CIOs can avoid kissing a lot of frogs on their quest for winning new tech, by borrowing some noise filtering tricks from VCs

Sapphire Ventures’ data shows that there are anywhere from 2,000 to 4,000 VC-backed enterprise software startups that get funded annually in the U.S. alone. In 2017, this equated to over $16B in dollars invested into enterprise startups. The winners from this large crop of funded startups will surely transform enterprise IT in momentous ways, presenting CIOs (Chief Information Officers) with exciting opportunities to find new innovation externally. But, in an overcrowded startup landscape, there is just as much risk to bet on the losers and the “me-toos” and miss out on the transformative players.

CIOs routinely tell us that one of their biggest challenges in making innovation bets is in navigating the dense startup ecosystem to correctly determine who the winners are, who are the has-beens — and which tech categories matter at all? To be effective “investors” in next-gen disruption, CIOs need to adopt filtering mechanisms. The good news is that CIOs aren’t alone.

We’re all on the same quest for “signal”

Just like CIOs, VCs need to parse the “signal from the noise” in the hunt for startups that will truly differentiate in crowded categories or create entirely new categories of enterprise technology. At Sapphire, we often say that CIOs are like VCs — except they bet with corporate dollars and IT resources.

As financial investors on a similar journey, here are some guidelines we can pass on to CIOs seeking “noise-reduction” strategies to whittle down the cacophony that surrounds them.

Follow the money: 3 ways in which CIOs should assess startup funding

The funding behind promising startups holds important clues that can translate into useful strategies for CIOs. Here’s how:

(1) How much money and how often?

Enterprises and CIOs partnering with young startups should closely track the funding cadence of their partners to make sure that they’re generally raising capital at the pace one would expect.

Size and frequency of venture funding is ultimately a proxy (albeit not a perfect one) for company quality and technology traction with enterprise customers. This is because top VCs will always make revenue-metric driven decisions around funding enterprise software startups, only funding companies that can boast double-digit growth in enterprise accounts and net-negative customer churn. Startups meeting their expected funding milestones track well in the above dimensions — and are more likely to be durable partners for enterprise customers and CIOs. It also means they will have ample capital available to continue investing in their products and platforms to the benefit of customers.

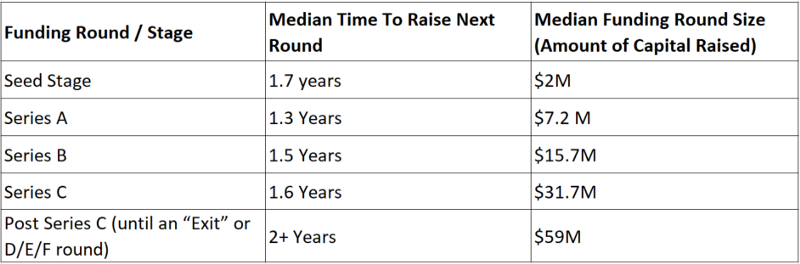

Specifically, data from Sapphire Partners’ investments platform shows that in today’s environment startups on strong footing will raise venture capital every 18–24 months. Below is a quick snapshot of how this progresses across funding stages.Ultimately, 45% of enterprise startups that receive a Series A or seed round will either cease to exist entirely, stagnate and fail to either have an “exit” (IPO or acquisition) or raise further funding. With every subsequent round of funding raised, the startup is validating its business, technology and durable value to the CIO. CIOs should roughly benchmark the funding success of their startup partners against the above brackets to minimize the possibility of betting on a company that might go out of business, or become a “zombie” operation and stagnate.

(2) Whose money is it anyways?

The quality of the VCs backing a startup is an important indicator of startup quality. It is especially useful if the CIO is trying to assess the quality of an early-stage startup that may not have raised much funding or be generating revenues that s/he can use as a proxy for traction. An early-stage startup that has raised funding from “smart money” VCs is one that has a much better shot of becoming a ubiquitous technology across the enterprise — and a game changer for the business. Sources such as CBInsights, Crunchbase and Pitchbook are good references that enterprise IT teams can use to stack through the huge population of VC firms and parse for indicators of quality — such as those that have had the highest shares of IPOs across the board or have excelled in funding winners in individual enterprise categories (eg: cloud or security).

(3) Finding like-minded VCs and portfolios

In the simplest terms, CIOs should find venture capitalists that have made a name for themselves investing successfully in the categories CIOs care about. Need to build a future-proof security strategy? Look for VCs that have funded now-mainstream security companies. Consumer marketplaces is the next big bet? Reach out to the investors that have funded category creators and disrupters in this domain.

CIOs should “interview” a series of VC investors (like they would interview any other partner) by simply taking time to talk to each VC about how they view the market. Do they view the market in ways that complement their own? If they differ, is it a valuable counterpoint to their strategy? And are they only interested in positioning their own portfolio companies– or are they looking to build a meaningful dialogue and lasting relationship with the CIO as an IT executive? Answers to all these questions will help CIOs identify VCs that can truly aid them in the long term in placing good bets on winning tech, and also serve as sounding boards and “noise filters”.

A note on funding stage selection

Startups come in all kinds of stages and each organization knows its own stage sensitivity and risk tolerance. Earlier-stage technologies and those that are built on top of hot buzzwords (“AI”, “blockchain”) will inevitably involve more noise because more venture dollars will go towards creating more startups, and also because the Darwinian shakeouts of startups haven’t happened yet. With mega-rounds and high valuations still being the norm, CIOs should note that a successful early-stage startup can very quickly graduate from seed stage to becoming a “late-stage” mature startup, in terms of capital raised and revenues. Ultimately, CIOs and their teams should know the “noise patterns” of the domains that are of interest to them — and select partners accordingly.

CIOs need to care — even if they don’t

Enterprise CIOs have a crucial stake in VC funding and startup ecosystems, whether they realize it or not. They must reflect on what their “signal” looks like and then build a sensor network and noise filters that helps them repeatedly place winning bets in the startup ecosystem. Someday, being able to say “we were early adopters of [insert name of now ubiquitous tech company]” will help them to be seen in a distinct class of innovators — while giving their company a technological leg up over peers in the industry.