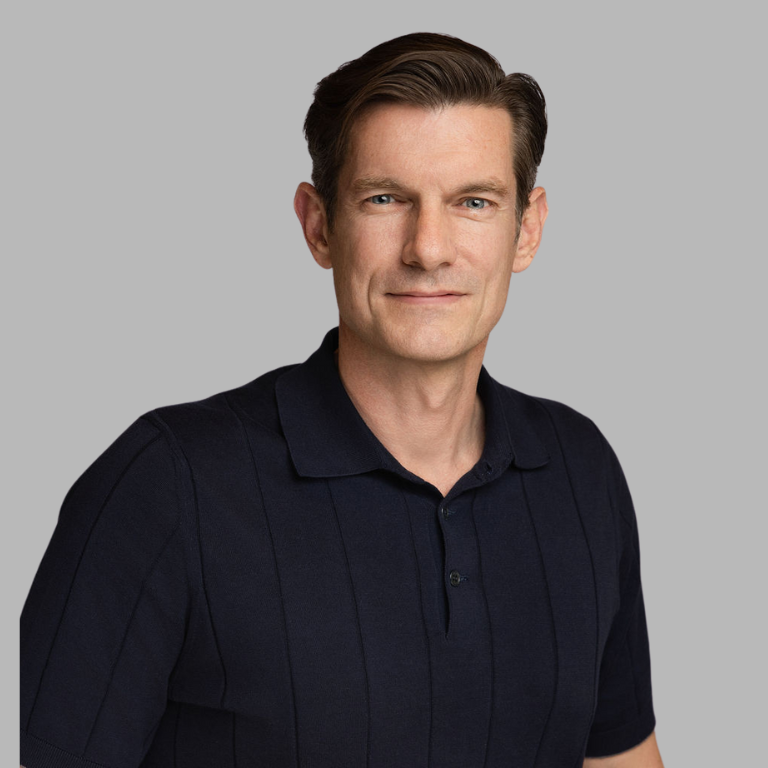

Rajeev is a Partner at Sapphire Ventures and has been investing for nearly 15 years across a few dozen companies. He is focused on partnering with exceptional founders building category-defining B2B software companies in horizontal and vertical AI, as well as leading innovators in fintech and healthcare. Rajeev’s notable investments include Glean, monday.com, Square, Wise, Livongo Health, Segment and Braze.

Rajeev deeply values and respects the entrepreneurial journey and is a firm believer that exceptional founders are the primary driving force behind the ultimate success of category-defining software companies. He is passionate about serving the founders and CEOs he works with, leveraging his many years of experience and Sapphire’s enterprise and talent network. Rajeev has been recognized as a Top 40 Under 40 Growth Investor by GrowthCap and by Silicon Valley Business in their annual 40 Under 40 list.

Prior to Sapphire Ventures, Rajeev invested in software companies for Silver Lake, a technology-focused private equity firm. Early on in his career, he worked for the investment banking division of Goldman Sachs and while in business school, worked with Amazon’s corporate development group. Rajeev holds an MBA from Harvard Business School and received a bachelor’s in business administration from the University of Southern California where he graduated magna cum laude.

“Top 40 Under 40 Growth Investor by GrowthCap” Sapphire has provided compensation to participate and be considered within third-party ranking conducted by Growth Cap, LLC, December 2021. Sapphire played no role in the compilation of the third-party analysis. The full extent of the scope of firms and data included in the related surveys or evaluations is unknown. “Silicon Valley Business Journal 40 under 40” Sapphire did not provide compensation to participate and be considered within third-party ranking conducted by Silicon Valley Business Journal, August 2022. Sapphire played no role in the compilation of the third-party analysis. The full extent of the scope of firms and data included in the related surveys or evaluations is unknown.

- AI-Driven SaaS

- Data & AI

- Vertical SaaS

- Fintech

- Healthcare

- Collaboration and Productivity

- Featured

- ALL

- Current

- Exited

-

-

-

-

-

-

IPO

-

-

-

-

M&A

-

-

-

-

-

-

-

-

-

M&A

-

M&A

-

-

IPO

-

M&A

-

M&A

-

IPO

-

-

-

M&A

-

-

-

-

-

M&A

-

-

M&A

-

-

-

-

-

IPO

-