In the fast-paced world of AI, a few weeks can feel like dog years, particularly in sales. With new companies emerging every day to automate how sales teams identify, engage and convert leads, the landscape is undergoing a significant shift. Below, we dive into why this shift is happening now, how the current prospecting software landscape is shaping up and what the future holds for AI in the space.

Selling Smarter Part 2: AI SDRs and the Future of Prospecting

Why is AI Transforming Modern-Day Prospecting?

With sophisticated LLMs and the abundance of data generated by prospects online, AI-powered prospecting has emerged as a transformative approach to generating pipeline efficiently. The “digital exhaust” from a prospect’s online activity contains valuable intent data that powers highly targeted, automated and scalable prospecting campaigns. This approach is referred to as “signal-based” selling, where real-time data, rather than intuition, guides account prioritization and engagement.

Today’s AI tools go beyond account-level insights, detecting individual intent through capabilities like champion tracking, product usage analytics and engagement tracking. By revealing which individuals are most ready to buy, AI helps sales reps identify the best targets and the ideal timing for outreach, reducing the guesswork in prospecting.

Traditionally, sales reps spent significant time on manual tasks like lead scoring, research and follow-ups. Now, AI automates these processes, freeing reps to be much more productive than before.

AI Sales Prospecting

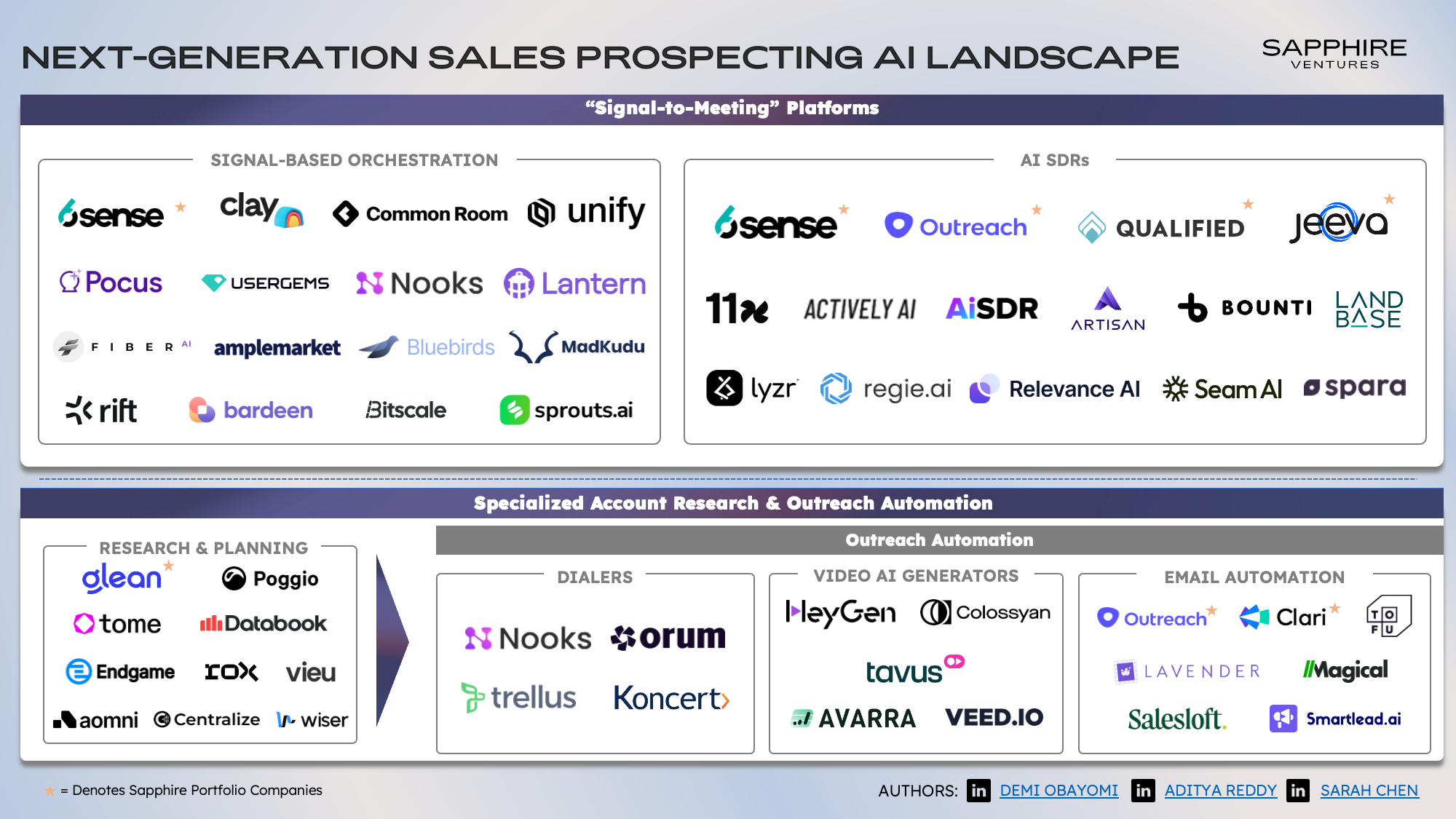

The prospecting AI landscape includes end-to-end automation platforms, as well as specialized solutions optimizing specific steps in the prospecting funnel. While the lines between categories are blurring, here’s a look at the key players today and their primary positioning in the ecosystem:

“Signal-to-meeting” platforms solve for the entire prospecting workflow— from list building and lead enrichment to account and lead research, outreach automation and scheduling follow-ups. This creates a seamless flow from identifying accounts that fit the ICP to booking meetings with the right leads.

Signal-based orchestration startups like Clay, Common Room and Unify empower sales teams to capture individual and company-level signals, triggering downstream workflows, including segmentation, playbooks and sequences, account/lead research and personalized email generation.

AI SDRs like Qualified*, Jeeva* and 11x provide similar end-to-end functionality, but take an “agent-first” approach. Their vision is to: 1) sell digital workers instead of software, 2) eventually run on autopilot rather than as copilots and 3) price their solution based on variables like usage and outcomes, not seats. The AI SDR approach gained traction following the rise of ChatGPT and marks a paradigm shift from “Software-as-a-Service,” where human users deliver output using software, to “Service-as-Software,” where the software itself is delivering the outputs, significantly reducing the need for human users to be involved.

Specialized account research and outreach automation tools focus on specific aspects of the prospecting workflow. Research and planning solutions like Glean*, Tome, Databook and Endgame enable AEs to build relationships with buyers based on expertise and solution alignment. These products aggregate all account information in one place and provide account research tools to ensure reps are prepared for every buyer interaction. Outreach automation tools execute buyer engagement with functionality that maximizes rep efficiency and lead conversion. Dialers (e.g., Nooks and Orum) boost call productivity with features like power and parallel dialing, as well as AI-powered coaching, enabling SDRs and AEs to cold-call more effectively. Video AI generators like HeyGen and Veed deliver personalized, AI-generated videos, offering a visually engaging touchpoint that improves buyer response rates. Video generation companies are also heavily used for developing engaging sales training and enablement videos. In a similar vein, the recently-launched startup, Avarra, creates buyer avatars, allowing reps to engage in live coaching conversations to reduce ramp time. Email automation platforms like Outreach* streamline email sequences and follow-ups, ensuring sales teams maintain consistent and timely communication with prospects. In addition, Tofu excels at generating hyper-personalized, on-brand messaging, while Lavender offers real-time feedback to optimize email effectiveness.

Barriers to AI Adoption in Sales

While the potential of AI in sales is significant, adoption remains in its early stages, with many companies still navigating key challenges to achieve full-scale implementation. We spoke with sales leaders in our network to understand the key hurdles they face in adopting AI:

Lack of an Intimate Understanding of the ICP and Effective Messaging. Before fully deploying AI for prospecting, GTM teams must gain a deep understanding of their ICP and develop an effective messaging strategy. This upstream work is essential for AI tools to effectively target and engage the right prospects when deployed at scale.

Variable Prospect Data Quality Potentially Inhibits Effectiveness of AI Prospecting. The effectiveness of AI in prospecting varies significantly across industries and company size due to inconsistencies in the depth and quality of available underlying prospect data. Ensuring high-quality, comprehensive prospecting data that is consistent across an organization’s buyer universe is paramount for AI to deliver value dependably at scale and over the long term.

Sales Teams Are Wary of “Flooding the Inbox.” With buyers already guarded against unsolicited emails, the introduction of AI-powered outreach raises concerns about how buyers may ultimately react to oversaturation of their inboxes. Organizations are mindful that more may not always be better and are hyper-focused on ensuring their AI-powered prospecting motion not only delivers more effective sales output but also drives a superior buying experience.

What Does the Future Hold for AI in Prospecting?

Prospecting is going to look radically different in just a few months, not to mention in the years ahead. To explore this shift, we asked sales leaders to share their vision of the future with AI at the forefront:

Unlocking Deep Personalization vs. Surface-level Insights

Prediction #1: The technology behind AI prospecting tools (i.e. LLMs), is not perfect, and users are still learning how to use it effectively. This can result in missteps, like awkward attempts at personalization (e.g. drawing an ill-fitting comparison between a CRM product and sumo wrestling) or embarrassing errors (e.g. AI pitching a buyer on the buyer’s own product). We predict that as prospecting AI technology and know-how mature, AI-powered tools will unlock bespoke outreach that is 1) tailor-made for each prospect, 2) rooted in data and research, 3) precisely speaks to the buyer’s challenges, 4) acknowledges the steps the buyer has already taken in the buyer journey and 5) offers a next step that the buyer finds compelling enough to respond to.

AI Will Augment, but Not Replace (All) Sellers

Prediction #2: Human sales reps will be involved in sales for the foreseeable future, but the critical question is just how many reps will GTM teams need relative to their current size? If the 80/20 rule holds, the future may see drastically smaller GTM teams, with top-performing reps supported by an army of Sales AI agents. This is the thesis behind AI-powered sales productivity platforms like Rox1.

Too Many AI SDRs, Not Nearly Enough AI for Buyers

Prediction #3: We believe AI SDRs are here to stay and will only get better as mentioned in our first prediction. However, in the meantime they are often misused, and the resulting backlash reminds us of Newton’s Third Law, “For every action, there is an equal and opposite reaction.” Will we see stronger spam filters, the emergence of a new category of AI agents that enable buyers to handle the flood of AI-generated emails, or something else? Some companies, like Operator and Vieu, are taking a contrarian approach. They are betting on a return to old-school selling, grounded in trusted professional and personal networks.

Building a Sales AI or Anti-AI Company? Get in Touch.

Without a doubt, sales teams will be augmented by AI agents operating in autopilot and copilot to complete prospecting tasks and other workflows across the entire sales process. While current technologies and companies are not perfect, they are akin to an evolutionary step on the way to an end state where a significant portion of the work in sales is automated by AI. And the pace of innovation is faster than ever before. Within a few weeks after publishing Selling Smarter, our original Sales AI post, we felt compelled to revisit the topic. However, for the foreseeable future, decision-making in sales will still come down to human buyers and sellers. For that reason, we also see a window of opportunity for companies that make sales feel more human in a way that AI struggles to replicate today.

If you’re building or operating in this space, we’d love to hear your reactions to this piece and your perspective on the future of AI in sales. Please reach out to Demi at [email protected], Adi at [email protected] and Sarah at [email protected]. We look forward to hearing from you!

Special thanks to Ale Murray, Danny Gilliland, Jordan Crawford, Josh Solomon, Justin Sun, Mark Kosoglow, Max Fleisher and Sudhakar Jukanti for the conversations that helped sharpen our views on where Sales AI is headed next.

1 Based on Rox article in Not Boring by Packy McCormick: https://www.notboring.co/p/rox.

*Denotes Sapphire Ventures portfolio company.

Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by Its direct growth and sports investing strategies is available here. No assumptions should be made that investments described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.