 2026. We think AI will take share from legacy means of creation across all modalities next year. More top 10 hits across music genres, breakout memes on social media, AI-generated commercials, use of AI in production of major movies and TV shows and by year-end, we expect AI to notch another breakthrough — its first ever Grammy for an AI-generated song.

6. Open, Small & World Models Gain Significant Market Share

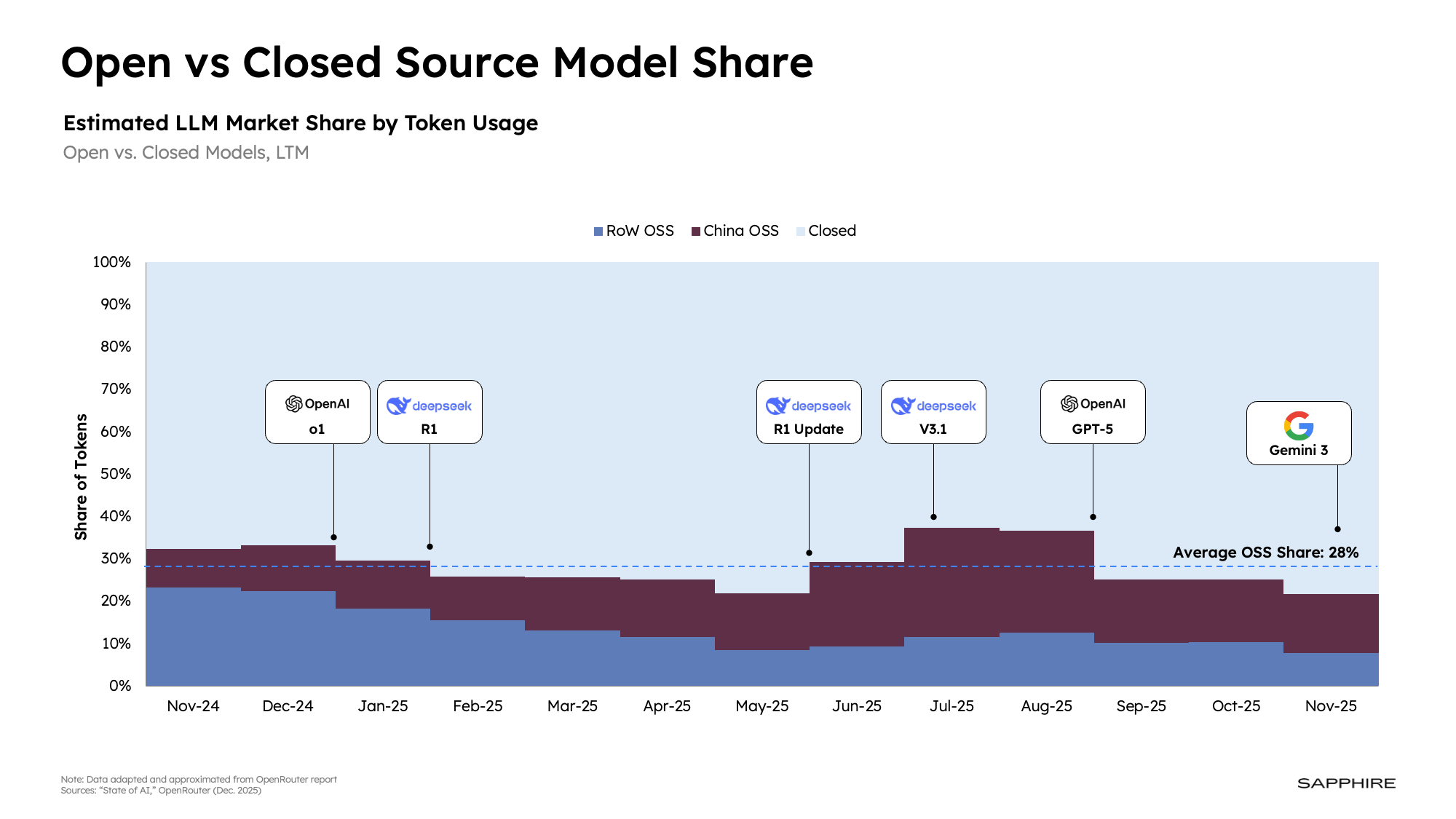

LLMs from leading labs dominate the headlines and benchmark leaderboards, but they’re no longer the only models that matter. Companies are now sophisticated at working with multiple models, balancing price/performance trade-offs, and increasingly adopting small and open-source options that offer “good enough” quality at a fraction of the cost. Though early, we expect meaningful progress and rising investor interest in 2026 as world models begin to demonstrate capabilities that benefit companies building in gaming, virtual reality, autonomous systems and robotics.

Anecdotes abound here – Airbnb recently chose a Chinese open-source model over OpenAI, Cursor’s “Composer” appears to be built on a similar model, and new data from MIT and Hugging Face shows Chinese open-source model downloads now lead U.S. offerings in total share. This is unsurprising given open-source models can be 1-2 orders of magnitude cheaper than leading closed-source offerings on a per-token basis. Tiny Recursive Models, 10,000x smaller than frontier models, are also emerging as promising performers on select logic tasks.

Finally, world models are opening a new frontier. Efforts led by Dr. Fei-Fei Li at World Labs and Yann Lecun aim to model physics and spatial properties of the world, which many believe will be critical to the advancement of both embodied AI and, eventually, AGI.

7. Robotics Adoption Ramps Slowly as Industrial Use Cases Lead

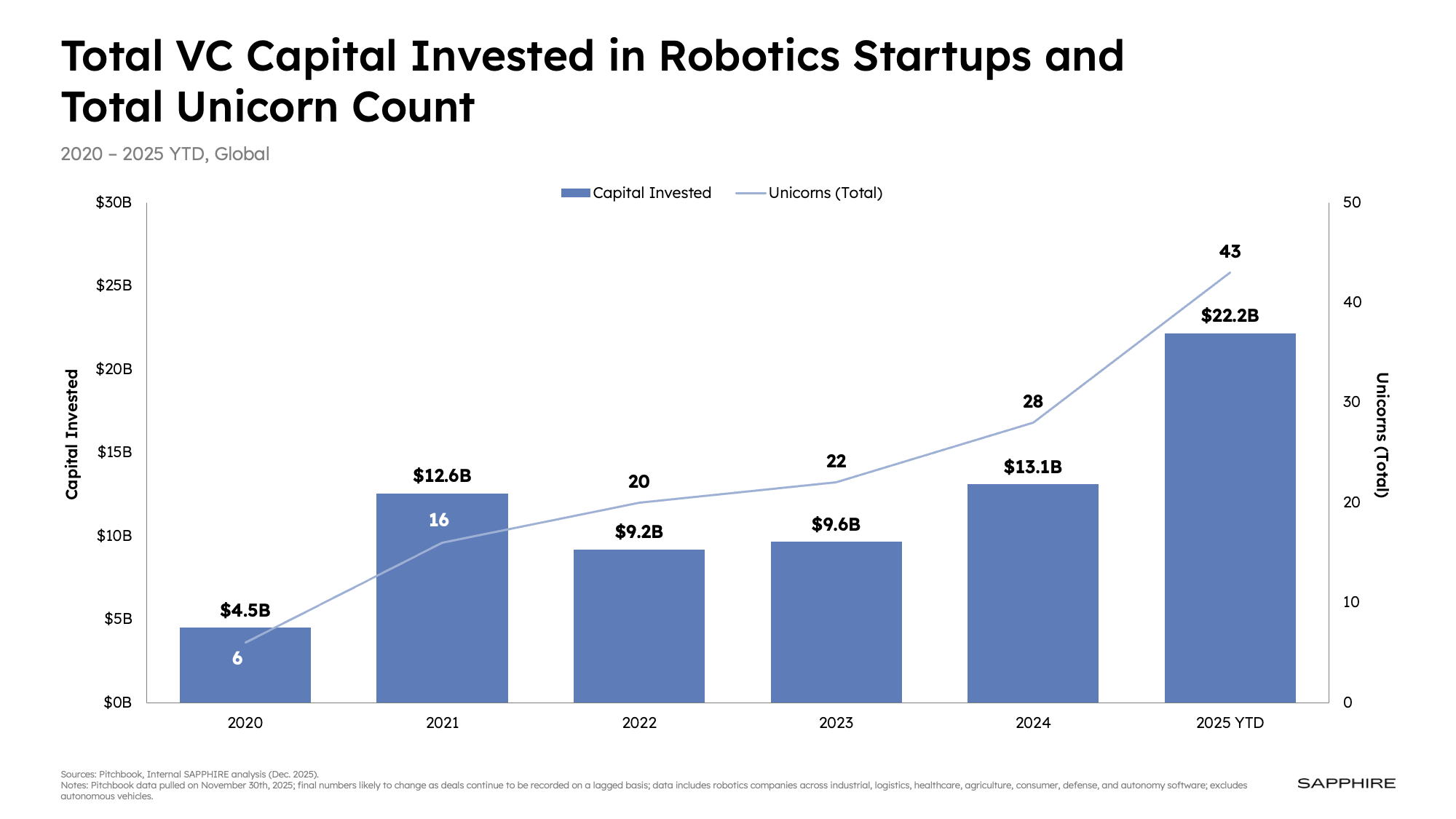

VC investment in robotics has soared in 2025, driven by major rounds for leading robotics foundational models and humanoid companies, including Figure, Physical Intelligence, Apptronik, 1x and Agility. In total, VC investors have poured $22.2B into the category year-to-date, a 69% increase year-over-year. We expect funding in robotics to remain strong as companies hit key software and hardware milestones and could double again in 2026.

The enthusiasm is justified — robotics could become one of the largest technology categories in the history of technology, with Morgan Stanley estimating a $5T humanoid TAM by 2050. But the timeline is long. Significant work across data, model development, hardware, manufacturing, safety testing and regulation remains. The decade-plus trajectory is similar to the slow build in autonomous vehicles and drones before broader adoption.

Moving atoms is always much more difficult than moving bits in building technology. We anticipate hearing about a lot more pilots in manufacturing and warehouse automation use cases (and less about robots in the home). However, the next few years will be a slow march of steady progression–likely thousands of robots in production next year from different manufacturers, not tens of thousands.

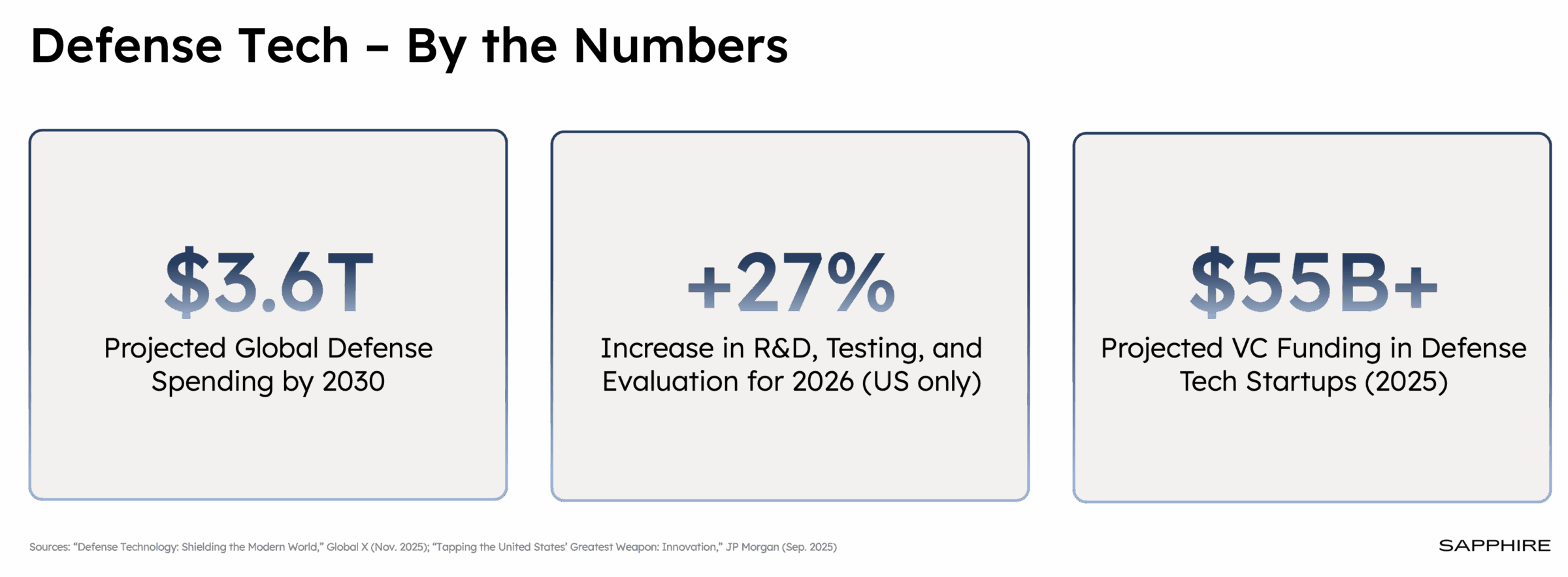

8. AI Becomes an Even More Critical Driver of Modern Defense Strategy

Last year, we predicted the Department of Defense would double down on AI – and they did. We think momentum at the intersection of AI and defense will accelerate in 2026, given the urgency to modernize military capabilities amidst an increasingly fractured geopolitical landscape. AI is beginning to touch every aspect of the military and will soon rewrite both how war is waged and the processes underpinning the defense industry.

This spans new weapons systems (e.g., drones), intelligence, surveillance and reconnaissance (ISR) capabilities, advanced cyber operations and real-time decisioning across supply chain, logistics, procurement, contracting, planning and maintenance. Delivering on this agenda requires the defense industry to rethink how it engages with both primes and startups. We expect investment in, and spending with, defense startups to surge in 2026, reinforced by the Defense Secretary’s recent comments that the status quo will be challenged. The startups that adapt fastest will benefit most next year and beyond.

9. Cybersecurity x AI – Securing the New Attack Frontier

Security will remain one of the most defensible categories of IT spend for CIOs in 2026, and we anticipate another strong year of VC funding ahead. As hackers continue to advance their techniques, we expect 2026 to bring two major challenges ripe for security companies to help solve:

- deepfakes will become a much greater challenge for both consumers and enterprises alike

- agent-level exploits will become one of the fastest-growing threat vectors as companies roll out agentics systems.

AI is both a major opportunity and risk in cybersecurity. It’s expanding the attack surface through model and data poisoning, prompt injection and more sophisticated tools now accessible to individual hackers and organized groups. Anthropic recently disclosed that a state-sponsored hacking group out of China used Claude models to automate most of an attack on 30 corporations, and improved LLMs are driving a surge in targeted social-engineering attacks across text, voice and video that was previously implausible.

At the same time, AI is becoming one of cybersecurity’s strongest defenses. Vendors are using it to monitor, detect and remediate attacks far more proactively, augmenting analysts with automation and agentic capabilities–a key factor behind elevated valuations across public and private markets and why incumbents have spent big on security acquisitions to bolster capabilities.

10. The AI Bubble Debate Rages On

Concerns about an AI bubble have grown as market momentum cools and investors question whether AI revenue can keep pace with the massive infrastructure buildout, which could reach $5–$7T by decade’s end. Echoes of past industrial bubbles, most notably the late 1990s telecom “dark fiber” buildout of the DotCom era, are ringing in investors’ ears, as they increasingly worry that the industry will build too much capacity too quickly using too much debt.

OpenAI’s role sits at the center of this debate, with observers asking how a company pacing toward $20B in ARR this year could possibly deliver on the $1.4T in infrastructure commitments alongside hyperscalers and chip makers over the coming years. Public comments from leadership have only intensified scrutiny.

Skepticism about this level of investment is, of course, warranted, yet the demand for AI products and services has never been stronger. Hyperscalers continue to accelerate growth and still can’t meet customer appetite. Models keep improving with no clear scaling wall, and AI-native startups, along with AI businesses inside incumbents, are growing at historic rates. With agentic software just beginning to take hold, there is a tremendous amount to be excited about as we head into 2026.

Looking Ahead: The Opportunity Has Never Been Bigger

Debates about bubbles and cycles will continue well into 2026, but one thing is clear – we’re in a golden age of innovation. The founders building through this moment and the investors backing them have an unprecedented opportunity ahead, standing to benefit from all the AI infrastructure currently in development. It’s an exhilarating time to be in venture, and we couldn’t be more excited to back the next generation of Companies of Consequence as they scale in the year ahead.

Sign up for our newsletter

Legal disclaimer

Nothing presented herein is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures, LLC (“Sapphire”). does not solicit or make its services available to the public. Prospective investors may rely only on a fund’s confidential private placement memorandum or an official supplement thereto. An investment in a Sapphire fund is speculative and involves a high degree of risk.

Information provided reflects Sapphires’ views at a point in time. Such views are subject to change without notice; as of December 10, 2025 unless otherwise noted.

Certain information contained in this presentation including any prediction or projection may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof, or comparable terminology. Due to various risks and uncertainties, actual events or results, or the actual results may differ materially from those reflected or contemplated in such forward-looking statements, and no assumptions should be made that any such strategy or investments were or will be profitable. Sapphire provides no assurance or no guarantee that any such prediction will ultimately occur.

This Presentation has been prepared from original sources, or other cited data, and is believed to be reliable. However, no representations are made as to the accuracy or completeness thereof. The information in this is not presented with a view to providing investment advice with respect to any security, or making any claim as to the past, current or future performance thereof, and Sapphire expressly disclaims the use of this Presentation for such purposes. The inclusion of any third-party firm and/or company names, brands and/or logos does not imply any affiliation with these firms or companies. None of these firms or companies have endorsed Sapphire or its affiliates. References to specific companies in this Presentation are for illustrative purposes only and should not be considered a recommendation to carry out securities transactions. It should not be assumed that recommendations made in the future will be profitable or will equal the performance discussed herein.

The content in this Presentation has not been reviewed or approved by the Securities and Exchange Commission.

Past performance is not indicative of future results.